The Bank of Tanzania (BOT) has released its Monthly Economic Review–December 2025, outlining Tanzania’s exports performance for the year ending November.

External Sector Performance

The external sector position further strengthened in the year ending November 2025, with the current account deficit narrowing to USD 1,907.7 million, from USD 2,687.9 million recorded in the same period of 2024.

This improvement was driven by robust export performance in both goods and services, coupled with a moderate increase in imports, largely inputs for production and investment activities.

Foreign exchange reserves remained stable at USD 6,432.9 million at the end of November 2025, adequate to cover 4.9 months of projected imports of goods and services—exceeding both national and EAC benchmarks.

Exports

Exports of goods and services rose by 13.1% to USD 17,561.5 million in the year ending November 2025, up from USD 15,521.1 million in the corresponding period of 2024.

The strong performance was driven by higher export earnings.

Export of goods reached USD 10,174 million in the year ending November 2025, from USD 8,760 million in the previous year.

An increase in the exports of gold, manufactured goods, tobacco, cashew nuts, and coffee contributed to the overall growth.

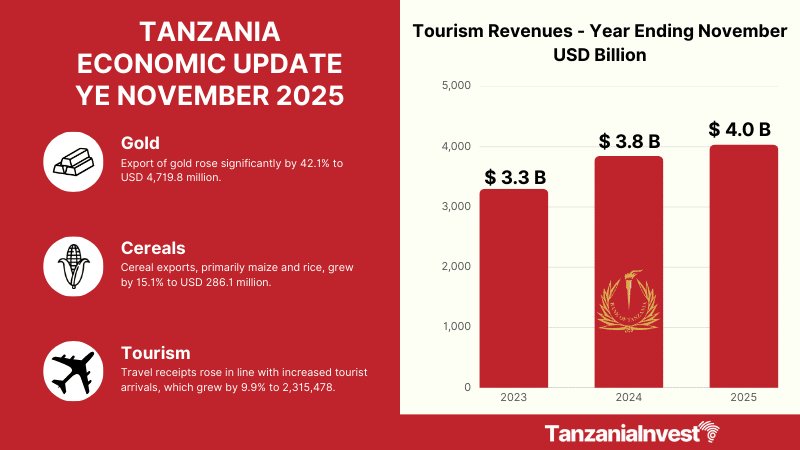

Notably, the value of gold exports reached a record high, surging by 42.1% to USD 4,719.8 million, compared with USD 3,320.8 million, largely reflecting higher global gold prices coupled with increased production amid heightened economic uncertainties.

Traditional exports experienced a modest increase, reaching USD 1,391.7 million, a 3.1% rise. The growth was mainly driven by tobacco exports, which benefited from both price and volume gains.

Cereal exports, primarily maize and rice, grew by 15.1% to USD 286.1 million, from USD 247.8 million.

On a monthly basis, the value of goods exports rose to USD 1,098.5 million in November 2025, up from USD 1,032.4 million in November 2024, boosted by strong performance in gold, manufactured goods, and tobacco.

Services receipts increased by 9.3% to USD 7,387.5 million, compared with USD 6,761.2 million in the year ending November 2024.

Higher earnings from tourism and transportation services supported the growth.

Travel receipts rose in line with increased tourist arrivals, which grew by 9.9% to 2,315,478 from 2,106,870 in the year ending November 2024.

Transport earnings, primarily freight from transit goods, rose by 37.3% to USD 2,772.4 million.

On a monthly basis, service receipts totalled USD 593.9 million in November 2025, marginally above USD 589.7 million a year earlier, driven by tourism and transport.

Imports

Import of goods and services amounted to USD 17,757.1 million in the year ending November 2025, rising slightly from USD 16,863.9 million in the corresponding period in 2024.

The increase was largely attributable to higher imports of industrial supplies, machinery and mechanical appliances, and industrial transport materials, as well as increased freight payments.

Oil imports fell 7.1% to USD 2,396.4 million, driven mainly by weaker global prices.

On a monthly basis, goods imports fell to USD 1,257.4 million in November 2025 from USD 1,317.4 million a year earlier, reflecting lower oil import values.

In the year ending November 2025, services payments increased by 14.4% to USD 3,114.1 million, from USD 2,722.5 million in the same period of 2024.

The growth largely resulted from higher freight payments, consistent with the increase in the import bill.

On a monthly basis, service payments stood at USD 270.9 million compared with USD 267.7 million in November 2024.

The primary income account recorded a deficit of USD 2,100.3 million in the year ending November 2025, from USD 1,864.3 million in the same period of 2024.

The increase was primarily driven by higher payments of income on equity and interest to non-residents.

On a monthly basis, the primary income account deficit stood at USD 211.8 million in November 2025, compared with USD 148.1 million in a similar month in 2024.

The secondary income account recorded a surplus of USD 388.3 million in the year ending November 2025, down from USD 519.1 million in the previous year.

The decline was largely attributable to lower personal transfers.

On a monthly basis, the surplus stood at USD 6.3 million in November 2025, a notable decrease from USD 50 million in November 2024.