First United Takaful has started offering Islamic insurance services in Tanzania, marking the company’s entry into the market.

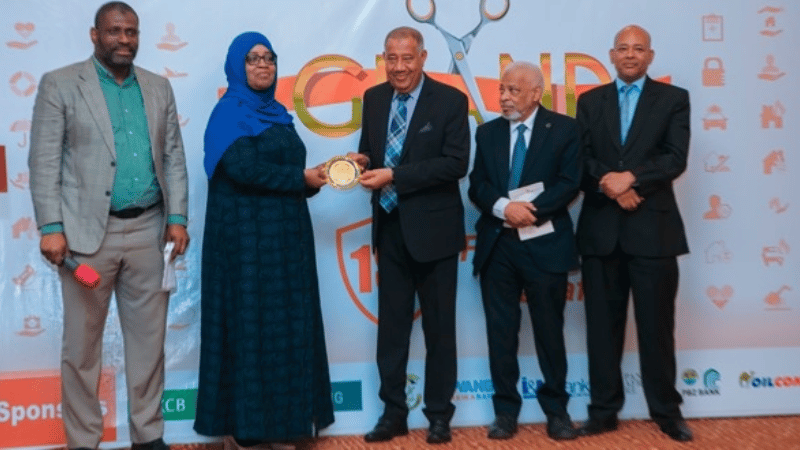

The launch, which took place last week in Zanzibar, positions First United Takaful as the second provider of Takaful services in the country after ZIC Takaful.

The introduction of these services aligns with the Tanzanian government’s objectives to enhance financial inclusion and support economic growth.

Dr. Saada Mkuya, Zanzibar’s Minister of State for Finance, highlighted the launch as a step towards achieving the national insurance sector vision and the economic goals set by the presidents of Tanzania and Zanzibar.

Abdulnassir Ahmed Mohamed, CEO of First United Takaful, and Dr. Kassim Hussein, Chairman of the Board, emphasized the company’s commitment to offering insurance products that cater to the needs of customers seeking services compliant with Islamic principles.

Hussein stressed that Takaful extends beyond merely being a product; it signifies a major shift within the insurance sector and that insurance must be universally available, irrespective of one’s religious convictions, and Takaful fulfills this vision while upholding ethical standards.

Islamic insurance, known as Takaful, adheres to Islamic law (Sharia) and is founded on the principles of cooperation, responsibility, protection, and shared risk.

Unlike conventional insurance, which is characterized by elements of uncertainty (gharar) and gambling (maisir), Takaful operates on a community-based model where policyholders contribute to a mutual fund used to settle claims.

This model is rigorously overseen by a Sharia board to ensure all operations comply with Islamic principles, including the strict prohibition of investments in haram (forbidden) sectors.

In Tanzania, with a population of 63 million where Muslims constitute approximately 35% to 40%, there is a palpable demand for Takaful.

Mohamed Issa, Chairman of Yusra Sukuk Company, Tanzania’s first Islamic brokerage and investment advisory firm, explains that one specific study conducted in 2012 by consultants from Malaysia assessed the demand for Takaful or Islamic insurance in Tanzania.

They surveyed the entire country including Zanzibar and found that the demand for Takaful was very large across Tanzania. So while formal studies are limited, industry indicators point to high demand. Data availability will improve as the industry grows.

Acknowledging this potential, the Tanzania Insurance Regulatory Authority (TIRA) facilitated the sector’s growth by issuing the Takaful Operation Guidelines in 2022.

In July 2023, Zanzibar President Hussein Mwinyi launched Tanzania’s first Islamic insurance company, ZIC Takaful, a subsidiary of the Zanzibar Insurance Corporation (ZIC).