The Bank of Tanzania (BOT) conducted a review to identify the main reasons behind high non-performing loans in the banking sector and established that, to a great extent, some banks and financial institutions are directly responsible.

High rate of non-performing loans is among major causes of high lending rates and may lead to instability of the banking sector, hand have been plaguing Tanzania’s banks for years.

BOT has found thar employees of certain banks issued loans without following procedures, fraud/corruption or other practices that are tantamount to lack of integrity.

In view of this, BOT has deemed it necessary to take measures to address the issue of high non-performing loans in the Tanzanian banking sector, namely:

- To conduct examination of banks and financial institutions to determine causes and employees who are directly responsible for non-performing loans. In this regard, where it is established that a particular employee is responsible for non-performing loans through issuing loans without following procedures, fraud or lack of integrity,

the concerned bank or financial institution will be required to take appropriate legal measures against the employee(s), and BOT will blacklist the concerned employees and bar them from being employed in any bank or financial institution operating in Tanzania; - To require banks and financial institutions whose employee(s) have non-performing loans with another bank or financial institution to submit details of the employee(s) to the credit reference bureau. Further, BOT will blacklist the concerned employee and bar them from being employed in any bank or financial institution operating in Tanzania, should it be found that failure to service the loan is on account of negligence, fraud or lack of integrity;

- To require banks and financial institutions not to grant any credit accommodation to unscrupulous borrowers who borrowed with the intension of not repaying the loans or using deceitful means. Details of such borrowers will also be kept in special register which will be shared with banks and financial institutions for that purpose. In the meanwhile, borrowers falling under this category are given three months to make arrangements to repay the loans before their names are entered into the special register; and

- To require banks and financial institutions to submit details of civil servants who have non-performing loans to their employers for appropriate actions. Further, details of such borrowers will also be kept in special register which will be shared with banks and financial institutions in order to ensure that such civil servants do not access any additional credit accommodation until appropriate action has been taken and the non-performing loan is regularized.

BOT also urges the general public to fulfill their fiduciary and contractual duties once they have accessed credit accommodation from banks and financial institutions.

Further, the general public is urged to report to the bank, financial institution or BOT any fraud or corruption event encountered when accessing any service from a bank or financial institution.

Meanwhile, BOT shall continue to engage banks and financial institutions to ensure that credit granting procedures are effectively adhered to in order to underwrite quality credits and reduce the rate of non-performing loans.

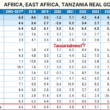

Tanzania Non-Performing Loans

The ratio of non-performing loans (NPLs) to gross loans in Tanzania decreased to 9.58% in 2019 from 10.51% in 2018 but was above the desirable level.

The ratio further declined to 9.3% in December 2020.

The improvement was attributed to various measures taken by BOT, including requiring banks and financial institutions to enhance credit-underwriting standards and loan recovery efforts.