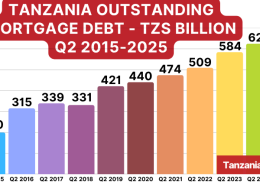

The mortgage market in Tanzania registered a 6% growth in the value of residential mortgages in Q2 2023 compared to the 3.6% growth recorded in Q1 2023.

This was indicated in the Tanzania Mortgage Market Update – 30 June 2023 recently released by the Bank of Tanzania (BOT).

The market registered a 15% year-on-year growth from TZS 509.99 billion in Q2 2022 to TZS 584.59 billion in Q2 2023.

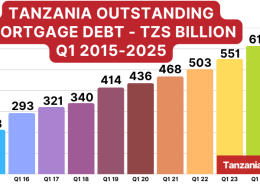

The outstanding mortgage debt as of 30 June 2023 increased to TZS 584.59 billion equivalent to USD 249.92 million as compared to TZS 551.76 billion equivalent to USD 237.53 million reported on 31 March 2023.

The overall average mortgage debt size as of 30 June 2023 was TZS 102.13 million equivalent to USD 43,662 marking an increase from TZS 98.60 million equivalent to USD 42,446 reported on the previous quarter.

The ratio of outstanding mortgage debt to Gross Domestic Product (GDP) increased to 0.33% compared to 0.30% recorded in the previous quarter.

Tanzania Mortgage Market in Q2 2023

There was no new entrant into the mortgage market during the quarter. The number of banks reporting to have mortgage portfolios remained at 31 banks as of 30 June 2023.

Mortgage debt advanced by the top 5 Primary Mortgage Lenders (PMLs) accounted for 66% of the total outstanding mortgage debt.

CRDB Bank was a market leader commanding 34.15% of the mortgage market share, followed by KCB Bank (10.55%), Azania Bank (7.78%), NMB Bank Plc. (7.76%) and Stanbic Bank (6.19%).

Typical interest rates offered by mortgage lenders ranged between averages of 15-19%.

Tanzania Housing Demand

The Tanzanian housing demand is estimated at 200,000 houses annually and a total housing shortage of 3 million houses.

The demand has been boosted by easy access mortgages, with the number of mortgage lenders in the market increasing from 3 in 2009 to 31 and the average mortgage interest rate falling from 22% to 15%.

The Tanzanian housing sector’s fast-growing demand is mainly driven by strong and sustained economic growth with GDP growth averaging 6-7% over the past decade, the fast-growing Tanzanian population, which is estimated to more than double by 2050, and efforts by the Government in partnership with global non-profit institutions and foreign Governments to meet the growing demand of affordable housing.

However, cumbersome processes around the issuance of titles (especially unit titles) continue to pose a challenge by affecting borrowers’ eligibility to access residential mortgages.

Efforts to develop housing projects by developers continue with a special focus on Dodoma Capital City as the Government has relocated its administrative functions there.