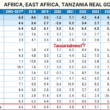

Official results from the Dar es Salaam Stock Exchange (DSE) IPO show that the bourse has raised TZS35.8b from more than 3,000 investors.

This is equivalent to 377% in excess of the targeted capital or almost 5 times the anticipated amount.

The excess funds raised beyond the request for green shoe option will be refunded to investors.

The green shoe option allows underwriters to sell investors more shares than initially planned by the issuer to meet higher demand for the security.

Following the completion of the refund process the DSE intends to self-list its shares on the secondary market in the Main Investment Market Segment (MIMS) on 12th July 2016.

Moremi Marwa, CEO of DSE, said that 70% of investors in DSE IPO were foreign but he noted that even if the shares were sold to local investors only, the IPO would still be oversubscribed by TZS2.2b.

DSE IPO was conducted from 16th May 2016 to 3rd June 2016 and aimed to raise TZS7.5b from the offer of 15m shares at a price of TZS500 each.

The DSE was a non-profit making body until it was demutualized in June 2015. The bourse aims at maximizing the value of investment through the process of demutualization.