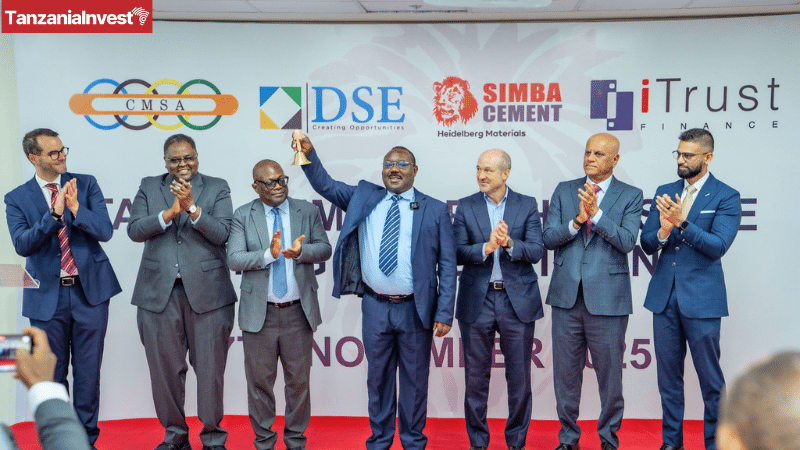

Tanga Cement PLC (DSE:TCCL) has completed its Rights Issue with a 100% subscription rate, raising TZS 203.74 billion and leading to the listing of 127,342,090 new shares on the Dar es Salaam Stock Exchange. The new shares began trading on 27 November 2025.

The Rights Issue followed the approval of the Prospectus by the Capital Markets and Securities Authority (CMSA) on 11 September 2025. The offer opened on 29 September 2025 and closed on 24 October 2025.

Shareholders were entitled to buy two new ordinary shares for every one ordinary share held at a price of TZS 1,600 per share. At the close of week 48 of 2025 on 28 November 2025, TCCL was trading at TZS 2,370.

Tanga Cement received applications for the full amount offered, matching the TZS 203.74 billion target.

The funds will be used to strengthen the company’s balance sheet, improve liquidity, repay foreign debt to reduce interest and currency exposure, expand production capacity, and enhance operational efficiency.

These actions are part of the company’s strategy to restore performance and support long-term growth.

Speaking on behalf of the Chief Executive Officer of the Dar es Salaam Stock Exchange (DSE), Chief Business Development Officer Emmanuel Nyalali said the 100% subscription reflects investor confidence in Tanga Cement’s transformation plan and in the broader growth of the industrial sector.

He added that the transaction demonstrates the ability of capital markets to support corporate recovery, capital raising, and economic development.

Tanga Cement is one of the largest cement producers in the country and plays a key role in the supply of cement for major national construction and industrial projects.

The company reported a strong financial performance in the quarter ended 30 September 2025, supported by higher revenue, improved profitability, and stronger cash generation.

Revenue reached TZS 84.69 billion, compared with TZS 65.52 billion in the previous quarter, while gross profit increased to TZS 15.36 billion from TZS 14.68 billion.

Operating profit stood at TZS 10.68 billion, close to the TZS 10.99 billion reported in the second quarter.

Profit for the period was TZS 20.94 billion, compared with TZS 0.68 billion in the previous quarter.