This free report provides a comprehensive analysis of the banking sector in Tanzania, examining the recent performances of various banks. It assesses the latest trends in credit allocation to crucial sectors fueling economic growth and explores how technology is playing a transformative role in improving financial accessibility for the broader population of Tanzania.

The report draws its insights from several key sources, including the 2022 Financial Sector Supervision Annual Report released by the Central Bank of Tanzania (BOT) in Q3 2023, the BOT Annual Report 2022/23, and the BOT National Payment Systems Annual Report 2022, published in 2024. Additionally, it incorporates data and insights from other reputable sources. Furthermore, the report includes perspectives from CEOs and MDs of banks operating in Tanzania, as well as input from various stakeholders. Moreover, it presents preliminary data and results for 2023 released by Tanzania’s largest banks.

Executive Summary

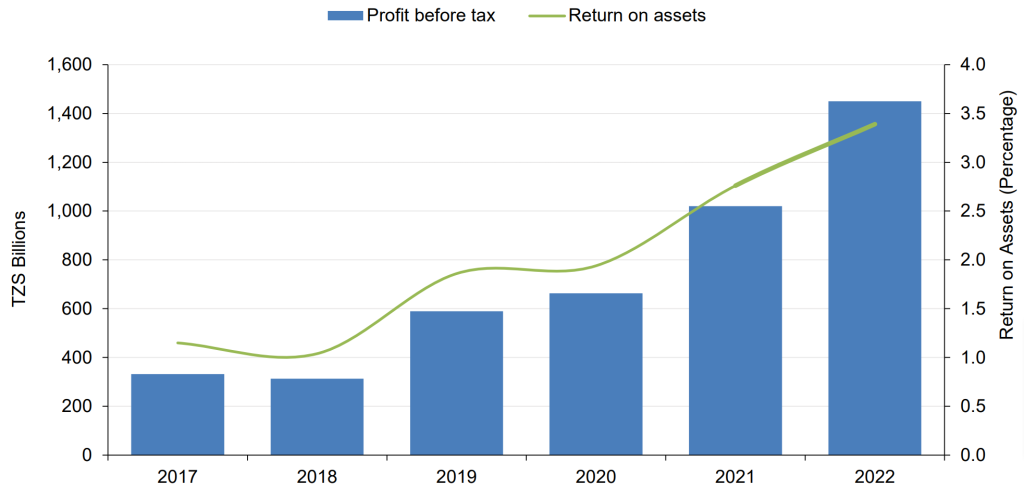

The Tanzanian banking sector recorded strong growth in 2022 (and 2023), with profits before tax reaching TZS 1.4 trillion, a 38% increase from TZS 1 trillion in 2021. Net profit reached TZS 875,027 billion compared to TZS 676,863 million.

As of March 2024, 47 licensed banks are operating in Tanzania: 34 commercial banks, 4 community banks, 4 microfinance banks, 2 development banks, 1 Non-Bank Financial Institution, 1 House Financing Company, and 1 Mortgage Refinancing Company.

Altogether, in 2022 they had 981 branches and 75,238 bank agents.

Additionally, the banking sector is supplemented by various non-banking financial institutions, including social security schemes, microfinance service providers, mortgage finance institutions, and financial leasing companies.

Their total assets increased by 17.3% to TZS 46,159.5 billion in 2022 from TZS 39,346.3 billion in 2021. This was mainly attributed to the increase in deposits, borrowings, and retained earnings.

Deposits increased by 14.3% to TZS 32,584.7 billion in 2022 from TZS 28,499.1 billion in 2021. The increase was due to public confidence in the banking sector, favorable economic activities, and deposit mobilization strategies instituted by banks and financial institutions.

Loans, advances, and overdrafts increased by 25.3% to TZS 26,095.9 billion which accounted for 56.5% of total assets. The growth was attributed to a favorable macroeconomic environment, BOT’s sustained accommodative monetary policy and regulatory measures taken to support the private sector’s credit growth.

