The Bank of Tanzania (BOT) released its Monthly Economic Review-January 2026, which covers key macroeconomic indicators for the year ending December 2025.

Table of Contents

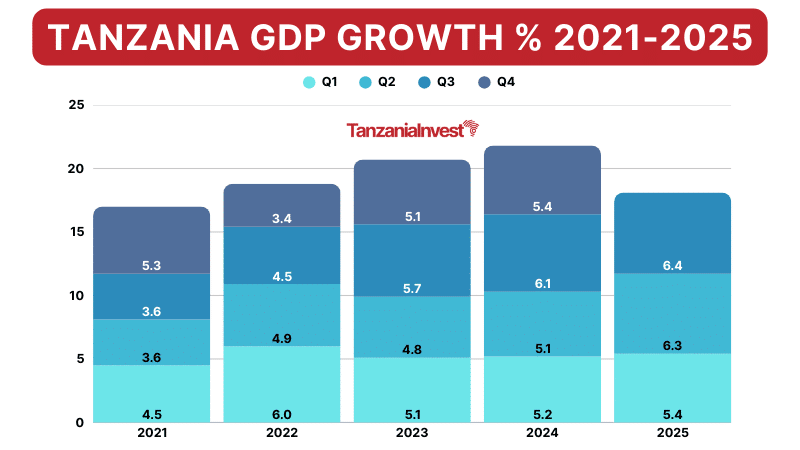

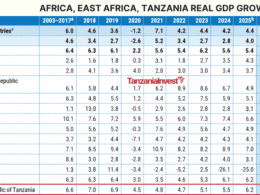

GDP Growth

The domestic economy maintained a strong growth momentum in the third quarter of 2025, driven by sustained investment from both the public and private sectors.

Real GDP in mainland Tanzania grew by 6.4%, up from 6.1% in the same quarter of 2024, with major contributions coming from agriculture, mining and quarrying, construction, and financial and insurance services activities.

Inflation

Headline inflation stood at 3.6% in December 2025, up from 3.1% in the same month of 2024, yet remained within the national target range of 3–5%.

The rate was also within the EAC and SADC convergence criteria of not more than 8% and 3–7%, respectively.

The uptick in inflation was largely attributable to higher food prices, driven by seasonal demand and associated pressures during the festive period.

Notably, the contribution of unprocessed food to overall inflation rose to 1.5% in December 2025, compared with 0.6% a year earlier.

Food inflation edged up to 6.7%, compared to 4.6% in the same month of the preceding year.

The increase was largely attributed to higher prices of staple food items such as rice, maize flour, wheat flour, finger millet, and sorghum.

Food stocks held by the National Food Reserve Agency (NFRA) amounted to 577,376 tonnes in December 2025, following purchases of 49.9 tonnes and the release of 13,098.2 tonnes of maize to traders during the month. These releases continue to ease food price pressures.

Core inflation decreased to 2.5% in December 2025, lower than 3.3% recorded in December 2024, mainly reflecting a slowdown in prices of processed products such as refined sugar and sunflower oil, liquefied petroleum gas (cooking gas), school uniforms and rickshaws.

Inflation for the energy, fuel, and utilities subgroup eased to 4.6% in December 2025 from 5.3% in the corresponding month of 2024.

This was primarily due to a slowdown in prices of petrol and kerosene, largely reflecting the decline in global fuel prices.

Monetary Policy

At its 239th meeting in October 2025, the Monetary Policy Committee (MPC) maintained the Central Bank Rate (CBR) at 5.75% for the quarter ending December 2025.

The decision aimed to sustain economic recovery amid low-inflation environment anchored within the 3–5% target range.

In line with this decision, monetary policy implementation focused on steering the 7-day interbank cash market (IBCM) rate within a +/-2 percentage-point corridor around the CBR.

In December 2025, monetary policy operations were broadly satisfactory.

Liquidity conditions in the banking sector improved, and the 7-day interbank cash market (IBCM) rate remained closely aligned with CBR.

The outcome was mainly attributed to reverse repo auctions amounting to TZS 1,419.3 billion, which aligned with the liquidity demand.

The improved liquidity position was reflected in broader monetary aggregates.

The extended broad money supply (M3) grew by 25.8% in the year ending December 2025, compared with 22.9% in the previous month.

Credit to Private Sector

Credit to the private sector continued to expand, growing by 23.5%, compared with 18.1% in the previous month.

Credit growth was highest in the mining sector at 91.1% in December 2025, followed by trade and agriculture with growth rates of 49.7% and 28.9%, respectively.

