The mortgage market in Tanzania registered a 1% growth in the value of mortgage loans as of 31st March 2021 compared to the previous quarter ending on 31st December 2020.

This was indicated in the Tanzania Mortgage Market Update – 31 March 2021 recently released by the Bank of Tanzania (BOT) and the Tanzania Mortgage Refinance Company (TMRC).

Tanzania Mortgage Market Growth

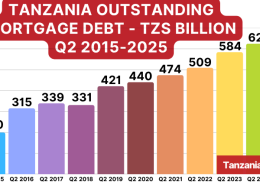

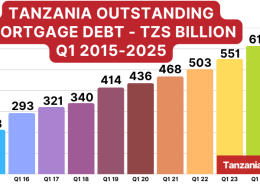

The mortgage market in Tanzania registered a 1% growth in the value of mortgage loans as of 31 March 2021 compared to the previous quarter which ended on 31st December 2020.

The total mortgage debt outstanding that resulted from lending by the banking sector for the purposes of residential housing was TZS 468.25 billion equivalent to USD 202.71 million.

The Tanzanian housing demand (which is estimated at 200,000 houses annually and a total housing shortage of 3 million houses as per NHC report) has been boosted by easy access to mortgages, with the number of mortgage lenders in the market increasing from 3 in 2009 to 32 by 31 March 2021, and the average mortgage interest rate falling from 22% to 15%.

Tanzania Mortgage Market Competition

As of 31st March 2021, 32 different banking institutions were offering mortgage loans. The mortgage market was dominated by five top lenders, who commanded 68% of the market.

CRDB Bank commanded 39.65% of the mortgage market share, followed by Stanbic Bank (11.12%), Azania Bank (6.24%), NMB Bank (5.69%), and NCBA (5.64%).

As far as the effects of the Covid-19 pandemic, they are yet to be fully discernable, but the Bank of Tanzania (BOT) has instituted a number of policy measures to safeguard the financial sector stability and continue facilitating the financial intermediation process.

These include lowering of the Statutory Minimum Reserve requirement from 7 to 6%, reducing the discount rate from 7 to 5%, reducing the haircuts on Government securities from 10 to 5% for Treasury bills and from 40 to 20% for Treasury bonds to increase the ability of banks to borrow from the Bank with less collateral, allowance of loan repayment moratorium on a case by case basis for borrowers experiencing financial difficulties as well as fostering the increase of daily transaction limits by mobile money operators to facilitate the use of digital platforms for transactions.

With these measures in place and as BOT continues to monitor and take appropriate actions to curb the potential negative impact of the pandemic on the economy, a positive outturn is imminent for the future of the mortgage market.

Obstacles to Growth of Tanzania Mortgage Market

The demand for housing and housing loans remains extremely high as it is constrained by an inadequate supply of equitable houses and high interest rates charged on housing loans.

Most lenders offer loans for home purchase and equity release while a few offer loans for self-construction which continue to be expensive beyond the reach of the average Tanzanians.

While interests rate on mortgage loans improved from 22-24% in 2010 to 15-19% offered today, market interest rates are still relatively high hence negatively affecting affordability.

Additionally, cumbersome processes around the issuance of titles (especially unit titles) continue to pose a challenge by affecting borrowers’ eligibility to access mortgage loans.

The Tanzania Mortgage Market

The Tanzania mortgage market registered an annual growth of 6% in the value of mortgage loans in 2020, reaching an outstanding mortgage debt of USD 202.71 million, compared to USD 190.74 million in 2019 and USD 183.67 million in 2018.