The Monetary Policy Committee (MPC) of the Central Bank of Tanzania (BOT) met on 18th January 2024 to set the Central Bank Rate (CBR), also referred to as the policy rate, at 5.5% for the first quarter of 2024.

This is the bank’s first ever MPC since it began implementing monetary policy using interest rates

The MPC noted that the Bank of Tanzania’s transition from monetary targeting to an interest rate (or price)-based monetary policy framework is a significant milestone in monetary policy transformation in the country.

This forward-looking framework is expected to improve the effectiveness of monetary policy in the changing economic environment. It is also a fulfillment of the country’s commitment to the implementation of the EAC Monetary Union Protocol.

The MPC’s decision on the CBR rate considered the need to contain inflation within the medium-term target of 5% while supporting economic growth to reach 5.5% or more in 2024 and ensuring the stability of the exchange rate.

The Bank of Tanzania will use monetary policy instruments to align the 7-day interbank rate, the operating targeting variable, within +/-200 basis points of the policy rate.

Recent Economic Performance and Outlook

In assessing the recent performance and outlook of the economy, the MPC observed the following:

Global Economy

i. Global growth was weak in 2023 and is projected to persist in the first quarter of 2024, largely due to geo-political tensions, tightening monetary policy, and heightened economic uncertainties.

ii. Inflation continued to decline in many countries after monetary policy tightening. Nonetheless, in advanced economies, it remained above the target of 2%. Inflation is expected to continue falling in many countries.

In advanced economies, it could remain above the 2% target in the first quarter of 2024. This might cause the central banks to continue upholding tight monetary policy, albeit with less intensity, because of concerns about growth.

In the EAC and SADC blocs, most countries experienced inflation below the convergence criteria of a maximum of 8% and 3-7%, respectively.

iii. Commodity prices were volatile but lower compared to the preceding year. Both demand and supply-side factors drove the movement of prices.

The price of oil declined in the fourth quarter of 2023 due to subdued demand. In the first quarter of 2024, oil prices are expected to decline. However, there is an upward risk to the projection in case OPEC+ maintains the stance of production cut.

The ongoing geopolitical tensions also pose a risk to the projection.

Domestic Economy

iv. The performance of the Tanzanian economy was satisfactory in 2023. Growth in the third quarter was 5.3%, projected at around 5.4% in the fourth quarter. Therefore, there is a high likelihood of attaining the growth projection of 5% for 2023.

The Zanzibar economy grew at 7%, and there is a high possibility of attaining a growth projection of 7.1% for 2023.

The performance of the domestic economy was reinforced by public investment and policies geared towards improving the business environment for the private sector.

In the first quarter of 2024, growth in Mainland Tanzania is projected to be 5.2%.

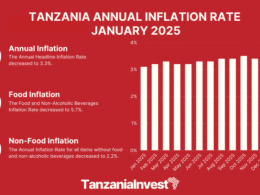

v. Inflationary pressures remained muted.

Inflation continued to decline, reaching 3% in December 2023 from 3.2% in the previous year. In Zanzibar, inflation decreased to 5.5% from 8.1%. Monetary and fiscal policies, adequate food supply, and a stable exchange rate drove this trend.

Inflation is projected to be around 3.2% in the first quarter of 2024. Potential risks to the inflation outlook include the ongoing geopolitical conflicts in the Middle East, the War between Russia and Ukraine, and the OPEC+ decision on oil production.

vi. Monetary conditions became relatively tight as 2023 unfolded, and money supply growth slowed.

This was partly due to the less accommodative monetary policy, which was intended to limit inflationary pressures while safeguarding growth. M3 growth slowed to 14.1% but was above the target of 10.1%.

Private sector credit growth remained strong, reaching 17.1% compared to the projection of 16.4%.

The tightening monetary condition helped to reduce pressure on foreign reserves and exchange rates.

vii. The financial sector remained stable throughout 2023. The banking sector was liquid, profitable, and adequately capitalized. Deposits, assets, and loans increased.

The asset quality improved, as reflected by the decline in the non-performing loans to 4.3% in December 2023 from 5.8% in 2022.

This reflects a decline in credit risk associated with stable macroeconomic conditions and risk mitigation measures adopted.

viii. Government fiscal performance was satisfactory.

During the first half of 2023/24, revenue in Mainland Tanzania was 96% of the target. In Zanzibar, revenue was 99.1% of the target. The improvement was on account of revenue administration measures and compliance.

Revenue is expected to continue improving, owing to measures executed to broaden the tax base and increase tax compliance. Expenditure continued to be aligned with the available resources.

ix. The external sector of the economy improved, albeit continued to face headwinds from external shocks.

The current account deficit continued to decline. Forex inflows from tourism, traditional exports, and official inflows reduced pressure on the current account, foreign reserves, and exchange rate.

Foreign reserves were adequate, reaching USD 5.5 billion at the end of December 2023. The reserves were equivalent to 4.5 months of projected imports.

The exchange rate was stable, depreciating by 7.8% year-on-year.

In the first quarter of 2024, the external sector of the economy is expected to continue improving.

Just as importantly, the MPC took note of the recent developments in the exchange rate and reiterated the need to continue implementing measures to improve the interbank foreign exchange market and ensure the stability of the exchange rate.

The CBR for the next quarter of 2024 will be issued in April this year in line with the MPC meeting calendar to be published in due course.