The Dar es Salaam Stock Exchange (DSE) Group recorded a 35% increase in profit after tax to TZS 1.6 billion for the third quarter ending September 2025, compared with TZS 1.19 billion during the same period in 2024.

Total revenue rose by 69% to TZS 5.18 billion, up from TZS 3.06 billion a year earlier, driven by higher listing, transaction, and registry fees.

Listing fees grew by 74% to TZS 2.07 billion, while transaction fees more than quadrupled to TZS 1.21 billion.

Registry and Central Securities Depository (CSD) fees more than doubled to TZS 883.6 million from TZS 377.3 million in the same quarter last year.

Profit before tax increased by 42% to TZS 1.7 billion from TZS 1.2 billion, with return on assets improving to 12% from 9% and return on equity rising to 14% from 11%.

Earnings per share reached TZS 205.37, up 46% from TZS 140.96 a year earlier.

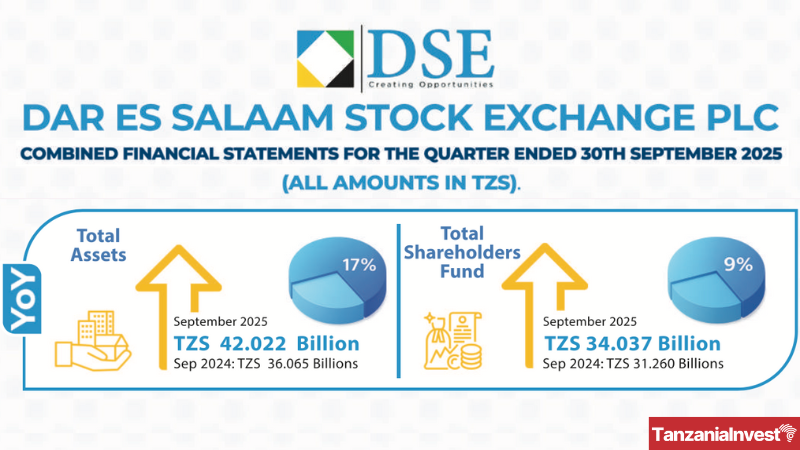

Total assets expanded to TZS 42.02 billion from TZS 36.07 billion, while shareholders’ funds increased to TZS 34.04 billion from TZS 31.26 billion.

DSE Chief Executive Officer Peter Nalitolela said the strong financial performance was supported by higher market participation, new listings, and the rollout of digital and investor education initiatives.

He explained that ongoing technology adoption and awareness programmes have enhanced trading activity and market depth.

During the quarter, the DSE’s total number of investors reached 705,156, while the number of listed companies remained at 28, including 22 domestic and six cross-listed firms.

Total expenses rose to TZS 3.48 billion from TZS 1.87 billion, reflecting higher staffing, administrative, and operational costs associated with expanding activities.

Dar es Salaam Stock Exchange (DSE)

The Dar es Salaam Stock Exchange was established in 1996 and began operations in 1998 as Tanzania’s primary securities market. It facilitates the issuance, trading, and settlement of equities and bonds and operates under the oversight of the Capital Markets and Securities Authority (CMSA).

The DSE is self-listed and offers both the Main Investment Market Segment (MIMS) and the Enterprise Growth Market (EGM) to support companies of different sizes and stages.

In 2024, the Dar es Salaam Stock Exchange (DSE) recorded a 1.47% increase in total equity turnover, rising from TZS 225.35 billion in 2023 to TZS 228.66 billion.

This growth was primarily driven by a 27.37% increase in trading activity on the normal counter, where turnover rose from TZS 47.14 billion in 2023 to TZS 60.05 billion in 2024.

In H1 2025, the Exchange has reported a 52% profit increase to TZS 3,284 million, driven by 45% income growth and improved margins. It also recorded stronger returns on assets and equity, with a lower cost-to-income ratio reflecting improved operational efficiency.