Asset quality improved as reflected by a decline in the level of non-performing loans (NPLs) ratio to 5.8% from 8.5% in 2021. The improvement in asset quality was due to improved credit risk management practices by banks and financial institutions as well as measures instituted by BOT.

Profitability improved as depicted by the increase in return on assets (ROA) and return on equity (ROE) to 3.5% and 14.2% from 2.8% and 11.5% recorded in the preceding year, respectively. The increase in profitability was driven by an increase in interest income consistent with growth in the loan portfolio, an increase in non-interest income, and an improvement in operational efficiency.

All in all, BOT explains that in 2022 the banking sector remained profitable, adequately capitalized, with a sufficient level of liquidity and improved asset quality, attributable to the recovery of businesses from the negative effects of the COVID-19 pandemic. The sector remained resilient to internal and external shocks and continued to grow in terms of deposits and assets, supported by a favorable macroeconomic environment, and regulatory and supervisory measures.

Tanzanian Banks Performances

According to the 2022 Financial Sector Supervision Annual Report of the Bank of Tanzania (BoT), in the same year the Tanzanian banking sector remained profitable, adequately capitalized, with a sufficient level of liquidity and improved asset quality, attributable to the recovery of businesses from the negative effects of COVID-19 pandemic.

The sector remained resilient to internal and external shocks and continued to grow in terms of deposits and assets, supported by a favorable macroeconomic environment, and regulatory and supervisory measures.

Assets Structure

The major components of the sector’s assets were loans, advances, and overdrafts which accounted for 56.5%; investment in debt securities (17.5%); and cash, balances with the Central Bank of Tanzania (BOT), balances with other banks and items for clearing (14.4%); while the remaining assets accounted for 11.6% of total assets.

Total assets grew by 17.3% to TZS 46,159.5 billion in 2022 compared to TZS 39,346.3 billion recorded in the preceding year, mainly financed by an increase in deposits, borrowings, and retained earnings.

Loans, advances, and overdrafts grew by 25.3% to TZS 26,095.9 billion compared to TZS 20,822.6 billion reported in the corresponding period in 2021.

The growth was attributed to the favorable macroeconomic environment, the BOT’s accommodative monetary policy, and regulatory measures taken to support the private sector’s credit growth.

Earning assets increased by 19.2% to TZS 38,175.0 billion compared to TZS 32,016.4 billion recorded in 2021.

The ratio of earning assets to total assets increased to 82.7% compared to 81.3% recorded in 2021, indicating that a significant part of the sector’s assets continued to be channeled to productive sectors of the economy.

Tanzania Banks Earning Assets Trend, 2018-2022

| Dec-22 | Dec-21 | Dec-20 | Dec-19 | |

| Total Earning Assets (TZS Billion) | 38,175.0 | 32,016.4 | 28,362.5 | 26,435.0 |

| Total Assets (TZS Billion) | 46,159.5 | 39,346.3 | 34,689.5 | 33,161.8 |

| Total Earning Assets to Total Assets (Percent) | 82.7% | 81.3% | 81.8% | 79.7% |

Asset Quality

Asset quality improved as evidenced by a decrease in the non-performing loan (NPL) ratio to 5.8% compared with 8.5% recorded in the preceding year, though the ratio remained slightly above the desired benchmark of not more than 5.0%.

The improvement in asset quality was attributed to an increase in the loan book while maintaining asset quality, improved credit risk management practices by banks and financial institutions, and measures instituted by the Bank.

The measures included monitoring the banks’ implementation of NPL reduction strategies; ensuring banks and financial institutions strengthen credit risk management practices including credit underwriting and monitoring processes; enhancing banks’ staff integrity; and implementing remedial measures to contain non-performing loans.

