The Bank of Tanzania (BOT) has released its Monthly Economic Review–October 2025, outlining Tanzania’s economic performance for the year ending September.

Output Performance

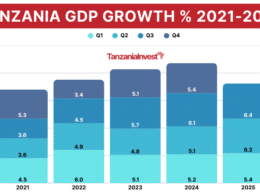

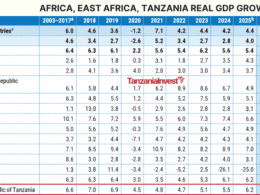

The domestic economy maintained strong growth momentum in the second quarter of 2025, supported by sustained investment from both the public and private sectors.

Real GDP in mainland Tanzania expanded by 6.3%, up from 5.1% recorded in the corresponding quarter of 2024.

This performance was largely contributed to by agriculture, mining and quarrying, construction, and financial and insurance services.

The economy is projected to grow by 6% in 2025, driven primarily by a reliable power supply, strong export performance, and prudent implementation of fiscal and monetary policies.

Inflation

Inflation remained stable and low at 3.4% in September 2025, unchanged from the previous month and within the target range of 3–5%.

The rate is also consistent with the EAC and SADC convergence criteria, which set ceilings of not more than 8% and 3–7%, respectively.

Looking ahead, inflation is projected to remain low and stable, within the target range of 3–5%, supported by adequate food supplies and exchange rate stability.

The stability in inflation was mainly driven by a decline in some food prices, which offset increases in non-food prices.

Core inflation remained the main contributor to overall inflation, followed by unprocessed food and energy-related components.

Core inflation rose to 2.2% in September 2025, from 2.0% in August 2025, largely driven by higher prices of household equipment and transport services.

Inflation in the energy, fuel, and utilities category decreased to 3.7% compared to 11.5% in the corresponding month in 2024, largely associated with easing global oil prices.

This downward trend in international oil prices is mirrored in lower prices of major petroleum products, including diesel and petrol.

Food inflation eased to 7.0% in September 2025, from 7.7% in August 2025.

This easing largely reflects price moderation in key food items, including sorghum, round potatoes, plantains, and cooking oil, which was mainly attributed to the adequate domestic supply of these crops.

However, on an annual basis, prices of some staple foods, particularly rice and maize, increased, driven mainly by higher demand, especially in regions bordering neighbouring countries.

Food stocks held by the National Food Reserve Agency (NFRA) increased to 570,519 tonnes following purchases of 39,590.34 tonnes.

During the same period, 6,641.87 tonnes were released to traders and the World Food Programme.

Monetary Policy

BOT continued to implement monetary policy to maintain the 7-day interbank interest rate within the target band of 3.75 to 7.75%.

The Central Bank Rate (CBR) for the third quarter of 2025 was 5.75%—set to support low and stable inflation while fostering economic growth.

Monetary policy implementation successfully maintained sufficient liquidity in the interbank market, as evidenced by the 7-day interbank rate remaining within the policy corridor—occasionally dipping below the CBR.

Liquidity management was primarily conducted through main and fine-tuning reverse repo operations.

Improved liquidity conditions also influenced broader monetary aggregates. The extended broad money supply (M3) grew by 20.8% in the year ending September 2025, broadly unchanged from the level in the previous month, driven mainly by strong credit expansion to the private sector.

Banks’ Credit to the Private Sector

Credit to the private sector maintained robust growth of 16.1%, almost the same as in the preceding month.

Mining and quarrying recorded the highest credit growth, expanding by 32.4%, outpacing agriculture, which recorded 27.6% growth, and trade, which recorded 24.8% growth.

Personal loans—mainly used to finance micro, small, and medium-sized enterprises—continued to benefit the lion’s share of private sector credit, accounting for 36.7%, trailed by trade and agriculture at 13.6% and 12.9%, respectively.

Interest Rates

Lending and deposit interest rates exhibited general stability, albeit with minor fluctuations across maturity spectrums.

The average lending rate edged to 15.18%, from 15.07% in the preceding month. Similarly, negotiated lending rates for prime customers increased marginally to 12.84% from 12.72% in August 2025.

The overall deposit interest rate decreased slightly to 8.50% from 8.61% in the previous month, while the negotiated deposit rate remained almost unchanged at around 11%.

