DEG Invest (DEG), a member of the German KfW Group which focuses on promoting business initiatives in developing countries, has recently announced in a press release that it has set aside a USD 20 million loan to Exim Bank Tanzania Ltd (Exim Bank) for supporting long-term lending to small and medium size enterprises (SMEs) in Tanzania.

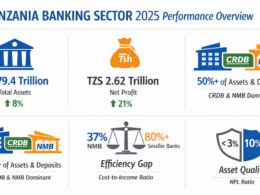

According to DEG, the loan is meant to cover the lending gap to SMEs in Tanzania, since they are constrained by the commercial banks’ average aggregate exposure of 37% of loans to SMEs of the total lending according to African Development Bank (AfDB) statistics.

Exim Bank will receive the funds by instalments according to the achievements on lending’s growth to SMEs.

According to Exim Bank Chief Financial Officer, Mr. Selemani Ponda, the loan has been accepted as a senior loan with the legal right to be cashed before any other debt that the banks is holding.

The loan is part of a strategy launched in 2010 by the Tanzanian Government with the support of the KfW Group, to reduce poverty in the country by promoting growth on income through the SMEs which in Tanzania represent more than 35% of the country’s GDP and 40% of total employment according to the Tanzania Chamber of Commerce, Industry and Agriculture (TCCIA).

DEG’s Director of Financial Institutions Africa and Latin America, Mr. Gudrun Bush, explained that the loan will help to reduce that constraint and support further development of SMEs throughout the country, yielding to a major Tanzania’s economic growth.

According to Ernst & Young, the lending sector in Tanzania has grown from TZS 4,534 billion in 2009 to TZS 10,211 billion at the end of 2013 from which a total of about TZS 3,778 billion has been addressed to SMEs.

Exim Bank accounts for 5.7% of the total amount lent in Tanzania with TZS 582 billion from which TZS 291 billion were destined to SMEs according to the 2013 company’s financial disclosure available on its website.