Banking

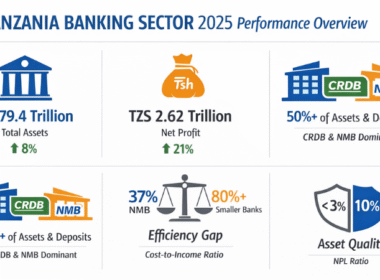

The Tanzanian banking sector recorded strong growth in 2022 (and 2023), with profits before tax reaching TZS 1.4 trillion, a 38% increase from TZS 1 trillion in 2021.

Net profit reached TZS 875,027 billion compared to TZS 676,863 million.

As of March 2024, there are 48 licensed banks in Tanzania: 35 commercial banks, 5 community banks, 4 microfinance banks, 2 mortgage banks, and 2 development banks.

Their total assets increased by 17.3% to TZS 46,159.5 billion in 2022 from TZS 39,346.3 billion in 2021. This was mainly attributed to the increase in deposits, borrowings, and retained earnings.

Tanzania Banking Sector Liberalization

The Tanzanian banking sector embarked on a plan for financial liberalization in the ’90s to sustain the country’s economic growth.

This has been accomplished through the mobilization of financial resources as well as by increasing competition in the financial markets and by enhancing the quality and efficiency of credit allocation.

As a result of the liberalization, new merchant banks, commercial banks, bureaus de change, credit bureaus, and other financial institutions have entered the market.

Tanzania Banking Sector Performances

According to the 2022 Financial Sector Supervision Annual Report of the Bank of Tanzania (BoT), in the same year Tanzanian banking sector remained profitable, adequately capitalized, with a sufficient level of liquidity and improved asset quality, attributable to the recovery of businesses from the negative effects of COVID-19 pandemic.

Total assets grew by 17.3% to TZS 46,159.5 billion in 2022 compared to TZS 39,346.3 billion recorded in the preceding year, mainly financed by an increase in deposits, borrowings, and retained earnings.

Loans, advances, and overdrafts grew by 25.3% to TZS 26,095.9 billion compared to TZS 20,822.6 billion reported in the corresponding period in 2021.

The growth was attributed to the favorable macroeconomic environment, the BOT’s accommodative monetary policy, and regulatory measures taken to support the private sector’s credit growth.

Earning assets increased by 19.2% to TZS 38,175.0 billion compared to TZS 32,016.4 billion recorded in 2021.

Tanzania Interest Rates

In the year ending December 2022, the average interest rate charged by banks on loans was 16.06%, whereas negotiated lending rates were around 13.29%. These rates are similar to the ones in December 2021 of 16.37% and 14.06%.

Tanzania Banking Network

In 2022, the total number of bank branches and ATMs fell to 987 from 989 in 2021. Large banks accounted for 55.2% of the branch network. Urban centers accounted for 51.6% of total branches.

Most of the branches are located in the major cities of Dar es Salaam, Arusha, Mwanza, Moshi, and Dodoma.

In 2013, the BoT introduced comprehensive agent banking guidelines that permit licensed banks and financial institutions to appoint retail agents for their banking services. This provides a mechanism through which banks can profitably extend their services to previously unbanked lower-income individuals.

In 2022, the total number of bank agents increased by 53% to 75,238 from 48,923 in 2021. Deposits through agents increased by 71.1% to TZS 61,915.9 billion.

Tanzania Banking Sector Outlook

Check our Report on the Tanzania Banking Sector for a detailed overview of the industry, and the consolidation taking place.

Latest Update: 1st April 2024