Oil & gas company Wentworth released the results of an independent evaluation of the gas reserves within the Mnazi Bay Concession in Tanzania, carried out by RPS Energy Canada.

Highlights of the finding are:

Proved + Probable (2P) reserves are valued at USD152.9 million after tax (NPV10)

Proved (1P) – 89.2 Bscf gross (14.9 MMboe); 68.2 Bscf net (11.4 MMboe)

Proved + Probable (2P) – 141.5 Bscf gross (23.6 MMboe); 95.5 Bscf net (15.9 MMboe)

Proved, Probable & Possible (3P) – 226.6 Bscf gross (37.8 MMboe); 135.3 Bscf net (22.6 MMboe)

Gerold Fong, Vice President Exploration of the Company and an Exploration Geophysicist, has read and approved the technical disclosure in the regulatory announcement.

Geoff Bury, Wentworth Managing Director, commented: “We are very pleased that we now have reserves associated with our Mnazi Bay concession. This is a further step towards bringing our gas on stream and follows on the heels of the signing of our gas sales agreement (GSA) last year, and the ongoing implementation of the field infrastructure.”

Wentworth indicates to have a gas sales agreement in place and the facilities required to produce these reserves are nearing completion.

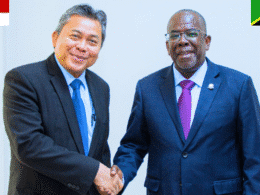

According to a recent announcement by recently appointed Tanzanian Minister for Energy & Minerals George Simbachawene, measures were approved to give priority to domestic use of natural gas resources over exports.

The company is listed at Oslo Stock Exchange (OSE: WRL) and AIM in London (AIM: WRL).