The Tanzanian real estate sector has been growing sensibly in the recent years accompanied by a strong and sustained economic growth averaging 7%, a fast growing population of 50 million and efforts by the Government, in partnership with global non-profit institutions and foreign governments, to meet the growing demand of affordable housing.

The Tanzanian housing sector’s fast-growing demand is mainly driven by the fast-growing Tanzanian population which is estimates to be 53.47 million and that is expected to more than double by 2050.

The Tanzanian housing demand has also been boosted by easier access to mortgages, with the number of mortgage lenders in the market increasing from 3 in 2009 to 21 in 2015 and the average mortgage interest rate in Tanzania falling from 22% to 16%.

The current demand for housing in Tanzania is estimated at 200,000 houses annually, and a total housing shortage of 3 million houses, as explained Nehemiah Kyando Mchechu, Director General of Tanzania’s National Housing Corporation (NHC), the Government’s company established to undertake an array of business in real estate.

Dar es Salaam, Tanzania’s commercial capital and Africa’s fastest growing city, has a current population of about 4.3 million which is expected to quintuple to about 20 million by 2050.

Housing price per square metre averages USD 1,200 in Dar Es Salaam versus USD 1,235 in Nairobi while the rent of one-bedroom apartment in the city center is around USD 775.3 a month in Dar es Salaam versus USD 444.5 a month in Nairobi.

The concept of absolute ownership of land is not recognized in Tanzania, where people have however the right to use and occupy the land in accordance with the approved use.

Foreign companies and individuals wishing to have rights to occupy and use land can only do so by acquiring derivative rights, applying to the Tanzania Investment Centre (TIC) or to landowners who have been granted right of occupancy.

Table Of Contents:

Tanzania Housing Demand And Supply

Tanzania Housing Legal Framework And Taxation

Tanzania Housing Financing

Tanzania Housing Outlook And Investment Opportunities

Tanzania Housing Demand And Supply: Shortage Of 3 Million Houses

According to the National Housing Corporation (NHC), the largest – state-owned – real estate developer established to support the growth in Tanzania’s property market, Tanzania’s housing demand is estimated at 200,000 houses annually, which represents 7.83% of the African daily housing demand.

This results in a current housing shortage in Tanzania of 3 million houses.

Tanzania Housing Demand: A Fast Growing And Young Population Moving To Urban Centers

The Tanzanian housing sector’s fast-growing demand is mainly driven by the fast-growing Tanzanian population which is estimates to be 53.47 million and that is expected to more than double by 2050 while increasing its growing rate from the current 1.56 million per year to 2.98 million per year in 2025 according to the United Nations (UN).

Tanzania has a predominantly rural population with only 31% of the population urbanized, but the country’s rapid urbanization rate estimated at 5.39% in the period 2013/2014 and above the average of 3.9% for African cities in the last decade, constitutes the main factor driving development of the real estate sector in the country, mostly focused on the commercial capital Dar es Salaam, but also on other major urban centers such as Mwanza, Arusha and Mbeya, due to growth in agriculture, mining and tourism sectors.

In addition, Tanzania counts with one of the youngest population in the world with an average age of 17.3 years which is expected to increase to 22.2 years by 2050 and that represents a high potential growth for Tanzania’s real estate sector as this segment of the population is the largest borrowers in the country.

This young and fast growing population represents most of the Tanzanian housing demand through either commercial loans to develop their own properties, or mortgage finance to acquire already built projects.

Dar Es Salaam Housing: Demand & Supply

Dar es Salaam, with a current population at about 4.3 million, which is expected to quintuple to about 20 million by 2050, is Africa’s fastest growing city according to The United Nations Population Division.

In Dar es Salaam, most of the housing demand and supply for residential real estate projects is concentrated in districts out of the Central Business District (CBD) which is compounded by Kisutu, Kivukoni, Upanga, and Kariakoo areas, where the retail property market is booming.

The Kariakoo area is famous for its clothes and electronic shops, Kisutu and Kivukoni are well known due for their tall buildings where private businesses and governmental authorities have set their offices, while in Upanga has seen a growing number of residential properties constituted by multi-familiar apartment projects due to the less density of the area.

For residential demand, specifically for apartments, Masaki, Kawe, Mbezi Beach, Mikocheni A, Msasani Beach, and Jangwani Beach are among the most popular areas.

Regarding residential demand for houses, Kigamboni, Mikocheni B, Masaki, Mbezi Beach, Jangwani Beach, and Kawe Beach constitute the most popular places.

Dar Es Salaam Housing: Rental & Sales Prices

In Dar es Salaam renting rates higher than those found in Kenya’s capital, Nairobi for example where a one-bedroom apartment in the city centre can be rented at around USD 444.5 a month while in Dar es Salaam it is at an average of USD 775.3 a month.

