Multinational professional services company PwC published the 8th edition of its “Hotels outlook: 2018-2022” report that provides an overview of how the hotel industry in South Africa, Nigeria, Mauritius, Kenya, and Tanzania is expected to develop over the coming years.

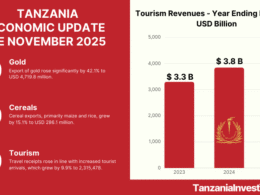

According to the report, Tanzania’s hotel room revenue amounted to USD 206 million in 2017, a decline of 5.5% over 2016 due to a drop in guest nights.

PwC reminds that in 2016, the Government of Tanzania introduced an 18% VAT on tourism services and increased the visa charge for business travel to USD 200 and that in July 2017, fixed-rate concession fees were introduced for hotels in the national parks – some as high as USD 59 per person per night.

The average room rate was virtually flat in 2017 after expanding by a cumulative 31% between 2014 and 2016, in part reacting to the new VAT and the new fixed-rate concession fees that made rooms more expensive.

The impact of the VAT amendment has now been more or less absorbed, but some hotel properties are still trying to recover from the introduction of the fixed-rate concession fee.

Outlook: 2018–2022

The company expects the Tanzanian hotel market to rebound in 2018, as more flights and new hotels provide a boost to the market, and forecast revenue growth of 10.2% this year.

Tanzania should also benefit from faster growth in global GDP, which should boost tourism, although the higher taxes and rates will remain an impediment to growth.

On the medium-term, Rotana, Anantara, City Lodge, Hyatt Regency Sarovar Portico and Ritz-Carlton are expected to open seven new hotels in Tanzania, most of which will be opened in the next two years.

Because of this, PwC expects 900 additional rooms by 2019 and 1,200 by 2022, with the total number of available rooms increasing from 7,700 in 2017 to 8,900 in 2022.

The company projects guest nights to rise from 1.5 million in 2017 to 1.9 million in 2022, a 4.8% compound annual increase, growing faster than available rooms, and hotel occupancy will increase from 53.4% in 2017 to 58.5% in 2022.

Such growth will lead to a projected 9.1% compound annual increase in room revenue, rising to $319 million from $206 million in 2017, PwC concludes.