Microfinance

Microfinance refers to the provision of financial services to low-income individuals who are traditionally not served by conventional financial institutions.

Microfinance is globally acknowledged and accredited for its role in fighting poverty as evidenced by many countries that use it.

In recognition of the potential of the microfinance sub-sector in poverty reduction and economic growth, the Government of Tanzania formulated and adopted the first National Microfinance Policy in 2000 (NMP, 2000).

The Policy was reviewed in 2017 by formulating the National Microfinance Policy 2017 (NMP 2017) and its implementation Strategy for the period of ten years from 2019/20 to 2029/30.

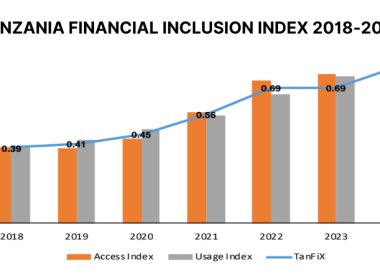

The main objective of NMP 2017 is to promote financial inclusion by creating an enabling environment for an efficient and effective microfinance sub-sector in the country that can serve the needs of individuals, households and enterprises on low incomes and thereby contribute to economic growth, employment creation and poverty reduction.

In addition, the Government enacted the Microfinance Act of 2018. The Bank of Tanzania (BOT) has been mandated to license, regulate and supervise the microfinance business in the country.

Tanzanian Microfinance Banks

The Act provides for the categorization of microfinance service providers into four tiers as follows: Tier 1, comprising deposit-taking microfinance service institutions; Tier 2, comprising non-deposit-taking microfinance service providers such as individual money lenders; Tier 3, comprising Savings and Credit Cooperative Organizations (SACCOS); and, Tier 4, comprising community microfinance groups.

According to the latest information of 2023 made available by BOT, there are in Tanzania 3 microfinance banks, (Tier 1 microfinance institutions), and 1,352 Tier 2 microfinance institutions.

Challenges Faced by Tanzanian Microfinance

-Management Information Systems: Most of the microfinance institutions (MFIs) have inadequate capacity to collect statistical and other relevant information regarding their operations as well as insufficient capacity to develop Management Information Systems (MIS);

-Lack of central credit information register: The lack of a unified central point for sharing and verifying client credit information has exposed the microfinance clients to multiple loans;

-High interest rates: Microfinance institutions in the country charge high interest rates based on the cost of capital, personnel, administration and loan loss. It is estimated that administrative costs amount to up to two thirds of interest paid by clients.There is no universal system applicable across all MFIs on the calculation of interest rates.The interest rates applied are differentiated by product, product attributes and features including loan type, cycle, amount and duration. Most of these institutions are not transparent in their pricing systems and therefore the interest rates charged are usually stated in nominal rates than in effective rates, which lead customers to make uninformed borrowing decisions. Some of MFIs charge significantly high effective interest rates ranging from 3 to 20 percent per month.

-Inadequate working capital for microfinance services providers: Most of the MFIs have inadequate working capital resulting from the poor saving culture of members and the inability to secure affordable and reliable financing sources; and

-Weak institutional capacity of microfinance service providers: MFIs face a set of inter-related challenges, such as: limitations in the scale of their operations in terms of outreach and number of clients served; poor portfolio quality; limitations in their professional capacity; weak governance structure; poor accounting and record keeping; inefficient operations; and, lack of financial discipline.