Economy

Introduction to the Economy of Tanzania

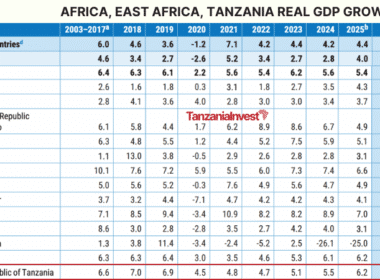

With an average real GDP growth rate of +5.5% over the decade 2012-2021, Tanzania is among the fastest-growing economies in Africa and the world.

During the same period, the average global GDP growth rate was +2.3% and the GDP growth rate in Sub-Saharan Africa was +2.7%.

The Tanzanian economy even maintained a positive economic growth in 2020 of +2% while most of the economies were in a recession due to the impact of the Covid-19 pandemic.

However, Tanzania’s GDP growth rate has been slowing down in recent years, from a peak of 7.9% in 2011.

In April 2021, Tanzania’s new president Samia Suluhu Hassan gave her first speech to the parliament, mentioning the priorities of the Sixth Phase Government in the next five years to reach a GDP growth rate of at least 8% yearly.

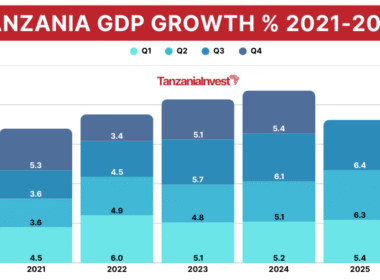

The Tanzanian Economy in 2023, 2024, and Beyond

According to the World Bank (WB), the GDP of Tanzania expanded by 4.6% in 2022, up from 4.3% in 2021, and is expected to rise to 5.1% in 2023.

The value of Tanzania’s GDP at current prices reached USD 75.5 billion in 2022. The GDP per capita rose by 1.4% in 2022 and the international poverty rate dropped marginally by 0.3% points.

Led by the services and industry sectors, the recovery remained broad-based as all subsectors surpassed their pre-pandemic production levels by Q3 2022.

This is consistent with high-frequency indicators including cement production, electricity generation, and tourist arrivals, all of which grew substantially in 2022.

The WB projects Tanzania’s GDP growth to reach 5.1% in 2023–about 2.2% per capita–as investment increases and external terms of trade improve.

An improving business climate and the implementation of structural reforms are expected to boost annual GDP growth to 5.6% in 2024, 6.0% in 2025, and 6.4% in 2026.

Similarly, according to the International Monetary Fund (IMF) World Economic Outlook of October 2023, the real GDP growth of Tanzania in 2022 was 4.7% % in 2022, and it is projected to be 5.2% in 2023, and 6.1% and 7.0% in 2024 and 2025 respectively.

On the same line, the Central Bank of Tanzania (BOT), in its Monetary Policy Committee Meeting Statement, issued in February 2024, estimates that the country’s economy reached a 5% growth in 2023. It also forecasts an economic growth of 5.5% in 2024.

For its part, the African Development Bank (AfDB) in its African Economic Outlook Report 2024,) projects that Tanzania’s real GDP growth will reach 5.7% in 2024 and 6% in 2025, driven by agriculture, manufacturing, and tourism and supported by public investments and reforms to improve the business environment.

Tanzania Key Economic Sectors

According to the data from the Bank of Tanzania, in 2021 Agriculture (agriculture, forestry, and fishing) accounted for 27% of the country’s GDP, Industry and Construction for 31%, and Services for 42%.

The main sectors of the Tanzanian economy in terms of their contribution to the GDP are Construction which accounts for 16%, Crops (14%), Manufacturing (9%), Wholesale and retail trade; repairs (9%), Transport (8%), Livestock (8%), and Mining and Quarrying (5%).

However, in the quarter ending September 2022, Mining and Quarrying reached 9.8% of the country’s GDP.

Another major sector of Tanzania’s economy is tourism whose contribution to GDP fell from 10.6% in 2019 to 5.3% in 2020 due to the impact of the Covid-19 pandemic and climbed to 5.7% in 2021.

