On June 14, 2024, Tanzania’s Minister for Finance, Dr. Mwigulu Lameck Nchemba Madelu (MP), presented the much-awaited national budget for the fiscal year 2024/2025 to the National Assembly.

In this comprehensive overview, we delve into the budget’s key expenditures and priorities, highlight significant projects, and examine its financing structure. We also cover the main changes and initiatives introduced, with a particular focus on new tax changes and tax breaks.

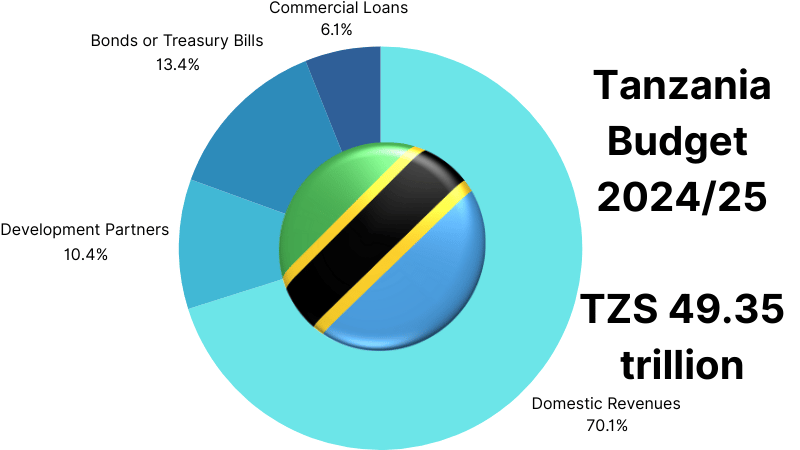

This comprehensive budget, amounting to TZS 49.35 trillion (USD 18.85 billion), marks an 11.2% increase from the previous year, driven by a combination of factors including the depreciation of the Tanzanian shilling, rising interest rates, and the maturation of loans.

Significant allocations have also been made for new employment opportunities, debt repayment, local government elections, preparations for the 2025 general elections, and the upcoming 2027 African Cup of Nations (AFCON), which includes extensive construction and rehabilitation of stadiums.

Themes and Economic Goals

The 2024/25 budget is the fourth in the implementation of the Third Five-Year National Development Plan (2021/22 – 2025/26), under the theme “Realising Competitiveness and Industrialization for Human Development”. The priorities identified in the Five-Year Plan include: realizing an inclusive and competitive economy; deepening industrialization and service provision; investment and trade promotion; and human and skills development. Additionally, in alignment with the East African Community’s agreed theme, the budget focuses on “Sustainable Economic Transformation through Fiscal Consolidation and Investment in Climate Change Mitigation and Adaptation for Improved Livelihoods”.

Macro-economic Policy Targets

Based on the documents and guidelines considered in the preparation of this Budget, the government’s overall macro-economic policy targets for 2024/25 include:

i. Accelerating GDP growth to 5.4% from 5.1% in 2023.

ii. Keeping the inflation rate within a single-digit range of 3.0-5.0%.

iii. Increasing domestic revenue to 15.8% of GDP, up from 15.4% in 2023/24.

iv. Raising tax revenue to 12.9% of GDP from 12.6% in the previous fiscal year.

v. Maintaining a budget deficit (including grants) not exceeding 3.0% of GDP.

vi. Ensuring foreign exchange reserves cover at least four months of imports.

Budget Assumptions

The preparation of macro-economic targets for 2024/25 is based on the following assumptions:

i. Increased participation of the private sector in investment and business activities;

ii. Continue to build resilience to the effects of disasters including drought, war, floods, and pandemic diseases;

iii. Strengthened global economy and price stability in financial and commodity markets;

iv. Improved food security; and

v. Maintained peace, security, unity, and stability within and in neighboring countries.

Budget Priorities

The budget prioritizes several key areas to foster inclusive and competitive economic growth. These include:

i. Completion of flagship and strategic projects. These include the Julius Nyerere Hydroelectric Power Project 2,115 MW; the construction of Standard Gauge Railway (SGR); the Revamping of Air Tanzania (ATCL); the East African Crude Oil Pipeline (EACOP) from Hoima (Uganda) to Tanga (Tanzania); the construction of Bridges and Flyovers including Kigongo-Busisi Bridge; the construction of Kilwa Fishing Harbour and procurement of fishing vessels; the construction of Mkulazi sugar processing plant, the construction of Ruhudji 358 MW Hydropower Project; the construction of the Rumakali 222 MW Hydropower Project; the construction of the Lindi Liquified Natural Gas Plant (LNG); the Engaruka Basin Soda-Ash Project; and the Mchuchuma and Liganga Projects.

ii. Strengthening production sectors.

iii. Enhancing human capital development, particularly in social services.

iv. Increasing the use of ICT.

v. Improving the business environment and investment climate.

