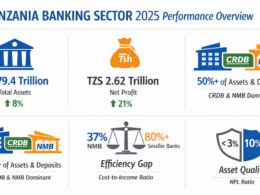

The Dar es Salaam Stock Exchange (DSE) has recently made the National Microfinance Bank Plc. (DSE:NMB) audited annual financial results for 2015 available, showing a net profit after tax of TZ148.8bn, down by -3.6% from TZ154.5bn in 2014.

Total assets grew by +17.6% to TZS 4,576bn in 2015 from TZS 3,888bn in 2014, while customer deposits grew by +19.4% from TZS2,973bn to TZS3,550bn in the same period.

Return on average total assets was 3.3% in 2015 compared with 4.0% in 2014.

Non-performing loans & advances were reduced in 2015 to TZS 51.7bn from 55.9bn in 2014 (-7.6%), and non-performing loans to total gross loans decreased to 2.1% from 2.8%.

Days ago, the bank announced plans to issue a retail bond within two weeks, after the go-ahead from the responsible authority.

This would make NMB the second commercial bank in Tanzania to issue a retail bond, after Exim Bank issued the country’s first retail bond in November 2015, guaranteeing investors an annual tax-free interest of 14% for a period of 6 years.

NMB is Tanzania’s second largest bank in terms of assets, after CRDB bank (DSE:CRDB).

Exim Bank Tanzania owns 6.6% of NMB’s stocks. The two largest shareholders are Rabobank of The Netherlands with 34.9% and the Government of Tanzania with 31.8%.