The Bank of Tanzania (BOT) Monetary Policy Committee (MPC) has decided to maintain the Central Bank Rate (CBR) at 5.75% for the first quarter of 2026.

The decision was taken considering that inflation is projected to remain within the target range of 3–5%.

The MPC expects economic conditions to be favorable, and therefore, keeping the CBR unchanged would support robust economic growth.

In line with the inflation and growth projections, BOT will implement monetary policy to ensure the 7-day interbank rate evolves within the band of 3.75 to 7.75%.

Economic Performances

GDP

The MPC assessed the domestic economic growth in 2025 as having been robust, with a GDP growth of around 5.9% in line with the projection of 6%.

This good performance was driven mainly by agriculture, mining, and construction.

The Zanzibar economy for 2025 is estimated to have grown by 6.8%, driven by construction, tourism, and manufacturing activities.

For the first quarter of 2026, growth in Mainland Tanzania is projected to remain strong at 6%, and the Zanzibar economy is projected to grow at 7.2%.

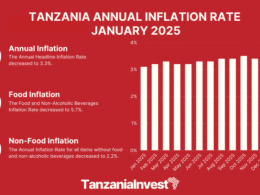

Inflation

Inflation remained low, changing slightly within the target range of 3-5%. In Mainland Tanzania, inflation averaged at 3.5% in the fourth quarter of 2025, while in Zanzibar it was 3.4%.

This was due to prudent monetary policy and favourable global conditions, which provided relief to the exchange rate and lowered imported inflation.

The MPC expects inflation to remain within the target of 3 to 5% throughout the year 2026.

Credit Supply

Credit to the private sector in 2025 expanded robustly by 20.3%.

The banking sector remained sound, with adequate liquidity for lending and a sufficient capital buffer to withstand shocks.

The loan portfolio increased, reflecting a favorable business environment.

Credit risk, as reflected by the non-performing loan ratio, was low at 3.1% compared to the tolerable level of 5%. Payment systems were resilient, operating efficiently and smoothly.

Fiscal Performance

Fiscal policy performance was satisfactory, with tax revenue in both Mainland Tanzania and Zanzibar improving.

The public debt increased moderately and remained sustainable at moderate risk to debt distress.

The Debt Sustainability Analysis for 2024/25 indicates that the ratio of public debt to GDP, in net present value terms, has declined to 40.6% from 41.1% in 2023/24. This ratio was below the maximum threshold of 55%.

External Sector

The external sector of the economy improved, with the current account deficit narrowing to a five-year low of 2.2% of GDP in 2025, on account of a significant improvement in exports of gold, agricultural products, tourism, and transport.

The decline in global oil prices also contributed to narrow the current account deficit.

On the side of Zanzibar, the economy sustained a current account surplus, driven primarily by tourism activities in 2025.

Forex

Foreign currency liquidity was adequate in the fourth quarter of 2025, mainly due to proceeds from exports of cashew nuts, tourism, and gold.

Consequently, the value of Tanzanian Shilling remained stable against USD, recording a slight appreciation of about 0.8% by the end of the quarter.

Foreign exchange reserves were high, amounting to more than USD 6.3 billion. This level was sufficient to cover about 4.9 months of imports, in line with the minimum requirement of 4 months.

The reserves are expected to remain adequate in the first quarter of 2026, supported mainly by strong export performance and moderate oil prices.

Next CBR announcement date

The next MPC meeting is scheduled for 2nd April 2026, and the CBR announcement for the second quarter will be made on the following day, 3rd April 2026.