FDI

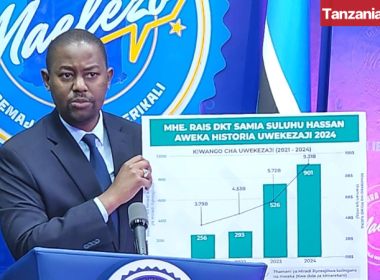

In 2024, Tanzania registered 901 investment projects with a total capital of USD 9.31 billion, according to the Tanzania Investment Centre (TIC).

This represents a 77% increase in projects (from 526 in 2023) and a 63% increase in capital investment (from USD 5.72 billion in 2023).

Foreign-owned projects accounted for 44.8% of all approved investments, while joint ventures made up 35.6%, and domestically owned projects represented 19.6%. This compares to 40.7% foreign, 34.6% JV, and 24.7% domestic ownership in 2023.

The top five sources of FDI in 2024 were:

1. China – USD 1,053.46M

2. Vietnam – USD 783.40M

3. Mauritius – USD 773.96M

4. UAE – USD 702.52M

5. United Kingdom – USD 394.30M

By sector, the top FDI recipients in 2024 were:

1. Manufacturing – USD 4,079.03M

2. Transportation – USD 1,361.15M

3. Commercial Building – USD 1,135.13M

4. Telecommunication – USD 809.74M

5. Agriculture – USD 687.20M

TIC attributed the remarkable growth to the conducive investment environment created under the new investment law.

According to the Bank of Tanzania (BOT) and the World Bank (WB), FDI inflow to Tanzania rose 13.2% in 2023 to USD 1,6 billion from USD 1.4 billion in 2022.

According to the World Investment Report of 2024 published by the United Nations Conference on Trade and Development (UNCTAD), foreign direct investment (FDI) inflow to Tanzania rose 12.5% in 2023 to USD 1,3 billion from USD 1.1 billion in 2022.

Latest Update: 15th June 2025

Sources: Tanzania Investment Center (TIC), United Nations Conference on Trade and Development (UNCTAD), World Bank (WB), Bank of Tanzania (BOT).