Dar es Salaam Stock Exchange (DSE) has recently released its financial performance highlights for the first half (H1) of 2025, reporting strong year-on-year growth across key profitability and efficiency metrics.

Total assets grew by 7% to TZS 38,278 million in H1 2025 compared with TZS 35,860 million in H1 2024.

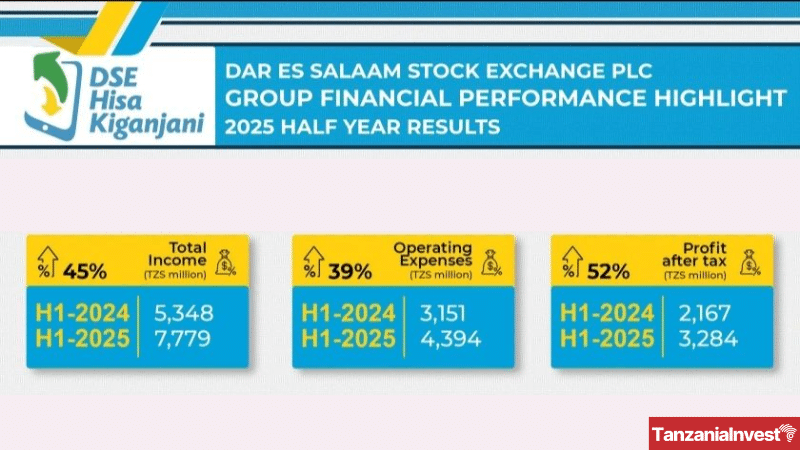

Total income rose by 45% to TZS 7,779 million from TZS 5,348 million, while operating expenses increased by 39% to TZS 4,394 million from TZS 3,151 million, contributing to a 52% increase in profit after tax to TZS 3,284 million from TZS 2,167 million.

Operating profit margin doubled from 13% in H1 2024 to 29% in H1 2025, with return on assets and return on equity improving to 9% from 6% and 9% from 7%, respectively.

Earnings per share increased by 52% to 137.82 from 90.95, while the price-earnings ratio declined slightly to 21.04 from 22.43.

Cost-to-income ratio improved to 56% from 59%, and staff-cost-to-revenue ratio reduced to 35% from 40%.