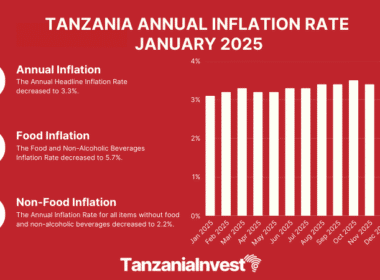

Tanzania Inflation

In 2022 (January to December) the average annual headline inflation in Tanzania was 4.3%. In 2021 it was 3.7% and 3.3% in 2020.

Inflation trended downward in 2023, reaching 3.3% in September 2023 from 3.6 percent in June 2023, associated with declining food prices.

In Zanzibar, inflation was 7.5%, up from 6.5% in June 2023, mainly driven by food prices.

Despite the recent increase in oil prices, BOT projects inflation to remain within the range set in the 3rd Tanzania Five-Year Development Plan (FYDP III) between 3.0% and 5.0% over the medium term.

Tanzania Exchange Rates

On 26th April 2023, the average market exchange rates (source bot.go.tz) for the Tanzanian shilling (TZS) against major currencies provided were: USD/TZS 2313.3707, GBP/TZS 2876.4486 EUR/TZS 2549.7983, CNY/TZS 334.2296.

A year earlier, on 26th April 2026, the average market exchange rates (source bot.go.tz) for the Tanzanian shilling (TZS) against major currencies provided were: USD/TZS 2298.7733, GBP/TZS 2932.3175 EUR/TZS 2468.1941.

In its Monthly Economic Review of March 2023, the Bank of Tanzania (BOT) explains that the shilling remained stable against currencies of major trading partners, trading at an average rate of TZS 2,321.13 per USD, compared with TZS 2,320.64 per USD in the preceding month.

On an annual basis, the shilling depreciated by 0.5% from TZS 2,309.61 per USD which was recorded in February 2022.

Tanzania Balance of Trade

The current account of Tanzania recorded a deficit of USD 5,294.5 million in the year ending February 2023 compared with a deficit of USD 2,744.3 million recorded in the corresponding period in 2022, on the account of the challenges endured by high inflation coupled with effects of the war in Ukraine.

The overall balance of payments also had a deficit balance of USD 1,294.2 million compared with a surplus of USD 801.9 million in the year to February 2022.

Exports of goods and services increased to USD 12,383.1 million in the year ending February 2023 from USD 10,202.1 million in the corresponding period in 2022, mostly driven by non-traditional exports (particularly minerals and manufactured goods), and services receipts, mainly tourism.

A notable increase was registered in the exports of minerals, particularly gold, coal, and diamonds.

Gold exports registered an annual increase of 7% to USD 2,859.6 million.

Exports of diamonds were USD 66.9 million, higher than USD 9.6 million in the year to February 2022.

Coal exports grew significantly to USD 228.6 million from USD 23.2 million.

Likewise, the export of manufactured goods increased by 19.9% to USD 1,490.2 million, largely driven by fertilizer, iron and steel, and cement.

Tanzania National Debt

Tanzania’s national debt stock, comprising the public and private sectors, was USD 40,738 million at the end of February 2023.

Out of the debt stock, 71% was external debt.

Multilateral institutions continued to account for the largest share of the debt stock, at 47.2%, followed by commercial creditors.

The largest portion of the disbursed outstanding debt was in the hands of transport and telecommunication activities, followed by social welfare and education, and energy and mining activities.

The structure of external debt by currency remained unchanged, where USD continued to dominate (68.9%), followed by the Euro.

Tanzania Foreign Direct Investment (FDI)

According to the World Investment Report of 2022 published by the United Nations Conference on Trade and Development (UNCTAD), foreign direct investment (FDI) to Tanzania rose by 35% to USD 922 million in 2021 from USD 695 million in 2020.

According to the Monthly Investment Bulletin-March 2023 released by the Tanzania Investment Center (TIC), the top five leading sources of FDI to Tanzania are China, the USA, Mauritius, Spain, and India.

Last Updated: 1st June 2024

Sources: African Development Bank (AfDB), Bank of Tanzania (BoT), Foreign Service Institute of the US Department of State, International Monetary Fund (IMF), Tanzania Investment Centre (TIC), Tanzania National Bureau of Statistics, World Bank (WB).