On 1st May 2023, Peak Rare Earths (ASX: PEK) announced that it has received commitments to complete AUD 27.5 million two-tranche institutional placement for the issue of 55 million new fully paid ordinary shares.

Tranche one of the placement will raise approximately AUD 14.3 million and tranche two which is subject to shareholder approval in mid-June 2023, is set to raise approximately AUD 13.2 million.

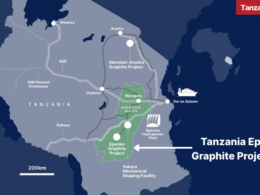

The company explains that the placement marks another critical step in the development of the Ngualla Rare Earth Project in Tanzania and follows the signing of a binding Framework Agreement with the Government of the United Republic of Tanzania and the granting of a Special Mining License.

Proceeds from the placement will be applied to finance the commencement of early works, front-end engineering design (FEED) and construction contracts, update environment and social studies, and external consultants.

Commenting on the placement, Peak’s Executive Chairman, Russell Scrimshaw, said: “The placement strengthens Peak’s balance sheet and ensures that it is well-capitalised to commence early works, front-end engineering and design and finalise binding offtake arrangements and project financing discussions, which are progressing well. The placement has been well supported by Peak’s existing shareholders and will further introduce a range of new, high-quality institutional investors to the register.”

He also added that following the recent execution of a Framework Agreement and grant of a Special Mining License for the Ngualla Project, Peak can now shift its focus towards making a Final Investment Decision by the end of September 2023.