TanzaniaInvest interviewed Mr. Joseph Sheffu, Country Managing Partner of EY Tanzania, a global leader in assurance, tax, transactions and advisory services.

Sheffu discuss the state of the Tanzanian economy, the tax and investment framework and opportunities, with a particular emphasis on the booking real estate market of Dar Es Salaam.

TanzaniaInvest: In 2014, EY published its Africa Attractiveness Survey and once again we see that Tanzania is among the top FDI destinations after South Africa, with Kenya, Ghana, Mozambique, Uganda and Zambia.

However in 2015 we have seen that the recent fall in commodities prices has negatively impacted some of these economies on their trade revenues and inflation rate, mostly Zambia.

How do see impacting Tanzania and its positioning among the best spots for investment in Africa?

Joseph Sheffu: Tanzania is still among the leading frontiers for investment in Africa.

One of the reasons is the fact that the GDP growth is still around 7% and that has been consistent.

I think this particular point gives confidence to investors, in terms of the general state of the economy and the investment opportunities.

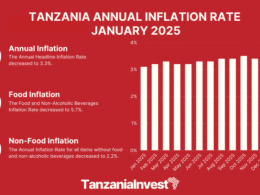

Of course Tanzania is not protected from fall in commodities and inflation.

We saw the inflation almost going to double digits in the past and the government tried hard to contain it and brought it down to around 4-5%.

But again, pressure on the domestic spending and also the performance of the Tanzanian Shilling has undermined the growth.

So those are the risks that exist but intervention by the government has helped, otherwise, it would have been much worse, given the conditions of the commodities and the price of crude oil.

There are challenges that put pressure on public spending, which also undermined economic growth.

Scaled down into the area of exploration, there is investor’s perception that the government is not putting enough focus on the area of mining, so there has been declining investment in the mining sector, as the government appears to favour oil and gas exploration.

We understand the next big phase in investments will be into commercialization of newfound gas reserves that will create a huge economic activity.

The question is whether the country is prepared to absorb those types of economic effects.

There’s going to be a lot of infrastructural development in support of commercialization of gas, in terms of the construction activities in putting up infrastructure.

This will absorb some workforce, but also financial flows.

Understandably, materials for infrastructure have to be imported so, there will be a lot of spending in forex, putting pressure on our currency.

But the problem will be compensated by the foreign investment that’s coming in.

We will not see the revenue for the gas coming in at least in the next decade, but there will also be an increase in tax revenue related activities in terms of transportation and infrastructure in preparation of development of the port, pipelines, security activity around pipelines and community development activities.

TI: Which are other hot sectors to invest in Tanzania at the moment?

JS: Real estate is another area that is booming, but we also need to balance with promoting investment in middle-class housing, which is very critical for the economy.

Housing is important in terms of affordability, creating the consumer society which is the middle-income citizens and those will stimulate growth in multiple sectors and consumption through value.

There has been under-investment in the real estate in the country whereby, access to finance was a big issue as it expensive to actually borrow money to build a house.

Banks were reluctant to lend long-term, as the government was borrowing at better rates.

So banks would rather lend money to the government, because, they were floating bonds, treasury bills, and bonds with much more competitive rates.

So, at some point, banks had over 50% of the deposit in treasury bills and bonds rather than giving lending out to the private sector.

As a result no one could actually think about taking of a mortgage, so there has been no mortgage products in the country.

Also there was no clarity in the past with regards to how to secure a lease or a loan.

The government later clarified its legislation such that banks can now accept leasehold certificates as collateral; which is an improvement.

But the interest rates are still a challenge.

TI: So how interesting is to develop real estate in Tanzania now?

JS: The rates in Tanzania for lease and sale of land are actually higher in Tanzania compared to the rest of the region.

For example, in Kenya, the rates per square meter are much cheaper compared to Tanzania.

My personal belief that at present they are not market rates and in the medium terms, the rates that are being offered will level down.

There are several habitable apartments, which however have been locked out for many years by owners because the owners could not actually secure their desired rents however hiked.

So, they lock them up rather than offering them at lower rents in order to avoid maintenance costs. But more and more properties are being developed.

TI: Do you think Tanzania is experiencing a real estate bubble?

JS: We need the economic activity that will support the rate of increase in real estate. But at present, it could be a bubble.

We see banks being concerned. It may become risky for the financial sector – those providing loans on speculative real estate projects.

When you analyse yearly financial reports of banks, the larger percentage of non-performing loans can be related to infrastructure.

So, it is an area that needs to be looked at to be prudent in these particular types of investments.

Some banks are now issuing loans for real estate projects on the speculation that the developer will secure tenants at the end of the day.

They want developer to already have signed up tenants before they can actually consider lending money, and they also want to see large sum of deposit upfront, so the risk is spread between the owner and the bank.

TI: The new government in place is focusing on reducing public spending and increasing tax compliance. Do you expect the increase in tax revenues able to compensate for the reduction in public spending?

JS: The government has been pretty prudent so far, because the rate of public debts is increasing, well beyond the public terms in terms of percentage of GDP.

So, the government has got the responsibility to make efforts to cut down.

I think the question around taxes is with regards to being able to capture all sources of revenue and plugging the holes on revenue leakages.

