On 10 July 2025, the Bank of Tanzania (BOT) released its Strategic Plan 2025/26–2029/30, outlining a five-year roadmap to enhance macroeconomic stability, financial sector resilience, and institutional effectiveness.

Strategic Themes

The Plan is structured around three core strategic themes:

- Macroeconomic Stability

- Financial Sector Stability

- Organizational Capacity

Each theme is supported by specific objectives, measurable targets, and strategic initiatives designed to reinforce BOT’s core mandate.

Strategic Objectives

Under Macroeconomic Stability, BOT will enhance monetary policy implementation by modernizing the government securities system, deepening domestic financial markets, and expanding policy advisory capacity.

It will also strengthen the management of foreign exchange reserves, aiming to ensure at least four months of import cover by 2029/30.

Financial Sector Stability will be reinforced through stronger regulatory oversight, development of systemically important payment systems, financial consumer protection, and promotion of a cash-lite economy.

A major innovation is the integration of climate resilience into financial sector regulation. BOT will introduce a Green Finance and Sustainable Investment Framework, promote clean energy financing, and embed ESG principles in its supervisory systems.

Organizational Capacity will be strengthened through ICT modernization, internal process optimization, staff development, improved risk management, and integration of artificial intelligence into operations.

Focus Areas

The Plan identifies 12 focus areas to guide implementation:

- Enhancement of monetary policy implementation

- Enhancement of foreign exchange reserves

- Enhancement of financial system stability and integrity

- Enhancement of consumer protection and market conduct supervision

- Strengthening of national financial inclusion

- Enhancement of research and innovation

- Improvement of risk management and legal compliance

- Strengthening of strategic partnerships with stakeholders

- Improvement of internal process efficiency and institutional resilience

- Expansion of the Bank’s geographic presence and infrastructure

- Integration of climate change and sustainability into financial strategies

- Integration of artificial intelligence and emerging technologies

Key Performance Indicators and Targets

To monitor progress, BOT has set the following measurable targets:

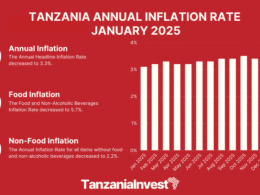

- Headline inflation between 3%–5%

- Foreign reserves covering ≥4.0 months of imports

- Financial Inclusion Index ≥0.80

- 87% of adults with access to transactable financial accounts

- 100% reliability of systemically important payment systems

- Customer satisfaction rate of ≥90% for banking and currency services

- Reduction of emissions from BOT operations by 35%

- Legal and regulatory compliance rate of ≥95%

- Strategic Management Maturity Level 4

- T+0 settlement for electronic funds transfers

Monitoring, Evaluation, and Financing

The implementation of the Strategic Plan will be financed through the Medium-Term Expenditure Framework (MTEF).

Monitoring will be conducted via the digital Plan and Budget Management System (PBMS), which automates performance tracking and reviews.

Quarterly, semi-annual, and annual reviews will be supported by tools such as the Corporate Scorecard, the KPI matrix, and departmental performance reports.

Major Projects Under Implementation

The Plan includes major national and institutional projects, such as:

- Tanzania Instant Payments System (TIPS) Phase III

- Real-Time Supervision Information System (RTSIS)

- SWIFT ISO20022 messaging migration

- BOT Academy construction in Mwanza

- New BOT branches and housing in Kigoma, Mtwara, Dodoma, and Zanzibar

In his foreword, Governor Emmanuel Mpawe Tutuba emphasized the Plan’s alignment with both domestic priorities and global financial trends: “The Strategic Plan provides a clear roadmap to deliver inclusive, sustainable, and resilient financial sector development. It aligns with global best practices while directly supporting national priorities like digital transformation and climate resilience.”