The Tanzania mortgage market registered an annual growth of 6% in the value of mortgage loans between December 31st, 2019 and December 31st, 2020.

This was indicated in the Tanzania Mortgage Market Update – 31 December 2020 recently released by the Bank of Tanzania.

The Tanzania Mortgage Market in Q4 2020

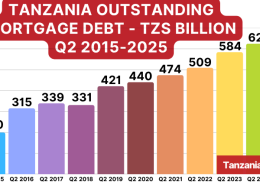

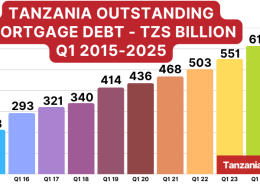

On a quarter-to-quarter basis, the mortgage market in Tanzania registered a 4% growth in the value of mortgage loans in Q4 2020 compared to Q3 2020.

The number of banks reporting to have mortgage portfolios increased from 31 to 32 in Q4 2020 with Mwanga Hakika Bank, resulting from the merger of Mwanga Community Bank, Hakika Microfinance Bank, and EFC Microfinance Bank.

EFC Microfinance bank did not report in Q3 2020 due to revocation of their license and Mwanga Hakika Bank reported for the first time in Q4 2020.

The outstanding mortgage debt as of 31 December 2020 stood at TZS 464.14 billion compared to TZS 445.21 billion as of 30 September 2020.

The ratio of outstanding mortgage debt to Gross Domestic Product (GDP) increased to 0.30% compared to 0.28% recorded for the quarter ending 30 September 2020.

The typical interest rates offered by mortgage lenders ranged between 15% and 19%.

Increasing Competition in the Tanzanian Mortgage Market in 2020

As at 31 December 2020, 32 different banking institutions were offering mortgage loans.

The mortgage market was dominated by five top lenders, who commanded 69% of the market.

CRDB Bank was the market leader commanding 39.73% of the mortgage market share, followed by Stanbic Bank (11.36%), Azania Bank (6.15%), NCBA Bank (5.95%) and NMB Bank (5.60%).

Obstacles to Growth of the Mortgage Market

Demand for housing and housing loans remains extremely high but is constrained by inadequate supply of affordable housing and high interest rates.

Most lenders offer loans for home purchase and equity release while a few offer loans for self-construction which for the most part continue to be expensive beyond the reach of the average Tanzanians.

While improved from the levels of 22-24% in 2010 to 15-19% offered today, market interest rates are still relatively high hence negatively affecting affordability.

Additionally, while some improvements have been noted,cumbersome processes around the issuance of titles (especially unit titles) continue to pose a challenge by affecting borrowers’ eligibility to access mortgage loans.

Tanzania Total Mortgage Debt Outstanding by Lenders – 31 December 2020