Additionally, significant funds will be allocated for wages, debt servicing, the 2024 local government elections, preparations for the 2025 general elections, and the 2027 AFCON preparations.

The specific projects within priority areas that the Government will implement through the 2024/25 budget are detailed in the National Economic Survey for the year 2023 and the Annual National Development Plan for the year 2024/25 prepared by the President’s Office for Planning and Investment.

Revenues and Financing

The government aims to raise TZS 34.61 trillion in domestic revenues, representing 70.1% of the total budget and 15.7% of GDP. The Tanzania Revenue Authority is expected to collect TZS 29.41 trillion, while non-tax revenue from ministries, agencies, and local government authorities is projected at TZS 3.84 trillion and TZS 1.36 trillion, respectively.

Development partners are expected to contribute TZS 5.13 trillion (10.3% of the total budget) in grants and concessional loans.

The government also plans to borrow TZS 6.62 trillion from the domestic market, with TZS 4.02 trillion earmarked for rolling over maturing government securities and TZS 2.60 trillion for development projects.

Additionally, TZS 2.99 trillion will be sourced from external commercial loans for development projects.

To strengthen the domestic capital market, the government will continue issuing benchmark bonds and open the market to investors from the East African Community and the Southern African Development Community. Efforts to increase domestic resource mobilization will continue under the Medium-Term Revenue Strategy (2024/25-2026/27), focusing on widening the tax base, enhancing tax administration, and promoting voluntary tax compliance.

Proposed Tax Reforms

The budget proposes significant amendments to the tax structure, fees, and levies aimed at stimulating business and economic growth. Key changes include:

Value Added Tax (VAT)

i. Exempt VAT on supply and importation of motor vehicles, equipment, machinery, and other goods for official use of Tanzania People’s Defence Force.

ii. Exempt VAT on supply of aircraft, engines, parts, and maintenance for local manufacturers and assemblers. Expected revenue reduction: TZS 7.1 million.

iii. Exempt VAT on supply and importation of water treatment chemicals and water meters, with approval by the Water Minister.

iv. Exempt VAT on importation of Video Assistant Referee equipment and accessories, with approval by the Sports Minister.

v. Require VAT refunds to be paid within 30 days of submission.

vi. Exempt VAT on single axle tractors (Power Tiller) of HS Code 8701.10.00 to harmonize HS Codes.

vii. Abolish VAT on agricultural implements (HS Codes 8201.10.00 and 8201.30.00). Expected revenue reduction: TZS 4,250 million.

viii. Zero rate VAT on gold supplied to the Central Bank of Tanzania to boost foreign reserves and gold refining.

ix. Zero rate VAT on gold supplied to domestic refineries to promote value addition before export.

x. Abolish VAT exemption on the supply of precious metals, gemstones, and other precious stones at refineries. Expected revenue increase: TZS 18,150 million.

xi. Zero rate VAT on locally manufactured fertilizer for one year to support farmers and consumers.

xii. Zero rate VAT on textile products made from locally grown cotton to support farmers and consumers.

xiii. Exempt VAT on double refined edible oil from locally grown seeds by local manufacturers for one year.

xiv. Incorporate online data services into the VAT base to broaden the tax base and adapt to technological changes.

The Value Added Tax Measures altogether are expected to increase Government revenues by TZS 22,393 million.

Income Tax

i. Charitable institutions dealing with health and environmental conservation to be exempt from Income tax to encourage their services.

ii. Tea processing companies facing persistent losses to be exempted from Alternative Minimum Tax for three years.

iii. Requirement to use electronic receipts for purchases to enhance tax compliance, except for certain foreign sellers.

v. Contributions of 15% to the Consolidated Fund by public institutions made deductible to simplify tax calculations.

v. Reduced applicable taxes on small passenger transportation businesses to ease tax burdens.

vi. Non-residents to withhold 5% tax on payments to resident digital content creators to broaden the tax base.

vii. Introduction of a 2% withholding tax on payments for industrial minerals to expand tax revenues.

viii. Introduction of a 3% withholding tax on income from digital asset transfers to increase government revenue.

ix. Introduction of a 5% withholding tax on income from digital content creation by resident businesses to enhance the tax base.

x. Introduction of a 2% final withholding tax on payments for agricultural, fishing, animal, poultry, and forestry produce.

xi. Exclusion of Section 56 applicability on allotment of shares in resident entities to resolve administrative challenges.

xii. Increase in profit base subject to tax from 30% to 40% from the fourth year of consecutive losses for businesses.

xiii. Exemption of withholding tax on interest payments to foreign non-resident financial institutions providing concessionary loans under government agreements.

xiv. Regulation for review and recognition of bad debts for improved income tax assessments derived from loans.

