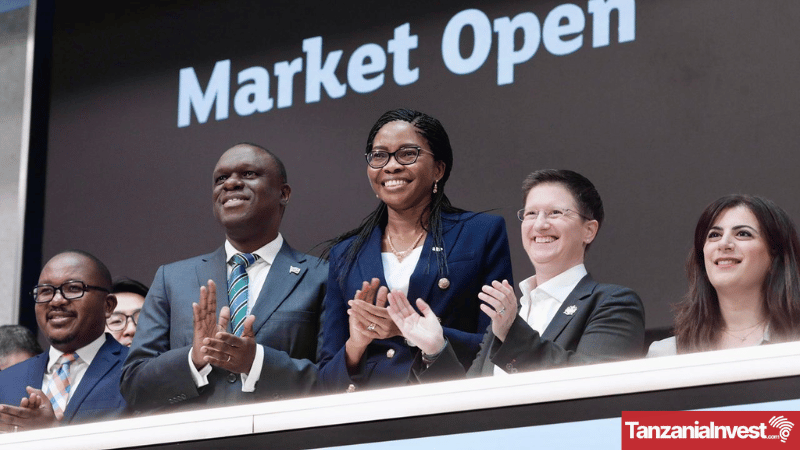

On 13th May 2024, Tanzania’s second-largest bank by asset, NMB, listed on the London Stock Exchange (LSE) its Jamii Sustainability Bond, a pioneering financial instrument designed to catalyze investment in projects that deliver tangible social and environmental benefits.

Jamii means “community” in Swahili, as the bond aims to deliver positive environmental and social impacts to the communities where customers, employees, shareholders, and all stakeholders of the bank live.

The bond comprised a USD tranche and a TZS tranche and raised a total of approximately USD 157 million. The proceeds of the bond will be used to strengthen resilience against climate change and for investments in renewable energy, sustainable agriculture, gender equality and youth empowerment, among other key social and environmental projects, empowering investors with the opportunity to generate financial returns while making a meaningful impact.

NMB’s Jamii Bond was first listed on the Dar es Salaam Stock Exchange (DSE) on 12th December 2023, raising a historic TZS 400 Billion, making it the largest sustainability bond ever in East Africa.

On 29th April 2024, the Bank listed the bond on the Luxembourg Stock Exchange (LuxSE), the world’s leading platform for sustainable securities.

Commenting on the listing, LuxSE’s CEO Julie Becker said, “We are delighted to mark this landmark sustainability bond listing with NMB, and we are committed to continuing our shared mission of fostering sustainable finance in the region and contributing to closing the funding gap.”

The bond was met with strong demand from both local and international investors, with leading development finance institutions such as the International Finance Corporation (IFC), the Netherlands’ FMO development bank, and the UK’s British International Investment (BII) having made significant investments in the Jamii bond.

Commenting on the latest listing at LSE, NMB Bank’s CEO Ruth Zaipuna said: “At NMB Bank, we recognize the critical role that finance plays in driving sustainable development and addressing the complex challenges facing our planet and society. The issuance of the first gender bond in Sub-Saharan Africa in 2022, the NMB Jasiri Bond, and now the first sustainability bond in East Africa, the NMB Jamii Bond, that we are cross-listing today at the LuxSE and LGX, attest to our commitment of advancing sustainable development and promoting responsible investment practices, with the assurance of rigorous impact assessment and transparent reporting. Being a domestic bond with both retail and institutional investors’ participation, the NMB Jamii bond has provided investment opportunities for retailers to invest and trade in the bond in a lower denomination. This has not only stimulated the development of our local capital markets but also provided much-needed financial inclusion and access. We also believe that being the first Tanzanian issuer to cross-list a sustainable bond to a world-class exchange like the LSE, will open up our capital market and our country to the world by attracting more investments in sustainable related projects and other areas of our fast-growing economy.”