Tanzania Mainland GDP grew by 6.3% in Q2 2025 and headline inflation averaged 3.4% in Q3 2025, according to the Bank of Tanzania Quarterly Economic Bulletin for Q3 2025.

GDP and Economic Growth

Mainland GDP growth in Q2 2025 was driven by the expansion of agricultural activities and increased mineral exports.

Zanzibar’s economy grew by 6.8% in the same quarter, supported by agriculture and services.

The fastest-growing sectors on the Mainland were mining and quarrying, which grew by 19.0%, financial and insurance activities by 14.8%, and information and communication by 11.1%.

The industry and construction cluster expanded by 7.8%, supported by manufacturing at 4.9% and construction at 5.2%.

Agriculture, hunting, and forestry grew by 4.1%, contributing significantly to total output.

The Bank of Tanzania reported that government initiatives to boost agricultural productivity, improve the business environment, and attract investment supported this performance.

The total value of selected mineral production in Q3 2025 was USD 991.1 million.

Gold production reached 10,573.7 kilograms, diamond output was 111,125.8 carats, and coal production stood at 754.3 thousand tonnes.

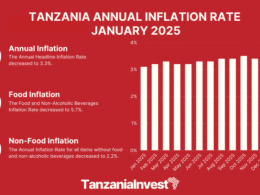

Inflation and Monetary Policy

Mainland headline inflation averaged 3.4% in Q3 2025, slightly higher than the 3.2% recorded in the previous quarter, remaining within the national target range of 3–5%.

Zanzibar’s headline inflation averaged 3.8% in the same period.

The rise in consumer prices was driven mainly by a 7.5% increase in the cost of food and non-alcoholic beverages.

Average domestic fuel prices in Q3 2025 were TZS 2,969.3 per litre for petrol, TZS 2,897.9 per litre for diesel, and TZS 3,286.8 per litre for kerosene.

In response to the stable inflation outlook and adequate food supply, the Bank of Tanzania’s Monetary Policy Committee reduced the Central Bank Rate to 5.75% from 6% in the preceding quarter.

Money Supply and Debt

Money supply grew by an average of 20.3% during the quarter, supported by sustained private sector credit growth.

The national debt stock reached USD 50,772.4 million at the end of September 2025, an increase of 4.9% from the previous quarter.

External debt accounted for USD 35,438.3 million, or 69.8% of the total, while domestic debt was USD 15,334.2 million.

External Sector Performance

The current account recorded a deficit of USD 570.5 million in Q3 2025, mainly due to higher imports of industrial supplies and refined petroleum products amid strong domestic demand and elevated global prices.

Exports of goods and services amounted to USD 4,689.7 million, while imports of goods and services reached USD 4,782.6 million.

Total exports of goods were valued at USD 2,911.2 million, led by gold at USD 1,347.6 million, tobacco at USD 203.9 million, and manufactured goods at USD 428.1 million.

Goods imports (F.O.B) were valued at USD 3,970.2 million, including USD 2,693.3 million in intermediate goods, of which refined petroleum products accounted for USD 781.1 million.

Zanzibar recorded a current account surplus of USD 257.8 million, supported by higher receipts from tourism-related services.

Foreign exchange reserves remained at USD 6,664.2 million, sufficient to cover more than five months of projected imports of goods and services.

According to the Bank of Tanzania, the quarterly indicators show stable macroeconomic conditions across the Mainland and Zanzibar, supported by strong sectoral performance, low inflation, and resilient external reserves.