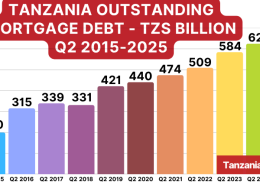

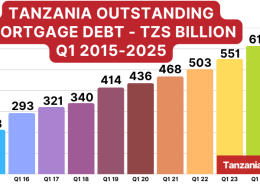

Tanzania Mortgage Refinance Company Limited (TMRC), a financial institution co-founded by the Tanzanian Government and the World Bank to support mortgage lending in the country, has recently released the Tanzania Mortgage Market Update highlighting a firm growth on mortgage loans of 44.76% from 2014 to 2015.

Mortgage loans grew from TZS 248 billion placed in the period ending in December, 2014 to TZS 359 billion placed in the same period in 2015.

This rapid growth attracted retail and commercial banks which started to include mortgage products in their portfolios as home purchases, commercial property mortgages and plot purchases that made the number of lenders to increase by almost 37% from 19 in 2014 to 26 in 2015, while the average debt size also increased proportionally by almost 64% from TZS 69 million to TZS 106 million in the same period.

The market outstanding debt increase was mainly driven by an increase on Equity Bank Tanzania’s mortgage accounts, from 20 as of December, 2014 to 66 in June, 2015 which raised the bank’s mortgage outstanding debt over 600% from TZS 11.75 billion to TZS 82.46 billion and market share from 7.51% to 24.7% in the same period.

At the end of 2015, Equity Bank Tanzania kept the first position as the largest mortgage lender totaling TZS 91.1 billion of outstanding debt and representing of the total market.

Equity Bank Tanzania also contributed with the majority of the increase in the average debt size since during 2015 its average mortgage loan size grew from about TZS 600 million to almost TZS 1,400 million.

This is far higher than the market’s average debt size at around TZS 100 million without considering Bank M and International Commercial Bank (ICB) which entered the mortgage market during the H1-2015 to compete in the high-income sector with Equity Bank Tanzania at an average loan size of TZS 1,400 million and TZS 600 million respectively.

According to TMRC, further development is expected in the mortgage market with larger banks launching new mortgage loan products due to intensifying competition in traditional bank products.

Continuing real estate projects undertook by Tanzania’s National Housing Corporation (NHC), a state-run entity to support housing supply in all income earners levels, will also boost the mortgage market with projects at affordable prices through the Civil Servants Housing Scheme that plans to build 50,000 houses within the next five years.

Public pension funds are also supporting further development as the National Social Security Fund (NSSF) which is already developing a housing project in Kigamboni in Dar es Salaam, at a cost of USD 544.5 million and delivery date in 2017.

Tanzania’s mortgage market growth from 0.36% of the country’s GDP as of December, 2014 to 0.45% of GDP in December, 2015, but there still room for development according to TMRA as neighboring countries have seen larger mortgage market growth in the same period.

Rwanda and Kenya’s mortgage debt to GDP grew from about 2.5% to 3.5% while Uganda stayed almost flat at around 1.0%.