Multinational oil & gas exploration company Tullow Oil (LSE: TLW, GSE: TLW, ISEQ: TQW), which owns a 33.33% stake in the Lake Albert crude oil development project in Uganda, has recently announced that its farm-down to Total and CNOOC terminated on 29th August 2019, following the expiry of the Sale and Purchase Agreements (SPAs).

The Government of Uganda has agreed on an export route through an oil pipeline – the Uganda–Tanzania Crude Oil Pipeline (UTCOP) – from Lake Albert to the port of Tanga in Tanzania.

Following the termination of the farm-down agreement with Total and CNOOC, delays in the development of the pipeline are likely.

The Lake Albert Crude Oil Development Project

The project has over 1.5 billion barrels of discovered recoverable resources and is expected to produce over 230,000 barrels of oil per day at peak production.

Development plans were approved by the Government of Uganda in August 2016 to develop the first 1.2 billion barrels of oil.

French multinational oil & gas company Total (Euronext: FP, NYSE: TOT) and Tullow entered into a SPA in January 2017 whereby Total would acquire 21.57% out of Tullow’s 33.33% interest in the Lake Albert licenses.

CNOOC, the third-largest national oil company of China, exercised its right to pre-empt 50% of the transaction.

As a result, Total and CNOOC would have each increased their interest to 44.1% while Tullow would have kept 11.8%.

Since 2017, all parties have been actively progressing the SPA.

However, Total explains in a recent press release that “despite diligent discussions with the authorities, no agreement on the fiscal treatment of the transaction has been reached. The deadline for closing the transaction has been extended several times, clearly demonstrating the endeavors of the parties to find an agreement.”

As the final deadline has been reached on 29th August 2019, the Acquisition Agreement has been automatically terminated.

Tullow explains that the termination of this transaction is a result of being unable to agree on all aspects of the tax treatment of the transaction with the Government of Uganda which was a condition to completing the SPAs.

“While Tullow’s capital gains tax position had been agreed as per the Group’s disclosure in its 2018 Full Year Results, the Ugandan Revenue Authority and the Joint Venture Partners could not agree on the availability of tax relief for the consideration to be paid by Total and CNOOC as buyers,” Tullow indicate in its press release.

The Joint Venture Partners had been targeting a Final Investment Decision for the Uganda development by the end of 2019, but the termination of this transaction is likely to lead to further delay.

As Tullow has been unable to secure a further extension of the SPAs with its Joint Venture Partners, it will now initiate a new sales process to reduce its 33.33% Operated stake in the Lake Albert project.

Paul McDade, CEO of Tullow commented: “Whilst this is a very attractive low-cost development project, we remain committed to reducing our operating equity stake. It is disappointing to report this news at a time when we are making so much progress elsewhere towards the growth of the Group with our recent oil discovery in Guyana and the first export of oil from Kenya.”

Arnaud Breuillac, President Exploration & Production of Total declared “Despite the termination of this agreement, Total together with its partners CNOOC and Tullow will continue to focus all its efforts on progressing the development of the Lake Albert oil resources. The project is technically mature and we are committed to continuing to work with the Government of Uganda to address the key outstanding issues required to reach an investment decision. A stable and suitable legal and fiscal framework remains a critical requirement for investors.”

Following the termination of the farm-down agreement with Total and CNOOC, delays in the development of the pipeline are likely.

However, the Tanzania Petrol Development Corporation (TPDC), which which was chosen to coordinate the 1,443 km long pipeline project on behalf of the Tanzanian government, assured the public that the project will be implemented according to the plan.

Total and CNOOC own each a 35% stake in the pipeline project, the Uganda National Pipeline Company owns 15%, Tullow 10%, and TPDC 5%.

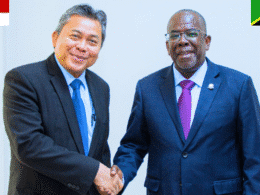

Following the statements from Total and Tullow, TPDC’s Managing Director James Mataragio commented that all the partners in the construction of the pipeline are still discussing the challenges and hopefully will soon strike a deal to implement the project.