Tanzania Banks’ Loan Portfolio

The loan portfolio was diversified in various sub-sectors of the economy, with personal loans (38.1%), trade (16.5%), manufacturing (10.0%), agriculture (8.6%), and building, construction, and real estate (7.0%) being the major sectors. The remaining sectors accounted for 19.8% of the loan portfolio.

Interest Rates

In the year ending December 2022, the average interest rate charged by banks on loans was 16.06%, whereas negotiated lending rates were around 13.29%. These rates are similar to the ones in December 2021 of 16.37% and 14.06%.

The overall deposit interest rate averaged 6.94%, higher than the 6.74% recorded in December 2021. Meanwhile, negotiated deposit rates averaged 8.88% in December 2022, slightly below 9.82 percent in December 2021.

Tanzania Lending and Deposit Interest Rates, December 2021-2022

| Dec-21 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | |

| Savings deposit rate | 1.6% | 1.61% | 2.05% | 2.16% | 2.07% | 1.61% | 1.71% |

| Overall lending rate | 16.37% | 16.18% | 16.09% | 16.07% | 16.07% | 16.08% | 16.06% |

| Short-term lending rate (up to 1 year) | 16.6% | 16.76% | 16.81% | 16.82% | 16.73% | 16.9% | 17.27% |

| Negotiated lending rate | 14.06% | 14.23% | 14.24% | 13.92% | 14.33% | 13.95% | 13.29% |

| Overall time deposit rate | 6.79% | 7.56% | 7.49% | 7.62% | 7.32% | 7.28% | 6.94% |

| 12-months deposit rate | 7.87% | 9.05% | 9.25% | 9.22% | 8.78% | 8.77% | 8.23% |

| Negotiated deposit rate | 9.82% | 9.78% | 9.59% | 9.67% | 9.52% | 9.5% | 8.88% |

| Short-term interest spread | 8.74% | 7.71% | 7.55% | 7.6% | 7.95% | 8.13% | 9.04% |

Credit Reference Bureaux

The use of credit reference bureaux services continued to improve as evidenced by the significant increase in the number of credit inquiries by 147.7% to 5,712,114 from 2,306,088 reported in the preceding year.

Likewise, the number of credit reports sold increased by 195.4% to 2,726,381 from 923,057 reported in the preceding year.

BOT continued to sensitize banks and other credit providers on the usefulness of credit information sharing to increase the efficiency of the credit market, reduce NPLs, and ultimately enhance the stability of the financial sector.

Liability Structure

The major components of the sector’s liabilities were deposits and borrowings, which accounted for 83.1% and 11.9% of total liabilities, respectively, while the remaining liabilities accounted for 5.0% of total liabilities.

Total liabilities of the sector increased by 18.3% to TZS 39,222.6 billion compared to TZS 33,145.5 billion recorded in the preceding year. The increase in liabilities was attributed to a capital structure increase in deposits and borrowings.

Total deposits increased by 14.3% to TZS 32,584.7 billion from TZS 28,499.1 billion recorded in the preceding year whereas, local and foreign currency deposits increased by 19.3% and 2.1% to TZS 24,241.0 billion and TZS 8,343.7 billion, respectively.

The increase in deposits was due to increased public confidence in the banking sector, favorable economic activities, and deposit mobilization strategies instituted by banks and financial institutions.

In addition, borrowings increased by 55.3% to TZS 4,669.6 billion from TZS 3,007.6 billion.

Capital Structure

The total capital of the sector was composed of share capital (35.4%), retained earnings (41.0%), share premium (6.7%), and other capital items (16.9%).

Total capital increased by 11.9% to TZS 6,936.9 billion compared to TZS 6,200.9 billion recorded in the preceding year, mainly on account of an increase in retained earnings by 37.9% to TZS 2,841.2 billion from TZS 2,059.7 billion in 2021.

In addition, profitability increased by 67.3% to TZS 934.4 billion compared to TZS 666.4 billion recorded in the preceding year. The capital increase signifies enhanced resilience of the sector to withstand shocks that may emanate from both internal and external environments.

