EY Tanzania released its comments on Tanzania’s budget for 2016–17, presented on 8th June 2016 by Finance and Planning Minister Philip Mpango. A number of tax proposals that also include Value Added Tax (VAT) on tourism and financial services, Capital Gain Taxes (CGT) on stocks and excises on mobile money transfer, have also been presented. The Finance Bill 2016 has not been made public yet.

Alert by EY Tanzania:

According to the budget, the Government revenue estimates for 2016/17 are TZS29.53 trillion, of which TZS18.46 trillion are internally sourced (tax and non-tax revenue) representing 62.3% of the GDP.

The projected internal revenue TZS15.11 trillion will be generated from various taxes; TZS2.69 trillion non-tax revenue and TZS665.4 billion will generated from Local Government Authority’s (LGA’s) own resources.

The 2016/17 budget focuses on achieving the following macroeconomic objectives and targets:

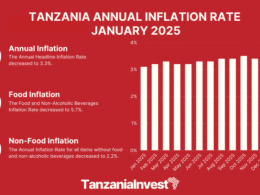

(i) Real GDP is projected to grow to 7.2% in 2016 from 7% in 2015

(ii) Inflation is expected to be maintained at a single digit increase

(iii) Domestic revenue including LGA’S own sources is projected at 14.8% of GDP in 2015/16 and will maintain an upward trend to 16.9% of GDP in 2016/17

(iv) Tax revenue is projected at 13.8% of GDP in 2016/17

(v) Total expenditures are estimated to increase to 27% in 2016/17

(vi) Fiscal deficit is projected at 4.5% of GDP in 2016/17

(vii) The ratio of current account deficit to GDP is narrowed down to 7.5% in 2016/17

(viii) Gross official reserves sufficient to cover at least four months of projected imports of goods and services by are anticipated by June 2017

This Alert outlines the key tax proposals.

Detailed Discussion:

Income Tax Act, 2004

The following amendments were proposed:

- Elimination of tax exemption on the final gratuity to members of Parliament

- Elimination of capital gains tax (CGT) exemption on sale of shares listed on the DSE by an individual holding less than 25%

- Reduction of Pay As You Earn (PAYE) to 9% minimum tax

- Imposition of withholding tax on payments to approved retirement funds for leasing and lending

- Granting of powers to the Commissioner General of the Tanzania Revenue Authority to determine the minimum market value of rental income for withholding tax purposes

Value Added Tax, (VAT) 2014

- Exemption of Raw Soya Beans, petroleum products, all un-processed vegetables and unprocessed edible animal products

- Exemption of vitamins and food supplements (micronutrient compound), water treatment chemicals in the list of exempted items which have been approved by the Minister responsible for Health

- Exemption of aviation insurance

- Imposition of VAT on tourism services e.g. tourist guiding, game drives, water safaris

- Imposition of VAT on fee based financial services (excluding interest on loans)

Motor Vehicle (Tax on Registration and Transfer) Act, CAP 124

- Increase in Motor vehicle registration fee from TZS150,000 to TZS250,000 and motor cycle registration fee from TZS45,000 to TZS95,000

- Increase in personalized registration number fee from TZS5,000,000 to TZS10,000,000

The East African Community (EAC) Customs Management Act, 2004

The Ministers for Finance from EAC Partner States agreed to effect changes in the Common External Tariff (CET) and amend the EAC Customs Management Act, 2004 for the financial year 2016/17. The changes in the CET which were recommended and agreed are as follows:

- Increase import duty on cement from 25% to 30%

- Increase the CET rate on flat rolled products of iron or non-alloy steel from 0% to 10%

- Increase import duty rate on bars and rods of iron steel from 10% to 25%

- Impose import duty rate of 0% one year and thereafter 25% used in construction of bridges and bridges sections

- Impose import duty rate of 10% on automotive bolts and nuts for one year and thereafter 25%

- Increase the import duty rate on fishing nets from 10% to 25%

- Increase import duty on oil and petrol filters from 10% to 25%

- Grant duty remission of 0% to air filters and splints which are raw material used to manufacture matches, bolts and nuts and aluminum cans

- Increase progressively the import duty remission of sugar confectionery to 15%, 20% 25% for 2016/17, 2017/18 and 2018/19 respectively

- Increase the CET rate on aluminum milk cans from 10% to 25%

- Increase duty on worn clothes and shoes from 0.2 USD/kg to 0.4 USD/kg

- Continue to impose a duty rate of 25% of US$200 per metric tons for one year on flat-rolled products of iron or non-alloy steel

- Grant application EAC CET rate of 35% on wheat grain instead of 10% per one year and manufacture of crude oil and apply 10% instead of 0% for one year

Additional amendments proposed in the EAC Customs Management Act (CMA), 2004 include:

- Amend the 5th Schedule to EAC-CMA (Chapters 84 and 69) to include incinerator’s equipment and materials used in hospitals to burn waste, refrigeration equipment for human dead bodies for use in Hospitals, city councils or funerals and to remove import duty exemption on uniforms for hospital staff

- Grant duty remission to the manufacturers of Inputs for the manufacture of deep cycle batteries and inputs or raw materials for use in the manufacture of solar equipment’s

- Amend the 5th Schedule to the EAC-CMA to include blood collection tubes

The Excise (Management and Tariff) Act, CAP 147

- Adjust for inflation with 5% increase of excise duty rates on non-petroleum products such as soft drinks, locally produced fruit juices, imported juices, beer made from local un-malted cereals, other beers, non-alcoholic beer, wine produced with domestic content exceeding 17%, wine produced with more than 25% imported grapes, spirits, cigarettes without /with filter tip containing domestic tobacco, cut rag or cut filler, lubricating oils, lubricating greases and natural gas

- Increase duty from 15% to 20% on imported furniture

- Abolish manufacturing selling, buying and use of plastic bags of less than 50%

- Extend excise duty of 10% on charges/fees payable by a person to telecommunication service provider on money transfer

The Finance Act 2016 is expected to be in force from 1 July 2016 after the Finance Bill 2016 has passed Parliament and is assented by the President.

An Alert on the Finance Act 2016 will be issued as soon as the Act is available.