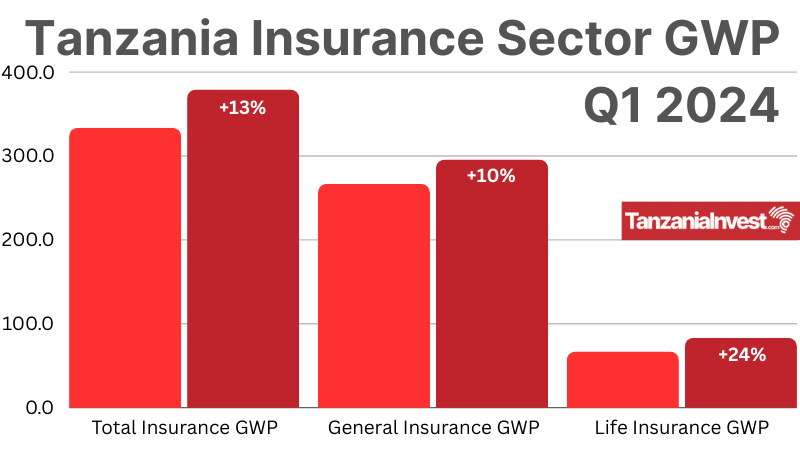

The Association of Tanzania Insurers (ATI) released its preliminary results for the industry for the period January-March 2024, indicating total Gross Written Premiums (GWP) of TZS 379.40 billion.

This represents an increase of 13.6% compared to TZS 333.8 billion in the same period of 2023.

General Insurance

The general insurance (non-life) sub-sector total GWP reached TZS 296 billion in Q1 2024 versus TZS 266.7 billion in Q1 2023, showcasing a year-on-year growth of 10.9%.

Out of 30 companies providing general insurance in Tanzania, Resolution Insurance experienced the strongest growth of +417.9%, followed by Phoenix Insurance/MUA (+41.6%), GA Insurance (+33.3%), and ICEA Lion (+32.2%).

The market leader, Strategis Insurance, with a 17.1% market share of GWP, also experienced strong growth of +20%, as did the second-largest insurer, Alliance Insurance, which commands 8.5% of the general insurance market and grew its GWP by +14.8%.

The worst performers were the Zanzibar Insurance Corporation (ZIC), which saw a reduction of -20.9% in its insurance premiums, and the National Insurance Corporation (NIC), which experienced a reduction of -18.8%.

Life Insurance

The life insurance sub-sector total GWP reached TZS 83.4 billion in Q1 2024 versus TZS 67 billion in Q1 2023, showcasing a year-on-year growth of 24.4%.

Out of six companies providing life insurance in Tanzania, Bumaco Life, the smallest of all, experienced the strongest growth of +81.3%, followed by Metro Life (+63.64%) and Sanlam Life (+34.72%), which continues to be the undisputed market leader with 66.5% of all Tanzania’s life insurance GWP.

Commenting on the results, Khamis Suleiman, the chairman of ATI, attributed the sector’s growth to various ongoing initiatives, particularly in infrastructure. He highlighted the impact of new projects, including road construction, port expansions, mining sector developments, and oil and gas exploration activities, all of which are boosting the insurance industry.

Suleiman also noted a growing awareness and understanding of insurance services across the country, reflecting an increasing recognition of the importance of protecting against potential risks.

He expects continued strong growth in the second and third quarters of 2024, as the approval of the national budget for 2024/25 will initiate numerous projects requiring insurance coverage.

Esther Mwamfupe, the Secretary of the Insurance Agents Association of Tanzania (IAAT), emphasized that the results demonstrate how small and medium-sized insurance companies are outperforming larger and government-owned insurance companies. She also highlighted that the remarkable increase in life insurance has been leading the growth trend.