Capital Adequacy

The sector remained adequately capitalized as evidenced by core and total capital adequacy ratios which were 17.9% and 18.7% compared to 19.5% and 20.2% reported in 2021, respectively.

Both ratios were above the minimum regulatory requirements of 10% and 12% for core and total capital, respectively.

The decrease in capital adequacy ratios was attributed to an increase in risk-weighted assets such as loans, advances, and overdrafts.

However, the decrease in capital adequacy ratios did not affect the banking sector’s capacity to absorb shocks that may arise from both internal and external environments.

Off-Balance Sheet Items

Off-balance sheet items comprised of guarantees and indemnities (51.0%), letters of credit (31.3%), undrawn balances of loans and overdrafts (14.5%), bills for collections (1.2%), and others (2.0%).

Off-balance sheet items increased by 26.7% to TZS 12,099.0 billion compared to TZS 9,546.0 billion recorded in 2021 (Table 2.3).

The increase was due to the effective participation of the banking sector in trade finance and the facilitation of Government strategic projects through guarantees.

The off-balance sheet items were 26.2% of the total assets compared to 24.3% recorded in the preceding year.

Earnings

The sector remained profitable as depicted by an increase in profitability by 67.3% to TZS 934.4 billion from TZS 666.4 billion reported in 2021.

Return on Assets (ROA) and Return on Equity (ROE) increased to 3.4% and 14.2% from 2.8% and 11.5% recorded in 2021, respectively.

The increase in profitability was driven by an increase in interest income consistent with the growth of the loan portfolio, an increase in non-interest income, and an improvement in operational efficiency.

Tanzania Banking Sector Earnings, 2017-2022

Non-interest expenses to total income ratio decreased to 43.9% from 49.8% reported in 2021 as a result of a decrease in non-interest expenses.

BOT continued to monitor the Cost to Income Ratio (CIR) of banks and financial institutions. The CIR decreased to 52.9% from 57.3% recorded in the preceding year indicating improvement in operational efficiency.

Liquidity

The banking sector continued to maintain adequate liquidity sufficient to meet maturing obligations and fund growth in assets. The ratio of liquid assets to demand liabilities was 26.1% compared to 29.4% reported in 2021, above the minimum regulatory requirement of 20%.

The decline in the liquidity ratio was attributed to a portfolio shift to more profitable investments including loans, advances, and overdrafts; and investments in debt securities.

The ratio of gross loans to total deposits increased to 89.2% in December 2022 from 81.8% reported in December 2021 indicating that deposits remained the main source of funding.

Tanzania Non-Banking Financial Institutions Performances

Mortgage Finance

According to the Tanzania Mortgage Refinance Company Limited (TMRC), a financial institution owned by banks and non-bank Tanzanian institutions to support banks to do mortgage lending, the mortgage market in Tanzania registered a 7.12% growth in the value of mortgage loans in 2022 compared to 2021.

The total mortgage debt outstanding that resulted from lending by the banking sector for residential housing was TZS 531.98 billion equivalent to USD 229.18 million.

Typical interest rates offered by mortgage lenders ranged between averages of 15-19%. The average mortgage debt size was TZS 93.53 million equivalent to USD 40,292.

The performance of the mortgage finance institutions business continued to improve as supported by an increase in capital, total assets, loan portfolio, and profitability.

The number of banks reporting to have mortgage portfolios was 31 as of December 2022.

The mortgage debt advanced by the top five Primary Mortgage Lenders (PMLs) accounted for 65% of the total outstanding mortgage debt. CRDB Bank was a market leader commanding 36.49% of the mortgage market share, followed by Azania Bank (7.44%), NMB Bank (7.38%), Stanbic Bank (7.02%), and KCB Bank (6.34%).

