Global provider of transformative household products and affordable finance for low-income households d.light has announced a successful securitization facility of USD 30 million from the Eastern and Southern African Trade and Development Bank Group (TDB Group).

This facility offers the potential to purchase up to USD 125 million of receivable assets.

The capital will be utilized to augment d.light’s existing securitized financing facility in Tanzania.

The primary aim is to expand its low-cost Pay-Go personal finance service, allowing more Tanzanians to access the company’s solar-powered household products.

Since 2020, d.light has amassed USD 490 million in securitized financing, with the Tanzanian facility being anchored by TDB.

d.light’s finance facility in Tanzania operates by leveraging payments from its existing and future customers for solar products purchased using its Pay-Go service.

This mechanism aids in raising funds to upscale the company’s activities in the country.

In April 2023, d.light celebrated the milestone of positively impacting over 150 million people globally with its range of solar-powered household products.

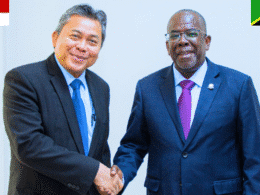

Nick Imudia, CEO of d.light, commented: “This new financing from TDB gives us the extra funding to reach more low-income families and households in Tanzania via our Pay-Go business, in a way that is affordable for our customers and sustainable for our business.”

Michael Awori, CEO of TDB, emphasized the importance of energy access and expressed delight in extending the facility to d.light in Tanzania, praising the company’s impactful track record.

Tanzania, with a population of 63.6 million, has only 40% of its inhabitants with electricity access. The majority lack grid connectivity and a reliable power supply.

The country’s vast geographical spread and limited grid connectivity make it a prime market for off-grid solar solutions.

Solar energy has been gaining traction in the country, especially in rural areas where the grid hasn’t reached.