The spread between one-year lending and deposit rates narrowed to 5.69% points, from 6.55% points in September 2024.

Financial Markets

Government Securities Market

During the month under review, BOT conducted one Treasury bill auction with a tender size of TZS 80.7 billion, mainly for financing government budgetary operations, and a small portion for facilitating price discovery in the short end of the yield curve.

The auction was oversubscribed, reflecting adequate liquidity in the economy, with received bids amounting to TZS 194.7 billion, of which TZS 80.7 billion were successful.

The overall weighted average yield decreased to 6.03%, from 6.83% recorded in the preceding month.

BOT also conducted auctions for 5-, 20-, and 25-year Treasury bonds, with tender sizes of TZS 136.2 billion, TZS 271.1 billion, and TZS 293.7 billion, respectively.

The 5-year Treasury bond auction was undersubscribed, while the 20- and 25-year bonds were oversubscribed, indicating investors’ continued preference for instruments with longer maturities.

Collectively, the auctions received bids amounting to TZS 2,271.5 billion, of which TZS 784.9 billion were accepted.

Weighted average yields eased to 12.48%, 13.55%, and 13.19% for the 5-, 20- and 25-year bonds, respectively.

Interbank Cash Market

The Interbank Cash Market (IBCM) continued to facilitate the redistribution of shilling liquidity among banks, thereby supporting the transmission of monetary policy.

In September 2025, total transactions in the market reached TZS 3,261.6 billion, up from TZS 2,374.5 billion recorded in the preceding month.

The 7-day transactions accounted for the largest share, at over 64.6% of total market turnover.

In line with adequate liquidity in the banking system, the overall IBCM interest rate eased slightly to 6.45% from 6.48% in August 2025.

Interbank Foreign Exchange Market

Foreign exchange liquidity remained adequate, supported by inflows from the export of gold, cash crops, and tourism activities.

Accordingly, the Interbank Foreign Exchange Market (IFEM) remained active with total transactions amounting to USD 93.8 million, slightly lower than USD 101.5 million recorded in the preceding month.

Banks accounted for 88.3% of the total transactions. BOT participated in the market, selling USD 11 million on a net basis, in line with the Foreign Exchange Intervention Policy.

The Tanzanian Shilling strengthened against the U.S. dollar, averaging TZS 2,471.69 per USD in September 2025, compared to TZS 2,490.16 in August 2025.

On an annual basis, the shilling appreciated by 9.4%, compared with 7.6% in the preceding month and a depreciation of 10.1% in the corresponding period in 2024.

Government Budgetary Operations

In August 2025, government revenue, including local government authorities’ collections, amounted to TZS 3,048.0 billion, equivalent to 106.3% of the month’s target.

The Central Government contributed TZS 2,915.9 billion, with TZS 2,492.0 billion from tax revenue and TZS 423.9 billion from non-tax revenue.

Revenue from taxes on imports, local goods and income taxes surpassed their targets, largely due to improved compliance.

The Government successfully aligned its expenditures with available resources, with total spending reaching TZS 3,900.7 billion in August 2025.

This expenditure was composed of TZS 2,433.9 billion in recurrent spending and TZS 1,466.8 billion for development projects.

Debt Developments

The national debt stock at the end of September 2025 was USD 50,772.4 million, 1.4% higher than the stock at the end of the preceding month. Of the debt stock, 69.8% was external debt.

External Debt

The external debt stock (public and private) recorded a monthly increase of 1.2% to USD 35,438.3 million at the end of September 2025.

Of this amount, 81.8% was public debt, and the remainder was private sector external debt.

External loans disbursed during the month amounted to USD 443.3 million, mainly to the government, whereas external debt service payments totalled USD 130.6 million, of which USD 75.3 million was for principal repayments.

The composition of external debt by creditor remained broadly unchanged from the preceding month and corresponding month in 2024, with multilateral institutions continuing to account for the largest share of the stock at 57.0%, followed by commercial lenders.

Balance of payments and budget support activities were the largest holders of the disbursed outstanding debt, followed by transport and telecommunication activities.

The US dollar continued to dominate the currency composition of external debt, followed by the Euro.

