The African Development Bank (AfDB) has recently released its African Economic Outlook 2022 report, projecting that Tanzania’s GDP will grow by 5.0% in 2022, and by 5.6% in 2023.

The theme of the 2022 African Economic Outlook is Supporting Climate Resilience and a Just Energy Transition in Africa.

The theme highlights climate change as a growing threat to lives and livelihoods in Africa and mirrors the theme of the 2022 Annual Meetings.

Performances of the African Economies in 2022

The release of the report comes against a backdrop of two major global crises: the lingering COVID-19 pandemic, and the Russia–Ukraine conflict.

The latter erupted as Africa’s economies were on a path of recovery from the ravaging impact of the pandemic, and it threatens to set back the continent’s promising economic prospects.

The African continent risks sliding into stagflation (a combination of slow growth and high inflation), with real GDP projected to grow by 4.1% in 2022, markedly lower than nearly 7% in 2021.

The growth will be driven largely by private consumption and investment on the demand side and by continued expansion in the services sector on the supply side.

The services sector, especially tourism, has shown strong post-pandemic recovery and is likely to remain buoyant in the medium term, supported by industry, especially in mining, underpinned by soaring metal prices.

Africa’s low COVID-19 vaccination rollout, persistent sovereign debt vulnerabilities,

high debt levels, and climate and environmental concerns remain the main threats to

medium- and long-term growth trajectories.

If the Russia–Ukraine conflict persists, Africa’s GDP growth is likely to stagnate at around 4% in 2023.

Tanzania’s GDP in 2022 and 2023

The AfDB’s report indicates that Tanzania’s GDP grew at 4.9% in 2021, up from 4.8% in 2020, supported by the global economic recovery.

The bank projects a GDP growth for Tanzania of 5.0% in 2022 and 5.6% in 2023, due to improved performance in tourism, the reopening of trade corridors, and the accelerated rollout of vaccines.

This is similar to AfDB’s projections in 2021 when it projected that Tanzania’s GDP would grow by 4.9% and 6.3% in 2022 and 2023 respectively.

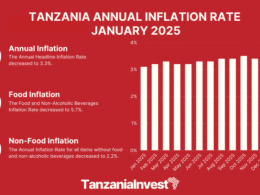

Inflation is projected to increase to 4.4% in 2022 and to 3.8% in 2023 due to higher energy prices because of the Russia–Ukraine conflict.

The fiscal deficit is expected to narrow to 2.7% and 2.8% of GDP in the same period due to better revenue performance and will be financed by domestic and external borrowing.

The current account deficit is expected to widen to 4.0% of GDP in 2022 due to higher oil prices before narrowing to 2.6% in 2023 as merchandise exports and tourism receipts stabilize and will be financed mainly by external borrowing.

The major downside risks relate to new COVID-19 variants and associated disruptions to economic activity but should be mitigated by increased public awareness and uptake of vaccines.

The report also stresses that Tanzania, albeit at a smaller scale due to the relative size of its reserves, could play a value-chain role in graphite.

Climate Change Issues and Policy Options for Tanzania

Agriculture, manufacturing, and energy are among the key sectors most vulnerable to climate change, with drought affecting agriculture and reliable power supply.

Tanzania is 67th on the 2021 Global Climate Risk Index (GCRI). Its latest review of the 2015 Nationally Determined Contribution (NDC) estimated the economic costs from climate shocks at about 1% of GDP.

The government has developed policies to support climate resilience, including the National Climate Change Strategy 2021–2026, the Zanzibar Climate Change Strategy (2014), and the Environmental Management Act Cap. 191.

Tanzania’s NDC has a target of reducing greenhouse gas emissions by 10–20% by 2030 through actions including the promotion of clean technologies and RE sources.

However, rapid population growth and a significant renewable energy financing gap present substantial challenges to achieving the NDC targets.

Tanzania estimates that about USD 60 billion is needed by 2030 for mitigation investments, requiring a scaling-up of mobilized climate finance.