Capital Markets

Tanzania’s Capital Market Executive Summary

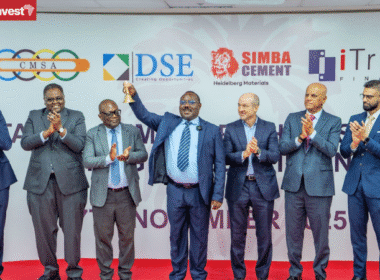

Currently, the Dar es Salaam Stock Exchange (DSE) has 28 listed companies, including 22 domestic firms and 6 cross-listed companies.

Tanzania Capital Markets History

Tanzania’s Stock Exchange, the Dar es Salaam Stock Exchange (DSE), was established in 1996 as part of the government’s broader economic reforms aimed at stimulating a dynamic private sector to be the primary engine for economic growth in Tanzania.

The DSE started business on April 15th, 1998 to support the Tanzanian Government in privatizing parastatal entities in order to boost economic growth, reduce the number of non-performing parastatal enterprises, and eliminate budgetary support to them.

Tanzania Oxygen Limited (DSE:TOL) was the first state-owned company selected for privatization through the DSE.

After TOL’s initial public offering (IPO) at DSE on April 15th, 1998 Tanzania Breweries Limited (DSE:TBL) followed on September 28th of the same year.

Tanzania Cigarette Company (DSE:TCC), Swissport (DSE:SWIS), Tanzania Portland Cement Company (DSE:TPCC), Tanga Cement Company Limited (DSE:TCCL) and National Microfinance Bank (NMB) completed the list of 7 companies out of 330 shortlisted to be privatized.

Following these first state-driven listings, other private companies decided to list in DSE as a part of their corporate growth strategy to raise capital.

TATEPA, CRDB Bank, Precision Air, Maendeleo Bank, Swala Gas & Oil, MKOMBOZI Commercial Bank, and DCB Commercial Bank listed respectively on December 17th, 1999, June 17th, 2009, December 21st, 2011, November 4th, 2013, August 11th, 2014, December 29th, 2014, and September 16th, 2008.

DSE also counts with six cross listed companies: Kenya Airways (DSE:KA), East African Breweries (DSE:EABL), Jubilee Holdings (JHL), Kenya Commercial Bank (DSE:KCB), National Media Group (DSE:NMG), and Uchumi Supermarket (DSE:USL) from Kenya.

These companies decided to cross list mainly to earn a higher visibility and name recognition in the Sub-Saharan region and to access potential investors in different markets for future plans to raise capital, as it was declared by the companies’ CEOs at the listing moment.

The DSE has also managed to diversify financial instruments on the market with equities, derivatives, government and corporate bonds and Real Estate Investment Trusts (REITs) with the Watumishi Housing Company (WHC-REIT) which was the first REIT in East Africa.

The DSE launched its own IPO of 15m ordinary shares at TZS 500 per share on 16th May 2016. As of 9th September 2020, the DSE trades at TZS 890, an increase of 78%.

Tanzania Capital Markets Regulation

The Capital Markets and Securities Authority (CMSA) is a government agency established to promote and regulate securities business in Tanzania, that has been established under the Capital Markets and Securities Act, 1994.

The Act sought to establish the legal framework for the regulation of the securities industry that is supplemented by regulations promulgated by the Tanzanian Ministry of Finance.

Last Updated: 31st July 2023