Housing price per square metre averages USD 1,200 in Dar Es Salaam versus USD 1,235 in Nairobi according to Numbeo, an online source of statistics on quality life topics by cities and countries.

Out of the Dar es Salaam city centre, to rent a one-bedroom apartment can cost up to USD 514.34 a month and average cost per square metre is USD 608.17.

Type Of Housing Demanded In Tanzania

Most of housing demand for residential properties in Tanzania is represented by small apartments of an average size of 60 square metres, generally constructed in plots of 400 square metres that can be afforded by the growing new urban households, compounded in majority by the young Tanzanian middle class according to a research from the Centre for Affordable Housing Finance in Africa (CAHF), a non-profit trust to promote housing finance in the continent.

The high demand coming from this growing middle class – daily income between USD 2 and 13 a day -, has encouraged real estate developers to diversify the supply by developing multi-familiar projects to tap the profitability of the average plot size at 400 square metres according to Pangani Group, a company involved with property services and solutions in Tanzania.

Regarding retail and commercial property projects, this sector has experienced a strong investment during the last years raising the commercial buildings supply in urban centres.

As a result, the supply of real estate projects built for commercial purposes as offices or stores, has grown at a faster rate than the growth in demand for these properties.

Consequently, the retail/commercial property sector currently holds an excess supply of 310,000 square metres.

Regarding Tanzania’s office market, in the recent years office space has achieved full occupancy and now it is common to see in Dar es Salaam new offices to be quickly occupied not only by old businesses that have moved from residential buildings used for commercial purposes, but also by new businesses according to PricewaterhouseCoopers (PwC).

The establishment of new businesses has been also a driver of growth in demand for retail/commercial property due to Tanzania’s steady growth in the last ten years at an average rate of 7.0% per annum according to UK Trade & Investment.

It has broadened Tanzania’s economy from reliance on agriculture sector and has encouraged the arrival and creation of new companies that are intensifying activity in sectors as energy, mining, information and communication technology (ICT), security, and financial services.

Tanzania Housing Legal Framework

All land in Tanzania is public land and is vested in the President as a trustee for and on behalf of all Tanzanians.

The Ministry of Lands, Housing and Human Settlements Development (MLHHSD) has been mandated to administer land and human settlement in Tanzania on behalf of the President of Tanzania who serves as the trustee of all land.

Land in Tanzania is divided into three categories : general land, village land and reserved land.

The Land Act regulates the general and reserved land while the village land is regulated by the Village Land Act.

The concept of absolute ownership of land is not recognized in Tanzania, where people have however the right to use and occupy the land in accordance with the approved use which is either for residential, commercial, mix of residential and commercial or for pastoral or farming purposes.

Accordingly a person can be granted right of occupancy of a land for 33,66 or maximum 99 years.

For general land, the right to use and occupy such land is applied and granted by the President, while for village land, by the Village Council.

Foreign Ownership Of Land In Tanzania: Derivate Rights

The Land Act provides that foreign citizens shall not be allocated or granted land unless it is for investment purposes as provided for under the Tanzania Investment Act.

The Act further provides that a corporate body in which majority shareholders or owners are foreign citizens shall be deemed foreign corporation and hence cannot be granted right of occupancy unless such a corporate body is registered and granted a Certificate of Incentives under the Tanzania Investment Act.

So foreign companies and individuals wishing to have rights to occupy and use land can apply to the Tanzania Investment Centre (TIC) which shall grant the derivative right to use and occupy the land.

Alternatively foreign companies and individuals can enter into lease agreements with landowners who have been granted right of occupancy as they can enter into lease agreements either with citizens or non-citizens.

Finally foreigners can enter into joint venture agreements with companies in which majority shareholders are Tanzanians and are able to acquire granted right of occupancy.

For village land, foreigners can apply for the right to use the land to the Village Council which may grant foreign citizens the right to use and occupy land for a limited period of time and under stipulated conditions as indicated by the Village Council and the Village Land Act.

Taxation Of Housing in Tanzania

Taxes levied on property in Tanzania include:

- Land Rent Tax: 11.5% – 12.5% on economic value of the land

- Lease Agreements: 1% of gross rent being stamp duty

- Conveyance: 1% of gross rent being stamp duty

- Withholding tax (rent): 15% of rental income. Can be credited against tax payer’s income tax liability

- Value Added Tax : 18%

- Capital Gains: 20%

- Property Tax: TZS 15,000 – TZS 75,000. Payment based on size, use location of the property

Tanzania Housing Financing: A Growing Mortgage Market

Traditionally most of the urban housing stocks in Tanzania were built by individuals rather than complex developers by using their own funds or informal lending instead of a traditional borrowing from commercial banks, with Tanzania’s housing microfinance and mortgage finance accounting for a small portfolio of the housing stock and representing a substantial potential for growth in the short term.

