Finance

Tanzania embarked on financial liberalization in 1992 in order to sustain its economic growth. This has been done by mobilizing financial resources, increasing competition in the financial market, and enhancing quality and efficiency in credit allocation. As a result, the sector has been booming, particularly during the last few years.

The reforms implemented to improve financial policy, legal and regulatory frameworks and strengthening the financial sector (banking, capital markets, social security, insurance and microfinance) have resulted in a strong growth of the financial sector, in which total financial sector assets increased to 37.8% of Gross Domestic Product (GDP) in 2017.

The banking, social security, insurance sub-sectors and open-ended collective schemes accounted for 26.3%; 10.4%; 0.8%; and 0.2% of GDP, respectively in 2017. On the other hand, financial inclusion increased from 57% in 2013 to 65% in 2017.

Despite the achievements made by the financial sector reforms, the sector is still facing challenges and limitations including inadequate access to financial services in urban and rural populations, an inadequate legal regime and supervisory framework for financial consumer protection, limited supply of long term development finance, financial system vulnerability, risks associated with money laundering activities and financial sector regional and international cooperation. Likewise, the rapid advancement in technology and innovations have had a significant impact on the development of the financial system in the country.

To address the aforementioned challenges, the Ministry of Finance of Tanzania (MOF) has developed the Financial Sector Development Master Plan (FSDMP) which will be implemented for a period of 10 years from 2020/21 to 2029/30. The FSDMP acts as a mechanism to develop a more resilient, competitive and dynamic financial system that supports and contributes positively to the growth of the economy and poverty reduction.

Tanzania Banking

As a result of the liberalization, the banking sector in Tanzania has been booming, particularly over the last few years and new merchant banks, commercial banks, bureaus de change, credit bureaus, and other financial institutions have entered the market.

With a total of 49 licensed banks and other non-banking financial institutions, the market is characterized by a few big players and several small banks, and increasing competition.

Tanzania Insurance

The insurance penetration in Tanzania, i.e. the contribution of insurance to National Gross Domestic Product remains very limited, paving the way for plenty of room for further growth.

The Tanzania insurance sector is growing steadily, with 30 insurance companies, 109 insurance brokers, and 635 insurance agents as of December 2018.

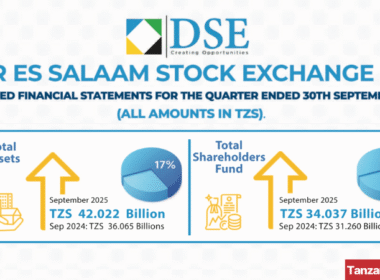

Tanzania Capital Markets

The securities market in Tanzania also emerged in the 1990s as a result of the government policy of liberalizing the financial sector.

Within such framework, the Capital Markets and Securities Authority (CMSA) was established in 1994 and the Dar es Salaam Stock Exchange (DSE) was incorporated.

As of September 2020, there are 27 companies listed at the Dar es Salaam Stock Exchange (DSE) with a total market capitalization of TZS 15,183.09 billion (USD 6.5 billion).