This report provides a detailed assessment of the performance of the insurance market in Tanzania while highlighting the prominent industry improvements that may have a significant impact in determining the market trends that define the future shape and domestic structure of the industry over the subsequent years.

The report is based on the 2022 Insurance Market Performance Report released by the Tanzania Insurance Regulatory Authority (TIRA) in December 2023. It also includes preliminary data from 2023 by the Association of Tanzania Insurers (ATI) and is enriched with information from other sources, along with comments from CEOs of insurance companies in Tanzania, and other stakeholders.

Executive Summary

The Tanzania insurance sector has maintained its robustness in 2022, supported by the favorable performance of both global and local economies.

The performance of the Tanzanian economy remained stable amid external shocks, growing at 4.7% and 6.8% in 2022 for Tanzania Mainland and Zanzibar, respectively. The growth was partly contributed by the recovery of economic activities coupled with sustained public and private sector investments.

The economy is estimated to have grown by 5.2% and 7.1% in 2023 for Tanzania Mainland and Zanzibar, respectively, due to improved business conditions, banking sector profitability, liquidity availability to fund business, and public investment in infrastructure.

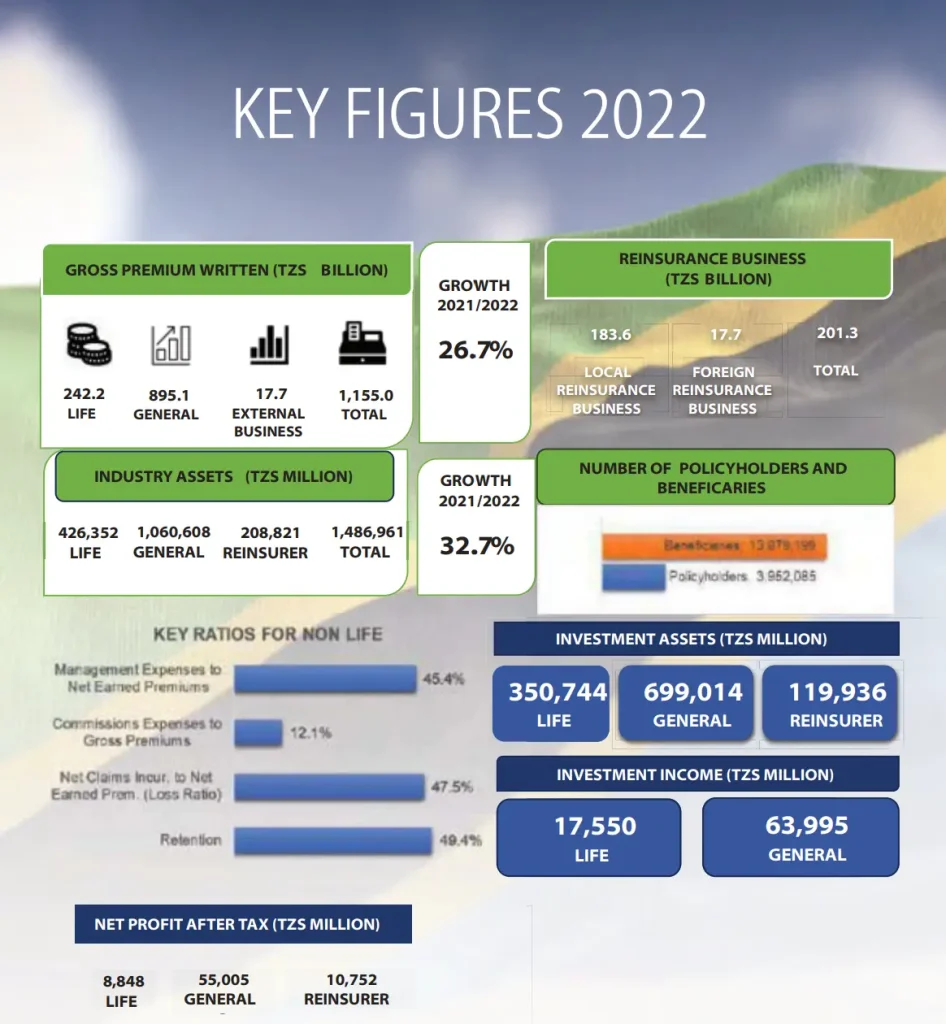

Within this framework, the Tanzanian insurance industry gross written premiums (GWP) amounted to TZS 1,138 billion in 2022, representing a nominal increase of 25% from TZS 911.5 billion written in 2021.

The growth in gross premiums for general insurance policies increased from TZS 746 billion in 2021 to TZS 895 billion in 2022, representing a significant growth of +20%.

The life insurance segment exhibited even stronger growth, with gross written premiums rising from TZS 165 billion in 2021 to TZS 242 billion in 2022, indicating a remarkable increase of +46%.

The insurance sector enhanced its financial stability and strength, with total assets growing by 32.7% from TZS 1,278.6 billion in 2021 to TZS 1,697.0 billion in 2022.

Net worth grew by 66.0% from TZS 416.0 to TZS 690.5 in 2022, and total liabilities by 7.5% from TZS 862.5 in 2021 to TZS 1,006.5 in 2022 indicating that the increase in liabilities is lesser by 60.0% compared to an increase in total assets.

The sector’s investment assets grew by 24.5% to TZS 1,169.7 billion, compared to TZS 939.7 billion in 2021.

The sector also saw new players entering the market, a diversification in their investment portfolio, and enhanced financial inclusion, with new and innovative insurance products and services being introduced, expanding insurance coverage and outreach.

In 2022, the number of insurance companies was 35 compared to 34 in 2022. The number increased to 36 in 2023. The number of insurance registrants increased from 988 in 2021 to 1,165 in 2022.

Sixteen new insurance products were approved, which cater to the needs of the low-income population. These products include microinsurance, health insurance, agriculture insurance, livestock insurance, funeral insurance, and marine insurance.

Insurance penetration (GWP / GDP) provided by commercial insurance companies only was 0.68% in 2022 (0.58% in 2021). However, overall insurance penetration including the public insurance sector was approximately 1.99% in 2022. The ratio slightly increased compared to a penetration ratio of 1.68% in 2021.

As of 31st December 2022, Tanzania boasted a total of 2.3 million commercial insurance policyholders across the country and 9.8 million commercial insurance beneficiaries.

The number of policyholders including the public insurance sector provided by NSSF, NHlF, and iCHF was 1.7 million, whereas the number of beneficiaries was 4.1 million.

Total number of individuals that were served by the insurance sector in 2022 was 17.8, representing 28.9% of the total population (61.7 million). In 2021, there were six million Tanzanians who used insurance services nationwide, out of a total population of about 60 million.

Other notable achievements and initiatives include the establishment of the Oil and Gas Coinsurance Consortium, and the Tanzania Agriculture lnsurance Consortium (TAlC). They were established to provide a mechanism for insurers to jointly underwrite large and specialized risks in the oil and gas sector, and affordable and accessible insurance solutions to smallholder farmers and agribusinesses.