Personal loans, predominantly extended to micro, small, and medium-sized enterprises, continued to constitute the largest share of private sector credit at 35.8%, followed by trade at 15.3% and agriculture at 13.2%.

Interest Rates

The lending and deposit interest rates moderated marginally in December 2025.

The overall lending rate eased slightly to 15.24%, from 15.27% in the preceding month.

Similarly, lending rates charged to prime customers (negotiated rates) decreased slightly to 12.38%, compared with 12.61% in November 2025.

On the deposit side, the overall rate was 8.36%, slightly lower than 8.54% in the preceding month, while the negotiated deposit rate remained almost unchanged at 11.66%.

As a result, the short-term interest rate spread of one-year lending and deposit rates narrowed to 5.88 percentage points, from 6.12 percentage points recorded in the corresponding month in 2024.

Financial Markets

Government Securities Market

During the month under review, the BOT conducted a single Treasury bill auction with a total tender size of TZS 176.1 billion, primarily to finance government budgetary operations and for monetary policy purposes.

Reflecting ample liquidity in the economy, the auction was oversubscribed, attracting total bids of TZS 341.2 billion, of which TZS 291.7 billion were accepted.

As a result, the overall weighted average yield declined to 5.87%, from 6.25% recorded in the preceding month.

The Bank also conducted a 20-year Treasury bond auction with a tender size of TZS 236.3 billion.

The auction was oversubscribed, reflecting investors’ appetite for longer-maturity instruments.

The auction received bids worth TZS 813.5 billion, of which TZS 232.9 billion were accepted.

Weighted average yields eased to 12.02%, signalling favourable borrowing conditions and sustained confidence in the domestic debt market.

Interbank Cash Market

The interbank cash market (IBCM) continued to facilitate the redistribution of shilling liquidity among banks.

Activity in the IBCM increased, as reflected in market turnover, which rose to TZS 3,481.9 billion in December 2025, from TZS 1,781.0 billion in the preceding month and TZS 1,616.8 billion recorded in the corresponding period of the year ending December 2024.

Trading was dominated by 7-day transactions, which accounted for 39.9% of total activity.

The overall IBCM interest rate remained almost unchanged at 6.29%, largely reflecting the adequacy of liquidity, which helped keep interbank rates close to the CBR.

Interbank Foreign Exchange Market

In December 2025, foreign exchange liquidity remained adequate, supported by inflows from export proceeds.

As a result, total transactions in the Interbank Foreign Exchange Market (IFEM) increased to USD 178.6 million in December 2025, from USD 158.68 million in the preceding month, with banks accounting for 88.3% of the total transactions.

The Bank participated in the market, selling USD 87.75 million on a net basis, in line with the Foreign Exchange Intervention Policy.

Reflecting increased foreign exchange liquidity, the Tanzanian shilling traded at an average of TZS 2,452.76 per USD in December 2025, almost the same as TZS 2,444.81 traded the previous month.

On an annual basis, the shilling depreciated slightly by 1.3%, compared with an appreciation of 3.8% recorded in the similar period in 2024.

Government Budgetary Operations

Domestic revenue collections in October 2025 were broadly satisfactory, amounting to TZS 3,080.2 billion. However, this was 4.4% below the month’s target.

The central government contributed TZS 2,946.6 billion, falling short of the monthly target by 3.8%, while the remainder came from local government authorities through own-source collections.

Tax revenue maintained strong performance, reaching TZS 2,529.0 billion, being 0.6% above the monthly target, underscoring the positive impact of ongoing improvements in tax administration.

In contrast, non-tax revenue stood at TZS 417.6 billion, below the monthly target of TZS 549.8 billion.

In the month under review, the Government aligned its expenditures with available resources, recording total expenditure of TZS 4,168.6 billion.

Of this amount, recurrent expenditure accounted for TZS 2,686.4 billion, while TZS 1,482.2 billion was directed toward development projects.

Debt Developments

The national debt stock at the end of December 2025 was USD 50,794.2 million, representing a 0.1% decline from the stock at the end of the preceding month. Of the debt stock, 69.5% was external debt.

External Debt

The external debt stock (public and private) recorded a monthly increase of 0.5% to USD 35,309.2 million at the end of December 2025.

Of this amount, 82.8% was public debt, while the remainder was private sector external debt.

External loans disbursed during the month amounted to USD 191.1 million, mainly to the government, while external debt service payments totalled USD 183.5 million, of which USD 136.8 million was for principal repayments.

The composition of external debt by creditor remained broadly unchanged, with multilateral institutions continuing to account for the largest share of the stock at 58.2%, followed by commercial lenders.