The total capital of mortgage finance institutions increased by 14.7% in 2022 to TZS 58.9 billion compared with TZS 51.3 billion recorded in 2021, attributed to an increase in profitability. The mortgage finance institutions met capital adequacy requirements as provided in respective regulations.

Total assets of mortgage finance institutions increased by 16.0% to TZS 254.5 billion from TZS 219.4 billion recorded in 2021.

The performance was attributed to an increase in investment in debt securities by 14.6% to TZS 73.5 billion from TZS 64.1 billion and growth of mortgage loan portfolio by 11.5% to TZS 164.7 billion from TZS 147.8 billion.

Major sources of funding for mortgage finance institutions were borrowings (57.0%), corporate bonds (19.9%), and shareholders’ funds (23.1%).

The loan portfolio of mortgage finance institutions increased by 12.8% to TZS 167.1 billion compared to TZS 148.1 billion recorded in the preceding year.

The increase was attributed to the recovery of businesses from the residual effects of the COVID-19 pandemic. Non-performing loans were 0.3% of the total mortgage portfolio, which was within the acceptable level of not more than 5%.

The profitability of mortgage finance institutions increased to TZS 2.4 billion compared to TZS 1.8 billion recorded in the preceding year. The increase was attributed to an increase in interest income by 13.0% to TZS 24.6 billion compared to TZS 21.8 billion recorded in 2021.

Microfinance

The performance of the microfinance business has improved as supported by an increase in the number of microfinance service providers (MSPs), total loans disbursed, number of beneficiaries, and increased outreach to the unbanked population.

In 2022, the number of licensed Tier 2 MSPs increased to 1,095 from 692 in 2021, and the amount of total loans disbursed was TZS 811.3 billion from TZS 620.6 billion in 2021.

The number of Tier 3 MSPs (SACCOS) increased to 759 from 580, and Tier 4 MSPs (Community Microfinance Groups) increased to 34,127 from 24,123 in 2021. Additionally, MSPs were located in all regions across the country.

BOT has continued to take measures to improve financial customers’ protection. The measures include instructing all licensed microfinance services providers to establish customer complaints handling mechanisms, conducting public awareness programs and capacity building to MSPs, enforcing the use of the reducing balance method for interest rate computation, and instructing MSPs to refund borrowers the over-deducted loan amounts.

Financial Leasing Companies

Total assets of financial leasing companies increased significantly by 77.0% to TZS 183.6 billion from TZS 104.1 billion recorded in the preceding year. The increase was mainly attributed to an increase in financial lease companies in the market.

Total assets comprised of finance leases (56.0%), operating leases (21.9%), cash and cash equivalents (6.8%), and other assets (15.4%). Major sources of funding were borrowings and shareholders’ equity, which accounted for 54.8% and 24.7% of the total funding, respectively.

The finance lease assets portfolio increased by 195.5% to TZS 102.8 billion compared to TZS 32.3 billion recorded in the preceding year. The increase was mainly attributed to an increase in finance lease investments as a result of an increase in financial leasing companies in the market and improved economic conditions.

Profitability decreased by 15.7% to TZS 5.2 billion from TZS 6.3 billion recorded in 2021, which was mainly attributed to an increase in operating expenses to TZS 32.5 billion from TZS 31.9 billion as a result of an increase in operating leases.

The performance of social security schemes improved as depicted by an increase in investment assets, members’ contributions, and investment income. Total assets amounted to TZS 17,799.9 billion mainly contributed by Investment assets by 91.5%, which was above the regulatory requirement of not less than 85.0%.

Investment assets increased by 14.5% to TZS 16,290.0 billion from TZS 14,224.5 billion reported in 2021. The increase was attributed to an increase in income from members’ contributions and investments.

Contributions from members increased by 21.9% to TZS 3,864.4 billion from TZS 3,169.8 billion reported in 2021, while Income from investments increased by 32.7% to TZS 1,437.1 billion from TZS 1,083.4 billion reported in 2021.