Wealthy households usually use their own savings to develop their own housing projects according to the Centre for Affordable Housing Finance in Africa (CAHF).

Also, Tanzania’s housing market has been characterized by the lack of literacy in terms of mortgage benefits, and local banks reluctant to lend long-term.

According to the African Union for Housing Finance (AUHF), an association of mortgage banks in Africa to promote housing finance in the continent, only 12.4% of the Tanzanian adult population can access housing finance due to low incomes and asymmetric information between borrowers and lenders that makes the risk assessment difficult for banks.

However, the Tanzanians have started to realize about the benefits of this financial product and many of them are now buying real estate projects to immediately rent them and keep the property as a source of income in the future.

A survey undertook by the AUHF in 2009 found that 62% of Tanzania’s population would opt for a commercial loan to develop their own housing project against 18% that would opt for a mortgage finance to buy pre-built units.

This situation encouraged the Tanzanian Government to take some measures in order to increase housing finance and mortgage lending to boost housing demand.

It reduced the Value Added Tax (VAT) on real estate investments from 20% to 18% and in 2010 it established the Tanzania Mortgage Refinancing Company (TMRC) whose main objective is to re-finance mortgage loans from commercial banks in order promote Tanzania’s real estate sector.

As explained by Oscar Mgaya, CEO of TMRC: “One of the main reasons commercial banks did not offer mortgage loans was because of lack of long-term funds, which are necessary in mortgage lending, to avoid assets and liabilities maturity mismatch risk. TMRC was born out of an initiative between the Government of Tanzania and the World Bank”.

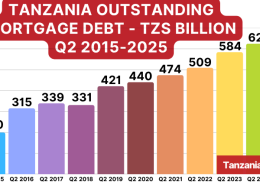

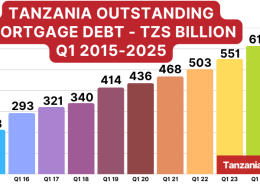

In 2010, Tanzania’s mortgage market started its growth with the first mortgage loan issued by the Commercial Bank of Africa (CBA) in 2007 for approximately TZS 376,830 or USD 300.

It was followed by Azania Bank Limited and Stanbic Bank which quickly joined the TMRC and benefited from its first disbursed loan in 2011 and second one in 2012 for a total of USD 2.7 million to refinance loan portfolios of minimum TZS 1 billion or USD 0.6 million.

By 2011, Tanzania’s housing market counted with a demand of 579 mortgage loans totaling TZS 76.72 billion or USD 36.06 million, and five TMRC member banks whose 324 mortgage loans totaled TZS 28.04 billion or USD 13.18 million.

In 2012 the Tanzanian housing market demand increased by 227.6% to 1,897 mortgage loans totaling TZS 113.01 billion or USD 53.12 million, and seven TMRC member banks whose 991 mortgage loans totaled TZS 46.15 billion or USD 21.69 million.

In 2013 Tanzania’s housing demand increased by 46.76% to 2,784 mortgage loans totaling TZS 156.50 billion or USD 73.56 million, and eight TMRC member banks whose 1,421 mortgage loans totaled TZS 62.76 billion or USD 29.50 million.

The growing trend followed in 2014 in the Tanzanian real estate market with an increase of 29.24% to 3,598 mortgage loans totaling TZS 248.35 billion or USD 116.74 million, and ten TMRC member banks whose 1,804 mortgage loans totaled TZS 96.73 billion or USD 45.47 million.

As of June 30th, 2015 the Tanzania mortgage market experienced a growth in demand by 24.37% to 4,475 mortgage loans totaling TZS 334.31 billion or USD 157.00 million, and 14 TMRC member banks whose 2,514 mortgage loans totaled TZS 102.58 billion or USD 48.22 million.

As a result the number of mortgage lenders in the market increased from 3 in 2009 to a total of 21 in 2015 and thanks the higher competition between commercial banks to in the mortgage lending market, the average mortgage interest rate in Tanzania fell from 22% to 16% and the mortgage loan’s maturity was extended from an average of 7.5 years to 17.5 years.

Tanzania Real Estate Outlook And Investment Opportunities

The Tanzanian property market has still a big room for development, with a housing shortage of 3 million houses and a demand growing by 200,000 units per year.

However there need to be a balance in promoting investment in middle-class housing, which is very critical for the economy, as explained by Joseph Sheffu, Country Managing Partner of EY Tanzania.

This is why the National Housing Corporation (NHC) announced plans to conduct a research on reducing the cost of construction to enable the majority of Tanzanians to access decent and affordable houses.