The International Finance Corporation (IFC)—a member of the World Bank Group—subscribed to a corporate bond issued by the Tanzania Mortgage Refinance Company (TMRC) to help increase access to longer-term, affordable mortgages and housing in Tanzania.

TMRC is a specialized private-sector financial institution that provides long-term funding to financial institutions for mortgage lending purposes. IFC has been a shareholder of TMRC since 2019.

The bond was listed on 15th July 2021 at the Dar es Salaam Stock Exchange and will support access to mortgages, helping Tanzanians more easily purchase homes in a country where access to longer-term financing has traditionally been constrained.

The TMRC’s listing raised over TZS 8.9 billion (USD 3.8 million) against a target of TZS 7 billion (USD 3 million), representing an oversubscription of 27%. IFC invested TZS 2.8 billion (USD 1.2 million) in the bond offer.

“IFC’s participation in the third tranche of TMRC’s medium-term note program will support the continued growth of the housing finance market in Tanzania. Additionally, it will enable us to diversify our funding sources,” said Oscar Mgaya, Chief Executive Officer, TMRC.

For his part, Frank Ajilore, IFC’s Resident Representative for Tanzania, said: “TMRC’s medium-term note program is contributing to the development of the debt capital markets in Tanzania and providing alternative investment instruments to institutional and private investors. Increasing access to affordable housing finance, with longer repayment schedules, will make homeownership more attainable for Tanzania’s emerging middle class.”

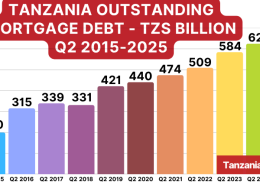

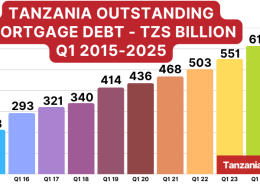

Tanzania Mortgage Market

High interest rates and lack of affordable housing remain the major constraints on the Tanzanian mortgage market growth despite the high demand for housing and housing loans.

The typical interest rates offered by mortgage lenders ranged between 15% and 19% in 2019, compared to 22% and 24% in 2010.

The mortgage market is dominated by five lenders, who amongst themselves command 68% of the mortgage market.