The Office of the Treasury Registrar (OTR) of Tanzania has reported a 40% increase in non-tax revenue collections from public institutions and government minority-share companies for the period July 2024 to May 2025.

The amount rose to TZS 884.7 billion from TZS 633.3 billion collected in the same period of the previous financial year.

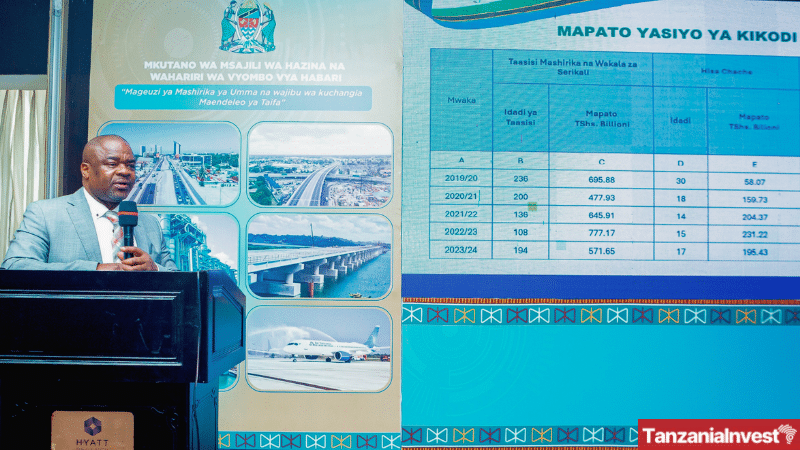

The announcement was made by Treasury Registrar Nehemiah Mchechu during a breakfast meeting with editors in Dar es Salaam on 2 June 2025.

He explained that the current figure represents a 15.3% increase from the total non-tax revenues collected in the full 2023/24 financial year, which stood at TZS 767 billion.

He attributed the growth to improved financial discipline, strengthened monitoring mechanisms, closer oversight of dividends and contributions, and the expanded use of digital systems.

Of the total non-tax revenue collected, 63.9% came from dividends, 29.7% from contributions calculated as 15% of gross revenue, and the remaining 6.4% from other sources, including loan repayments, interest from on-lent funds, and Telecommunications Traffic Monitoring System (TTMS) fees.

Mr Mchechu also revealed that the OTR is targeting a total of TZS 1 trillion in non-tax revenue collections by the end of the 2024/25 financial year.

As of 2 June 2025, nearly TZS 900 billion had already been collected from approximately 200 public institutions and companies in which the government holds minority stakes.

He urged all institutions that have not yet submitted their dividends to do so within the current week to ensure full compliance ahead of Dividend Day 2025, scheduled for 10 June at State House in Dar es Salaam.

Dividend Day is a government initiative aimed at promoting transparency and accountability by requiring institutions to formally remit dividends to the Treasury. The event will be officiated by President Samia Suluhu Hassan.

According to Mr Mchechu, recent performance improvements reflect broader reforms within the public sector.

These include the integration of key government systems such as PlanRep, ERMS, e-Watumishi, and the upgraded MUSE platform, allowing real-time expenditure tracking and streamlined data sharing across institutions.

The reforms also focus on leadership development and performance monitoring.

This year, 111 Chief Executive Officers of public institutions have participated in induction programmes aimed at strengthening governance and strategic management.

Additionally, the use of Key Performance Indicators (KPIs) has been expanded to assess board and management performance across institutions.

Mr Mchechu noted that the government has also enhanced its participation in companies where it holds minority shares, particularly in the banking, industrial, and mining sectors, through revised shareholder agreements and improved governance.

As a result, the value of government investments rose from TZS 75.79 trillion in FY 2022/23 to TZS 86.29 trillion in FY 2023/24.

He concluded by emphasizing the importance of continued collaboration with the media to support national development goals and promote transparency.

He stated that increasing revenue is not just about collection figures, but about transforming public sector operations to deliver tangible value to citizens.