TanzaniaInvest sat with Sasa Chonza, the CEO of First Housing Finance Tanzania, the leading mortgage specialist in the country.

Chonza explains the origin and unique positioning of First Housing Finance, as well as the company’s commitment to providing affordable housing solutions to those who may not be served by traditional commercial banks.

Tanzania’s demand for affordable housing is estimated at 200,000 housing units per annum with an existing housing deficit of 3 million housing units.

Chonza also delves into the company’s risk mitigation strategies, competitive advantages, and innovative financing sources.

TanzaniaInvest: Can you explain the origin of First Housing Finance and why you’re the only one specializing in mortgages in Tanzania?

Sasa Chonza: First Housing Payments was launched in 2016, and our operations started in 2017. Five shareholders came into the organization, with the leading shareholder being Bank M with 40% of the shares. Due to liquidity challenges, Bank M ceased to exist and its shares were transferred to Azania Bank. The other shareholders are the International Finance Corporation (15%), HDFC Investments, Armut (15%), and Sanjay Suchak (15%).

TanzaniaInvest: Why did Bank M decide to set up a different entity specifically for mortgages instead of developing mortgages within the bank?

Sasa Chonza: This was due to the enormous opportunity in the real estate space after the collapse of the Tanzania Housing Bank in 1995, which specialized in issuing mortgages. The collapse was caused by malpractice, deficiencies in management, and credit matters related to fraud and corruption. From 1996 to 2000, there was no player in the mortgage space, and despite property development by entities like the National Housing Corporation (NHC) and the Tanzania Building Agency (TBA), there was no dedicated company to provide finance for buying these properties. Recognizing this gap and the opportunity, our company was initiated to focus on affordable housing solutions through the issuance of mortgages.

TanzaniaInvest: Can you define what affordable housing solutions mean and what size of finance projects are you targeting on average?

Sasa Chonza: Affordable housing refers to properties that are accessible and affordable based on individuals’ cash flows and ability to pay monthly instalments. Our definition includes properties with a value of not less than TZS 20 million (about USD 10,000) up to TZS 50 million (about USD 25,000). The income range of the buyer for these properties is not less than TZS 500,000 (about USD 250) up to TZS 3 million (about USD 1,500). Our focus is on the low-income and middle-income segments, which big banks typically don’t cater to. These segments have different needs and financial capabilities when it comes to purchasing properties. Our aim is to provide affordable financing solutions to those who may not be served by traditional commercial banks.

“Our aim is to provide affordable financing solutions to those who may not be served by traditional commercial banks.”

TanzaniaInvest: Customers with lower incomes and limited collateral are often perceived as a higher risk. How do you mitigate the risk?

The default rate for mortgages is relatively low due to the nature of the product and the customer’s commitment to homeownership. Our non-performing loans are around 2%, compared to the industry average of 5%.

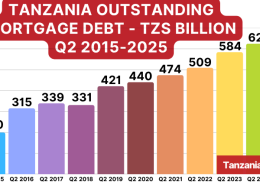

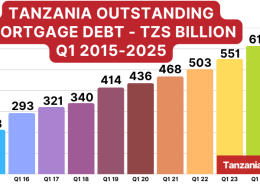

Since 2019, our portfolio has been robust, with significant growth year-on-year. The number of mortgages has more than doubled, and we have expanded our personnel, governance, and risk management. As a result, we have become one of the leading players in the mortgage market, serving a growing customer base.

” Our non-performing loans are around 2%, compared to the industry average of 5% [and] we have become one of the leading players in the mortgage market, serving a growing customer base.”

TanzaniaInvest: What are your competitive advantages in providing mortgages to the Tanzanian public?

Sasa Chonza: One of our competitive advantages is specialization. Unlike other banks that deal with various types of loans, we focus solely on mortgages. Our specialization allows for a more efficient and personalized process. These are the attributes that have helped us to be much more efficient in the process as compared to our competitors. We have developed efficient processes, including faster loan processing times, averaging around 22 days, compared to other banks’ two to three months.

Additionally, our lending rates are lower, averaging around 15-16% compared to the market average which can get up to 19%. We have the lowest rates despite facing challenges in terms of accessing long-term funding. The margins we get from our customers are enough to take care of operating expenses and pay for the loans.

“We have developed efficient processes, including faster loan processing times, averaging around 22 days, compared to other banks’ two to three months. Additionally, our lending rates are lower, averaging around 15-16%.

TanzaniaInvest: Where do you source your financing since you don’t hold deposits like commercial banks?

Sasa Chonza: Initially, the funding came from our five original shareholders who provided seed capital. However, as the demand increased, we sought funding through various channels. One of these channels is the Tanzania Mortgage Refinance Company (TMRC), which provides liquidity to primary mortgage lenders. We also explore borrowing from commercial banks and other financial institutions, both domestically and abroad. Additionally, we are looking into foreign Development Finance Institutions (DFIs) and capital markets as alternative sources of funding.

TanzaniaInvest: What makes First Housing Finance a good partner for concessional financing, and what unique selling propositions do you offer to DFIs?

Sasa Chonza: As a specialized mortgage lender, we have the expertise and reach to the low-income and middle-income segments that are often underserved by other players in the market. We are banking the unbanked, providing mortgages to those who are unable to access them. Our interest rates are favourable, and we are open to partnering with DFIs and other impact investors who share our mission of social and economic development through affordable housing finance.

“We are open to partnering with DFIs and other impact investors who share our mission of social and economic development through affordable housing finance.”