Domestic Debt

As of the end of September 2025, domestic debt amounted to TZS 37,459 billion, a 0.9% increase from the preceding month.

This growth was driven by the net issuance of Treasury bonds. The domestic debt portfolio remains concentrated in long-term instruments, particularly Treasury bonds, with nearly three-quarters held by commercial banks, pension funds, and BOT.

In September 2025, the Government secured TZS 764.5 billion from the domestic market to support budgetary requirements, with TZS 689.5 billion sourced through Treasury bonds and TZS 75 billion through Treasury bills.

Domestic debt servicing amounted to TZS 370.4 billion, including TZS 134 billion in principal and TZS 236.5 billion in interest payments.

External Sector Performance

The external sector continued to strengthen despite trade and policy shifts, reflecting resilience and adaptability. Robust export growth and favorable movements in global commodity prices largely drove the improvement.

Consequently, the current account deficit narrowed to USD 2,234.9 million for the year ending September 2025, a notable reduction from USD 3,043.8 million recorded in the same period of 2024.

At the end of September 2025, foreign exchange reserves stood at USD 6,664.2 million, adequate to cover more than five months of projected imports of goods and services, surpassing both national and EAC benchmarks.

Exports

Export of goods and services rose to USD 17,094.2 million in the year ending September 2025, from USD 14,896.3 million in the same period in 2024.

The growth was largely driven by increased service receipts and stronger performance in the export of gold, manufactured goods, and traditional exports, particularly cashew nuts and tobacco.

Goods exports amounted to USD 10,120.3 million, a notable increase from USD 8,229.2 million recorded in the previous year.

The increase was due to higher exports of gold, manufactured goods, cashew nuts, cereals, and tobacco.

Gold exports surged by 35.8% to USD 4,431.2 million, compared to USD 3,263.9 million, primarily due to elevated global gold prices.

Traditional exports improved to USD 1,483.9 million, marking a 38.3% increase, largely attributed to strong exports of cashew nuts and tobacco, supported by both price and volume effects.

Cereal exports also saw significant growth, rising to USD 340.6 million from USD 194.2 million, spurred by heightened demand from neighbouring countries.

On a monthly basis, exports of goods increased to USD 1,020.4 million in September 2025, from USD 934.2 million in September 2024, largely driven by gold and manufactured goods.

Service receipts amounted to USD 6,973.9 million for the year ending September 2025, higher than USD 6,667.1 million in the same period of 2024.

The growth was mainly driven by increased earnings from travel and transport services.

The rise in travel receipts reflects the continued strong performance of the tourism sector, with tourist arrivals increasing by 11.9% to 2,315,637.

Transport earnings, primarily freight, amounted to USD 2,535.4 million compared to USD 2,283.6 million the previous year.

On a monthly basis, service receipts stood at USD 576 million in September 2025, down from USD 584.7 million in September 2024.

Imports

For the year ending September 2025, imports of goods and services rose to USD 17,728.7 million from the USD 16,759.4 million recorded in the same period in 2024.

Significant increases were observed in industrial supplies, industrial transport equipment, parts and accessories, and machinery and mechanical appliances.

Oil imports, which account for 16.8% of total imports, saw a notable decline to USD 2,469.6 million, largely on account of the price effect.

On a monthly basis, goods imports amounted to USD 1,503.4 million in September 2025, higher than USD 1,251.9 million in September 2024.

Service payments amounted to USD 3,089.5 million in the year ending September 2025, up from USD 2,604.2 million in the same period in 2024.

This increase was driven by higher freight payments, in line with the increase in import bill.

Service payments were USD 288.2 million in September 2025, up from USD 270.8 million in September 2024.

For the year ending September 2025, the primary income account recorded a deficit of USD 2,071.5 million, higher than USD 1,765.9 million recorded in same period in 2024.

Payment of income on equity and interest abroad explains the development in the primary income account.

On a monthly basis, the primary account deficit amounted to USD 221.2 million in September 2025, up from USD 159.5 million in September 2024.

The secondary income account recorded a surplus of USD 471.2 million, down from USD 585.2 million in the corresponding period in 2024, mainly supported by personal transfers.

On a monthly basis, the surplus was USD 18.4 million in September 2025, a decrease from USD 40.7 million in September 2024.