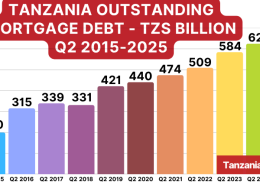

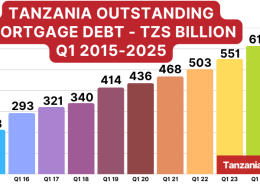

The mortgage market in Tanzania registered a growth of 6% in 2017, compared to a growth rate of 16% in 2017, the Tanzania Mortgage Refinance Company Limited (TMRC) indicates in its latest market update of 31 December 2017.

3 new banks joined the list of mortgage lenders in Tanzania, increasing the total number of lenders to 31 from 28 in 2016. However, the mortgage debt advanced by top 5 lenders accounts for 59% of the total outstanding mortgage debt.

The new entrants in 2017 were Letshego Bank (T) Limited, Yetu Microfinance Bank PLC and Mufindi Community Bank Ltd.

Outstanding mortgage debt as at 31 December 2017 stood at TZS 344.84 billion (±USD 151.72 million) compared to TZS 324.08 billion (±USD 142.59 million) as at 31 December 2016.

During 2017 the average mortgage debt size was TZS 82.62 million (±USD 36,350) versus TZS 93.6 million as at 31 December 2016(±USD 41,200) ), with a typical interest rate of 16-19%.

The ratio of outstanding mortgage debt to Gross Domestic Product (GDP) stood at 0.33% in 2017 versus 0.34% in 2016).

TMRC stressed that a number of real estate development projects are currently underway, creating various opportunities for interested local and foreign investors.

It also reminds that Tanzanian housing sector’s fast-growing demand continues to be driven by the strong and sustained economic growth averaging 6-7% and the fast-growing Tanzanian population of 55 million and is expected to more than double by 2050.

Tanzania Housing

The Tanzanian housing demand is estimated at 200,000 houses annually and a total housing shortage of 3 million houses.

However, high-interest rates and lack of affordable housing remain the major constraints on market growth.