The Income Tax Measures altogether are expected to increase Government revenues by TZS 31,738 million.

Excise Duties

i. Reduce excise duty on locally produced bottled water (HS Code 2201.10.00 and 2201.90.00) from TZS 63.80 to TZS 58 per liter to support small-scale factories, provide consumer relief, and promote clean water use.

ii. Introduce excise duty on non-denatured ethyl Alcohol: TZS 7,000 per liter on imports and TZS 5,000 on local production (HS Code 2207.10.00), with exemptions for non-manufacturing purposes.

iii. Introduce a 10% excise duty on the value of stake on betting, gaming, and national lottery, with funds directed to the Universal Health Insurance Fund.

iv. Introduce a 10% excise duty on advertisement fees in TV, print media, and radio for betting, gaming, and lotteries.

v. Amend the Excise (Management and Tariff) Act, CAP 147 to introduce a TZS 300 per kilogram duty on imported and locally manufactured tomato sauce, ketchup, chili sauce, and mango pickle (HS Codes 2103.20.00 and 2103.90.00).

vi. Introduce a TZS 500 per kilogram excise duty on locally manufactured and imported solvent-based paints and varnishes (heading 32.08).

vii. Introduce excise duties on imported opaque beer (TZS 963.90 per liter, HS Code 2206.00.20) and other imported beer made of mixed fruits (TZS 2,959.74 per liter, HS Code 2206.20.90).

viii. Allocate 2% of excise duty collections from carbonated soft drinks, cosmetics, and alcoholic drinks to the Universal Health Insurance Fund.

ix. Insert a provision in the Electronic Tax Stamps Regulations, 2018, requiring a manufacturing license for excisable goods only after the installation of ETS machines and production commencement, with regular inspections to ensure compliance. This measure aims to protect domestic industries, improve excise duty collection, and prevent revenue loss.

The Excise Duty measures altogether are expected to increase Government revenues by TZS 196,142 million.

Export Levies

i. Introduce a 10% export levy on Crude Sunflower Oil, Sunflower Cake, and Sunflower Seeds.

This measure is anticipated to boost Government revenues by TZS 2,048 million.

Mining Act

i. Exempt the supply of gold to the Bank of Tanzania (BOT) from paying a 1% inspection fee. This aims to incentivize gold supply to BOT and reduce costs, promoting growth in national gold and foreign currency reserves to address USD shortages.

ii. Reduce the royalty rate from 6% to 2% on gold supplied to BOT, with the royalty being treated as final payment. This is intended to further encourage gold supply to BOT and reduce associated costs, supporting national gold and foreign currency reserves.

iii. Reduce the royalty rate from 4% to 2% on gold supplied to domestic refineries to incentivize local supply and ensure the availability of feedstock.

iv. Mandate mineral right holders and dealers to set aside minerals, starting with 20% of gold, for processing, smelting, refining, and trading within Tanzania. Exemptions apply to mining companies with agreements with the Tanzanian government, subject to renegotiation. This measure aims to enhance gold supply to BOT and local refineries, supporting national reserves and refining capacity.

v. Recognize BOT as the Statutory Gold Dealer to align with the Bank of Tanzania Act and clarify its role in purchasing gold. This measure seeks to streamline gold purchases by BOT, supporting national gold and foreign currency reserves.

These amendments collectively aim to boost the supply of gold to BOT and domestic refineries, enhance national gold and foreign currency reserves, address USD shortages, and clarify regulatory roles.

All these measures together are expected to reduce Government revenues by TZS 114,519 million.

Fees and Levies in Tourism

The proposed budget includes adjustments in the aviation and tourism sectors to reduce operational costs, stimulate growth, and attract investment in the tourist industry, specifically:

i. The Tanzania Civil Aviation Authority (TAA) to charge a fee for renewing licenses to operate safety planes (Air Operators Certificates – AOC) at the rate of USD 600 per company per year instead of the current rate of USD 600 per aircraft per year.

ii. To charge Tourist Business License fees in Tanzanian Shillings, instead of US Dollars. These proposed measures go hand in hand with the requirement of the fee to be paid for a period of 12 from the last day of the execution of the final payment for the business license;

iii. To reduce the fee of the Tanzanian Tourist Business License which is paid by an agent of the mountain climbing from US Dollar 2,000 per annum to TZS 3,000,000 per annum. The fee shall be payable in Tanzanian shillings.

Conclusion

Tanzania’s 2024/25 budget underscores a strategic approach to economic growth and development. Through substantial investments in infrastructure, human capital, and industrialization, coupled with significant tax reforms to stimulate business activity, the government aims to achieve robust GDP growth and fiscal sustainability. The budget not only addresses current economic challenges but also lays a foundation for long-term prosperity, reflecting Tanzania’s commitment to inclusive development and enhanced regional competitiveness in East Africa.