Cement

Tanzania Cement

The first cement Tanzanian factory commenced operations in 1966, and the number has since then increased reaching 13 factories in 2020, following the liberalization measures started in the second half of the 1980s to address supply gaps and the need to respond to demand in the construction of physical and social infrastructure and for job creation and revenue enhancement.

As a result, cement production in the country has been increasing reaching 6.5 million tonnes in 2020 compared with the estimated domestic demand of 6.7 million tonnes.

Tanzania’s cement production increased to 7,598,073 tons in 2022, up from 6,614,359 tons in 2021, which represents an increase of +14.9% (+983,714 tons).

Tanzania’s cement consumption increased to 7,532,173 tons in 2022, up from 6,863,004 in 2021, representing an increase of +9.7%.

Today’s cement industry in Tanzania includes six integrated plants and several grinding facilities with a production capacity of around 11 million tons.

Tanzania’s cement exports in 2022 increased to 632,726 tons, up from 441,828 tons in 2021 which is an increase of 190,898 tons equivalent to 43.2%.

In 2022, cement imports decreased to 566,826 tons, down from 690,474 tons in 2021 (-17.9%).

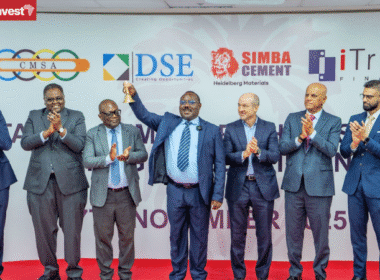

Tanzania’s largest cement producers are Tanzania Portland Cement (Twiga), Tanga Cement (Simba), and Dangote Cement.

Dangote, Africa’s leading cement producer, estimated Tanzania’s total market sales to reach 6.2 mt in 2021.

It also noted that Tanzania’s per capita cement consumption of around 50kg per annum is well below the global average and low even for Africa.

Nonetheless, it indicated that the improving performance of the Tanzanian economy has fueled strong growth in cement demand and the prospects remain favourable, given the linear relationship between economic growth and cement consumption.

A study released by the Bank of Tanzania in 2023 reveals that the primary challenges in cement supply in Tanzania stem from domestic production constraints. Cement factories generally match production with demand, leading to intermittent shortages in some parts of the country, followed by price hikes during periods of constraint.

These constraints are multifaceted, encompassing the availability of raw materials, energy supply, technology gaps, transport and logistics, spare parts, and skills availability. For instance, the availability of clinker, a key ingredient in cement production, significantly influences the supply chain.

Furthermore, despite the increase in production, regular shortages of the product in the domestic market have been reported, with price hikes have occurred in some parts of the country.

Last Updated: 24th July 2023

Sources: Tanzania National Bureau of Statistics (NBS), Tanzania Portland Cement, Tanga Cement, Dangote Cement.