The World Bank (WB) has recently released its 19th Tanzania Economic Update (TEU) under the title “Enhancing the Efficiency and Effectiveness of Fiscal Policy in Tanzania”. We provide a summary with the key takeaway points.

The TEU is a biannual report describing the recent evolution of Tanzania’s economy, and each edition highlights a subject of critical interest to policymakers.

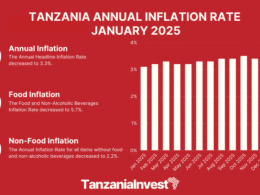

This 19th edition stresses that Tanzania’s tax-to-GDP ratio increased from 10% in 2004/05 to 11.8% in 2022/23, with a peak of 13.3% in 2015/16. This ratio is closer to that of low-income countries (LICs), while Tanzania is already a lower-middle-income country (LMIC).

Low domestic revenue mobilization has led to low overall public expenditure. While public spending is low across all expenditure categories compared to comparable countries, the most pronounced gap is observed in social spending.

To illustrate, Tanzania’s public spending on education and healthcare amounts to only 3.3% and 1.2% of GDP in 2021/22, respectively. These figures fall below the average spending levels of 4.4% and 2.3% for LMICs.

Nathan Belete, World Bank Country Director for Tanzania, commented: “While additional resources are needed to close the service delivery gaps in both sectors, there is scope to improve the efficiency of spending within the current systems. For example, if the healthcare system were to operate at its utmost efficiency, Tanzania could enhance critical health outcomes by 11% without necessitating additional resources.”

Emmanuel Mungunasi, World Bank Senior Economist and co-author of the Update added: “Low budget execution rates suggest that there are opportunities for improvement in strategic planning, budget preparation, and procurement processes. Additionally, there’s a need to address delays in contracting non-concessional loans as well as delays in project preparation and implementation, as these are linked to the under-disbursement of concessional funds.”

Recent Economic Developments

The report indicates that despite unfavorable global and regional developments, Tanzania’s economy continues to expand at a moderate pace. However, the economy is still operating below its long-term potential.

The GDP growth rate reached 4.7% in 2022, slightly down from 4.9% in 2021. However, growth was not constant across all subsectors, and accelerations in some compensated for slowdowns in others.

The growth of the industrial sector edged up from 5.4% in 2021 to 5.5% in 2022. Construction led the sector, followed by mining and manufacturing. Construction grew by 4.4% during the year, representing about two-fifths of the total increase in industrial output. As construction activity expanded, domestic cement manufacturing rose by 14.9%, with a similar increase in cement consumption during 2022.

The services sector was responsible for almost half of overall GDP growth in 2022. The sector’s annual growth rate rose from 5.0% in 2021 to 5.2 percent in 2022, driven by the strong performance of the finance and insurance, accommodation and restaurant, transportation, and storage subsectors.

Fiscal and Debt Developments

Tanzania’s overall deficit, including grants, widened from 3.6% of GDP in FY2021/22 to 4.4% in FY2022/23.

Total government resources stood at 14.8% of GDP in FY2022/23, almost the same level as the prior fiscal year but 1.1% lower than anticipated. Representing 80% of total government resources, tax revenue dropped slightly from 11.9% of GDP in FY2021/22 to 11.8% in FY2022/23.

The government has implemented structural fiscal reforms and new tax measures over the past fiscal year, but the downtick in tax-revenue collection relative to GDP suggests that those reforms have yet to yield significant results.

Value-added tax (VAT) and import taxes drove revenue growth, contributing more than one-half and one-third of the overall increase in tax revenue, respectively. VAT collection increased from 2.0% of GDP in FY2021/22 to 2.3% in FY2022/23, while import taxes remained broadly unchanged at about 4.6% of GDP.

Income tax revenue fell from 4.5 to 4.2% of GDP over the period, partly reflecting the slowing growth of household income and a decline in tax receipts from private corporations.

Meanwhile, non-tax revenue and total grants (largely project grants) remained stable at 2.6 and 0.4% of GDP, respectively. However, driven by lower-than-expected revenue from

parastatal dividends & contributions, ministries, and regions, non-tax revenue fell 0.7% points short of its budgetary target.

While the government’s revenue-to-GDP ratio nearly approaches a historic high, the tax revenue-to-GDP ratio remains low by international standards and close to the average for low-income countries (LICs).

Macroeconomic Outlook & Risks

While Tanzania’s economy is projected to grow by 5.1% in 2023, this projection has been adjusted downward to reflect the impact of worsening global economic conditions and insufficient rainfall in agricultural areas.

In 2022, the post-pandemic economic reopening, coupled with sustained tourism inflows, boosted domestic demand, helping to offset a modest increase in inflation and a slowdown in external demand.

Meanwhile, public investment in megaprojects contributed to capital formation.

GDP growth is likely to edge up further to 5.5% in 2024 as the business climate improves and domestic reforms take hold.

However, medium-term growth is expected to average about 5.8%, as the impact of pent-up demand subsides while inflation remains elevated and higher interest rates temper domestic demand.

The annual GDP growth rate is not expected to return to its potential until 2025 when the cyclical recovery will close the output gap.

This projection assumes that the government’s reform agenda will be successfully implemented.

Without mitigation measures, the country’s long-term growth potential could weaken, with GDP growth ranging from 4.5 to 5.5% (or 1.6 to 2.6% per capita) in 2023 under alternative scenarios (Figure 18).

A deteriorating external environment and the delayed implementation of domestic reforms are the major risks to the macroeconomic outlook.

The expansion of agriculture and services activities is expected to drive growth and poverty reduction over the medium term.

Agricultural output growth is expected to accelerate from 3% to about 5% by 2025, while the growth of services is expected to rise from 5% to 7%.

The agricultural sector, which employs nearly 70% of the rural workforce, is expected to benefit from increased government spending on irrigation infrastructure and extension services, boosting agriculture productivity and the incomes of the people.

In FY2022/23, the government almost doubled agricultural spending from about 0.4% of GDP in previous years to about 0.7%.

Meanwhile, the rapid expansion of retail and repair services is expected to boost incomes among urban informal workers.

The continued expansion of tourism could also increase incomes and support poverty reduction in urban areas.