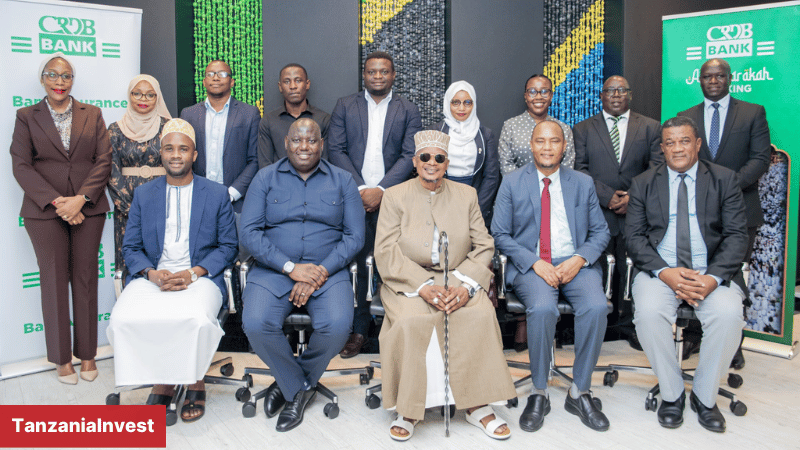

Tanzania’s largest bank, CRDB Bank, unveiled Shariah-compliant insurance services, known as Takaful, in partnership with ZIC Takaful, the dedicated subsidiary of the Zanzibar Insurance Corporation (ZIC).

The announcement, made on 29th February 2024, garnered praise from Dr. Abubakar Zubeir, the Grand Sheikh and Mufti of Tanzania, who commended the bank for its progressive approach in addressing the needs of customers with religious affiliations.

“We commend CRDB for this innovative step. Shariah compliance is of paramount importance for Muslim believers, and there are individuals of diverse faiths who also appreciate its principles. With the introduction of Takaful insurance services, CRDB will cater to the needs of many,” remarked Sheikh Zubeir.

Dr. Baghayo Saqware, Commissioner of Insurance and CEO of the Tanzania Insurance Regulatory Authority (TIRA), stressed the importance of innovative solutions in overcoming barriers to insurance accessibility, fostering sectoral growth, and enhancing public confidence in financial planning.

“Takaful services offer an alternative for individuals dissatisfied with conventional insurance models involving interest. Not only does Takaful provide insurance, but it also represents an investment benefiting both clients and service providers,” stated Dr. Saqware.

CRDB Bank established CRDB Al Barakah Banking in 2021, a dedicated unit for Shariah-compliant services, which attracted over 135,000 customers and facilitated financing exceeding Sh125 billion, with significant support directed towards small and medium-sized entrepreneurs.

Boma Raballa, Chief Business Officer of CRDB Bank, highlighted the institution’s commitment to continuous improvement, citing the previous year’s introduction of services facilitating Hajj and Umrah pilgrimages.

“As we strive to enhance our offerings, CRDB Bank, in partnership with Zanzibar Insurance Corporation (ZIC) Takaful, is proud to introduce Shariah-compliant insurance services known as Takaful,” announced Raballa.

Raballa emphasized the differences between Takaful and conventional insurance, particularly Takaful’s exclusion of interest payments and adherence to mutual assistance principles in times of adversity. He added that profits from clients’ contributions are distributed according to procedures stipulated by the Takaful company.

“Our collaboration will deliver general insurance services encompassing vehicle, home, fire, business, transportation, and machinery insurance,” affirmed Raballa.

Said Abdallah Basleym, CEO of ZIC Takaful, expressed optimism about the partnership’s potential to extend Takaful services to a broader segment of the population.

“We believe this collaboration will significantly expand access to Takaful services. We remain committed to collaborating with stakeholders genuinely interested in promoting these services for the benefit of every Tanzanian,” concluded Basleym.

About Islamic Insurance and Bancassurance in Tanzania

In Tanzania, with a population of 63 million where Muslims constitute approximately 35% to 40%, there is a palpable demand for Takaful.

Acknowledging this potential, TIRA facilitated the sector’s growth by issuing the Takaful Operation Guidelines in 2022. The following year, in July 2023, ZIC Takaful, a subsidiary of the Zanzibar Insurance Corporation (ZIC), was launched.

In January 2024, the landscape expanded with First United Takaful becoming the second company in Tanzania to provide Islamic insurance.

Bancassurance is a term used to describe the sale of insurance products through banks. In Tanzania, bancassurance refers to the practice of banks selling insurance products, such as general insurance, life insurance, health insurance, and property insurance, to their customers.

Twenty-eight (28) bancassurance agents are registered to operate in the Tanzanian insurance market. Out of the total gross written premium during 2022 (TZS 1,137.2 billion), TZS 208.3 billion representing 18.3% was transacted through bancassurance agents.