The Bank of Tanzania (BOT) has released its Monthly Economic Review–November 2025, outlining Tanzania’s exports performance for the year ending October.

External Sector Performance

The external sector of the economy continues to perform satisfactorily.

The current account deficit narrowed to USD 2,217.8 million for the year ending October 2025, a notable improvement from USD 2,893.3 million recorded in the same period of 2024.

This was equivalent to 2.4% of GDP, from a peak of more than 6% of GDP in 2022.

The improvement is largely driven by higher exports, particularly gold, tourism, and agricultural commodities such as cashew nuts and tobacco.

The improved exports were accompanied by a decline in imports due to moderate prices in the world market and increased domestic production of some consumer goods, which were largely imported previously.

Foreign exchange reserves continue to increase, amounting to about USD 6,171.1 million at the end of October 2025, sufficient to cover 4.7 months of projected imports of goods and services, surpassing both national and EAC benchmarks.

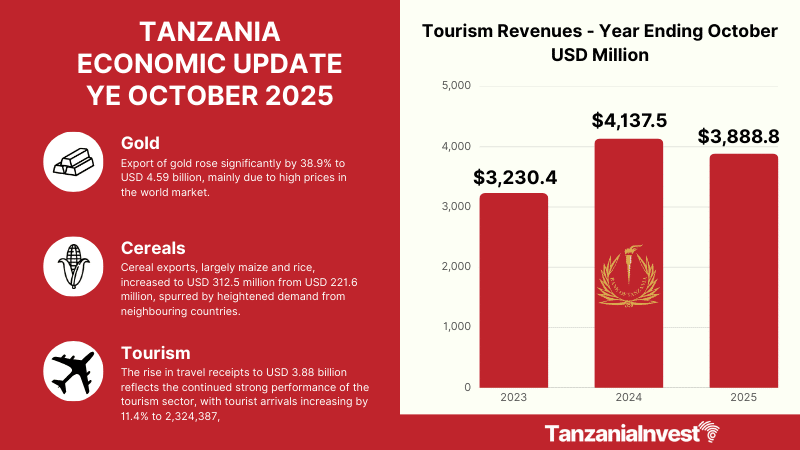

Exports

Export of goods and services rose to USD 17,048.7 million in the year ending October 2025, from USD 15,133.5 million in the corresponding period in 2024.

Export of goods reached USD 10,137.9 million, an increase from USD 8,461.5 million in the previous year.

This increase was driven by higher exports of gold, manufactured goods, tobacco, cashew nuts and coffee.

Notably, the value of gold exports surged by 38.9% to USD 4,596.5 million, up from USD 3,308.9 million, mainly driven by higher global gold prices.

Traditional exports rose to USD 1,438.2 million, representing a 25.2% increase, driven by higher tobacco and cashew nut exports, explained by both price and volume gains.

Cereal exports, largely maize and rice, increased to USD 312.5 million from USD 221.6 million, associated with increased demand from neighbouring countries.

On a monthly basis, the value of goods exports rose to USD 949.2 million in October 2025, up from USD 928.3 million in a similar period in 2024, driven largely by strong performance in gold and manufactured goods.

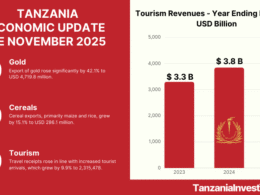

Service receipts amounted to USD 6,910.8 million for the year ending October 2025, higher than USD 6,672 million in the previous year, on account of increased tourism and transportation receipts.

Tourist arrivals rose by 11.4% to 2,324,387, while transport earnings, primarily freight, amounted to USD 2,470.7 million compared to USD 2,260.5.

On a monthly basis, service receipts were USD 543.2 million in October 2025, down from USD 606.2 million in October 2024.

Imports

For the year ending October 2025, imports of goods and services rose to USD 17,679.5 million, from USD 16,774.3 million in the same period in 2024.

Industrial supplies, transport equipment, parts and accessories, as well as machinery and mechanical appliances, accounted for a substantial share of the increase in imports.

Oil imports declined by 12.5% to USD 2,394.4 million, largely reflecting lower prices in the global market.

On a monthly basis, goods imports amounted to USD 1,226.3 million, compared to USD 1,257.6 million in October 2024.

Service payments amounted to USD 3,072 million in the year ending October 2025, from USD 2,660.1 million in the same period in 2024.

The increase was driven by higher freight payments, consistent with the increase in the import bill.

On a month-on-month basis, service payments were USD 254.9 million, down from USD 281.9 million in October 2024.

The primary income account recorded a deficit of USD 2,036.6 million for the year ending October 2025, an increase from USD 1,803.3 million recorded in the corresponding period in 2024.

The outturn was primarily attributed to payments related to income on equity and interest abroad.

On a monthly basis, the primary income account deficit amounted to USD 221.7 million, almost the same as the deficit recorded in October 2024.

The secondary income account had a surplus of USD 450 million, down from USD 550.8 million in the previous year, mainly supported by personal transfers.

On a monthly basis, the surplus was USD 15.5 million, a decrease from USD 31.1 million in October 2024.