The sectoral distribution of disbursed outstanding debt remained concentrated in Balance of Payment (BOP) and budget support activities, followed by transport and telecommunication activities, while the US dollar continued to dominate the currency composition of external debt by 66.0%, followed by the Euro.

Domestic Debt

Domestic debt stock declined by 1.2% month-on-month, reaching TZS 37,898.98 billion at the end of December 2025.

The domestic debt portfolio remains largely concentrated in long-term instruments, particularly Treasury bonds, with commercial banks and pension funds holding approximately 56% of the total.

In December 2025, the Government mobilized TZS 247.8 billion from the domestic market to finance budgetary requirements, comprising TZS 166.6 billion through Treasury bonds and TZS 81.2 billion through Treasury bills.

Domestic debt servicing during the month amounted to TZS 488.01 billion, including TZS 211.8 billion in principal repayment and TZS 276.2 billion in interest payments.

External Sector Performance

The external sector continued to improve in 2025, as reflected by a narrowing of the current account deficit to USD 2,015.5 million from USD 2,379.8 million recorded in 2024.

The performance was mainly supported by strong growth in exports of goods and services, as compared to import bills, which were largely dominated by intermediate and capital goods associated with production and investment activities.

Foreign reserves amounted to USD 6,329 million at the end of December 2025, from USD 5,546.9 million at the end of December 2024.

The level of reserves was adequate to cover 4.9 months of projected imports of goods and services, above the national and EAC benchmarks.

Exports

In 2025, exports of goods and services rose by 10.2% to USD 17,599.2 million, from USD 15,968.4 million in 2024.

Exports of goods increased to USD 10,282.4 million in 2025, from USD 9,121.6 million recorded in 2024.

This increase was driven mainly by exports of gold, manufactured goods, tobacco, and coffee.

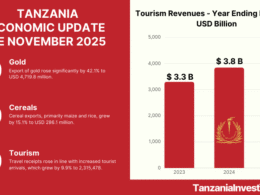

Gold exports, which accounted for 45.7% of total goods exports, rose by 37.4% to USD 4,697.6 million, benefiting from favourable global prices and increased production.

Exports of manufactured goods also strengthened, climbing to USD 1,548.6 million from USD 1,341.3 million in 2024.

Traditional exports rose to USD 1,512.2 million in 2025, an increase from USD 1,473.3 million recorded in 2024.

This growth was mainly attributed to higher exports of tobacco and coffee, which were influenced by both rising prices and increased export volumes.

On a monthly basis, goods exports reached USD 1,059.8 million in December 2025, compared to USD 951.5 million in December 2024, reflecting strong performance in gold and manufactured goods.

Services receipts also recorded a strong performance, increasing to USD 7,316.8 million in 2025 from USD 6,846.8 million in 2024.

The improvement was largely driven by higher earnings from travel and transport services.

Travel receipts increased to USD 3,948.2 million in 2025 from USD 3,903.1 million in 2024, in line with a 7.1% increase in international tourist arrivals to 2,294,495.

Transport service receipts increased to USD 2,796.5 million in 2025 from USD 2,353.4 million in 2024, reflecting higher freight earnings from transit goods, which grew by 34%.

Monthly movement, however, differs from annual trend, with service receipts amounting to USD 626.1 million in December 2025, compared to USD 696.7 million in December 2024.

Imports

Import of goods and services increased to USD 17,826.1 million in 2025, from USD 16,990.7 million in 2024.

The increase was driven by higher imports of industrial supplies, freight services, industrial transport equipment, and machinery and mechanical appliances, which are largely capital and intermediate goods.

Notably, oil imports declined by 6.7%, from USD 2,552.3 million to USD 2,380.1 million, reflecting the moderation of global oil prices.

On a monthly basis, imports of goods amounted to USD 1,379.1 million in December 2025, from USD 1,340.2 million in November 2025.

Services payments increased by 12.5% to USD 3,144.4 million in 2025, compared to USD 2,795 million recorded in 2024.

The increase was mainly driven by higher freight payments, in line with the increase in import bills.

On a monthly basis, service payments amounted to USD 288.8 million in December 2025, higher than USD 261 million in December 2024.

In 2025, the primary income deficit widened to USD 2,072.1 million, compared to USD 1,887.4 million in 2024, mainly associated with the higher payments of income on equity and interest.

On a monthly basis, the primary income account deficit amounted to USD 199 million in December 2025, compared with USD 181.8 million in December 2024.

The secondary income surplus was USD 283.5 million in 2025, a decrease from USD 529.9 million in 2024, largely due to a decline in personal transfers.

On month-to-month, the surplus was USD 16.6 million in December 2025, compared to USD 109.3 million in December 2024.