I think that area itself without say, revising tax rates, will be sufficient to get everybody into the tax framework. Preventing leakages of those revenues is most important.

Then we should see much better government revenues commensurate with the size of the economy and economic activities in the country.

That’s one way of managing public spending and ensures that the funds are used to meet government spending, as the government has to resolve issues around areas of payment of supplies, which has really piled up.

I think the solution is private sector participation; catapulting itself into growth and new industries set up.

For this the government can set up partnership with the private sector to deliver those goods and services to the public, charging some reasonable returns.

TI: But don’t you think as you are reducing public spending from one side, you should stimulate private sector business activity?

JS: Yes and that is an area the government has to look at.

For example, in the issue of ease of doing business, Tanzania has been performing really badly in the last two years.

It’s pretty sad that at some point we were actually going up in terms of removing the bottlenecks and then we made a reverse and put on so many bottlenecks.

Nowadays, you can’t renew your business clearance unless you get tax clearance certificates; which in my personal opinion is a regression. So what comes first? Pay tax first and do business later or do business now to make money to pay tax?

So, these so called “nuisance taxes “need to be removed; all barriers to do business must be removed and allow business to grow.

This will in turn create revenue to the government: it will result in more businesses being set up, more employment, easing pressure on the government on the spending on the public goods and services.

TI: Do you think corporate tax rate at 30%, VAT at 20% and a number of withholding taxes, are adequate?

JS: I think the current tax rates are pretty fair.

The 30% corporate tax rate is fairly within the average of Sub-Saharan Africa.

The VAT rate is probably on the high-side with other countries in the regions at 18-19%.

TI: Tanzania is the only country to be simultaneously member of the East African Community (EAC) and the Southern African Development Community (SADC). How is the country leveraging in this?

JS: looking at its strategic position, Tanzania is and trying to balance between trades with Southern and Eastern Africa.

Tanzania is finding itself in the middle of it, and it’s friendly with both the South and with the East.

Tanzania at present is actually geared very well to grow much faster in its relationship with East Africa, who is the natural partner to Tanzania.

Particularly there is a natural connection between Tanzania and Kenya, East Africa’s largest economy, with almost similar culture and demographics.

Supply and demands are pretty mixed up in those two economies.

Kenyan products very easily reach Tanzanian retailers and consumers; similarly, agricultural produces also find their way from Tanzania to Kenya.

So, it’s a pretty natural relationship between the two countries.

TI: What are Tanzania’s competitive advantages in welcoming investments compared to Kenya?

JS: When you look at the advantages of Tanzania, it lays mostly on its natural resources, with plenty of unexploited opportunities in terms of greenfields.

Having a port means also means the ability to export easily.

Certainly, there are challenges with infrastructure but Tanzania is also a good entry point: it gives you access to Kenya, Uganda and Rwanda through the common trade tariffs.

At present, Tanzania is really friendly in terms of foreign exchange with market driven rates and externalization of foreign is controlled but pretty liberal.

Tanzania has got a higher population compared to Kenya so consumer base is much larger here.

In terms of purchasing power, Kenyans has got bigger purchasing power compared to Tanzanians, so with low level consumer products, investors could make more money out of Tanzania compared to Kenya.

There is also a limited diversity of products in Tanzania so opportunities exist in bringing in new variety of products that are not in the market at present.

TI: Isn’t there the risk of Tanzania being a consumption economy, with no value addition generated here?

JS: Tanzania didn’t fully utilized opportunities like the AGOA with only two or three companies from Asia setting up base in Tanzania to make use of the Tanzanians position in the AGOA.

But Tanzania is endowed with about 1,400 kilometers of cost lines and this give access to the sea and channels of export to Western markets.

So it actually creates a very good environment for export processing.

Tanzania needs to look at those opportunities to create export processes in partnership with China or other Asian countries.

We have a lot of arable land, water sources and yet we don’t have commercial farming.

That is one way to ensure that Tanzania doesn’t become a consumption economy; rather you also add value to the country and generate trading employment.

For this, adequate infrastructure and energy are key and hence they represent among the most interesting investment opportunities in Tanzania.

TI: What would be your piece of adviser to investors looking at Africa and at Tanzania?

JS: Our Africa Attractiveness Report identified a negative perception with regards to Africa and Tanzania in terms of corruption and poor infrastructure.

So, people who are outside of Africa are kind of scared to come and invest in Africa.

But when you look at investors who have eventually invested in here, they are pretty upbeat and they see a lot of opportunities.

Western companies who are investing in Africa are saying “we are here to stay, and it’s the right place to be.”

So there’s a disconnect; it’s an issue about the branding of Africa.

Yet, Africa is not one country: It’s over fifty countries and each country has got different regimes.

Each country in Africa is unique, so you have to really understand each country’s uniqueness, laws and regulations.

Secondly, Africa wants participation.

One of the challenges of the investor is the pre-conceived idea that you fly in, invest money and fly out.

Africa required investors who are willing to invest long-term, as short-term can be pretty challenging.

Investors could really build a profitable business by using those local talents and build capacity: they have to spend a little bit more in terms of developing people, as they won’t get ready-made people especially in skilled positions.

But otherwise, the rate of returns on investment tends to be much higher than anywhere else.