The Bank of Tanzania (BOT) released its Monthly Economic Review-January 2023 which covers key macroeconomic indicators for the year ending December 2022.

Inflation

Global supply chain disruption caused by the war in Ukraine and the after-effects of Covid-19 continued to exert pressure on commodity prices, particularly food and energy.

As a result, domestic inflation sustained an increasing trend since April 2022.

However, headline inflation eased slightly to 4.8% in December 2022 from 4.9% in November 2022 on account of a slowdown in prices of some non-food items.

The rate was, however, higher than 4.2% registered in the corresponding month in 2021 but still within the country target of 5.4% for 2022/23 and in line with regional benchmarks.

Tanzania Inflation and Targets December 2021-2022

Money Supply & Credit

The Bank of Tanzania continued to implement monetary policy that aimed at maintaining a balance between controlling inflation and supporting growth in response to increased inflationary pressures.

The policy resulted in a moderate annual growth of money supply (M3) at 11.6% in December 2022, which is consistent with the target of 10.3% for 2022/23.

The growth was mostly driven by sustained strong growth of credit to the private sector.

Tanzania Money Supply December 2021-2022

Growth of private sector credit remained strong, with an annual rate of 22.5% in December 2022, reflecting the ongoing recovery of economic activities from the effects of the COVID-19 pandemic, complemented by supportive monetary and fiscal policies.

Tanzania Banks’ Credit to Private Sector December 2021-2022

All major economic activities recorded credit growth, except hotels and restaurants.

Credit to agriculture activity registered the highest growth, attributable to the monetary policy measures rolled out by the central bank to provide cost-effective credit intermediation to agriculture and agri-business activities.

In terms of share, the largest portion of outstanding loans was held in personal undertakings, followed by trade, manufacturing, and agriculture activities.

Tanzania Share of Credit to Selected Economic Activities December 2021-2022 (in %)

Interest Rates

Interest rates charged by banks on loans remained virtually unchanged in December 2022, compared with the rates registered in the preceding month and the corresponding month in 2021.

The overall lending rate averaged 16%, whereas negotiated lending rates were around 13%.

The overall deposit interest rate averaged 6.94%, slightly lower than 7.28% recorded in the preceding month, but was higher than 6.74% recorded in December 2021.

Meanwhile, negotiated deposit rates averaged 8.88% in December 2022, slightly below 9.5% in the preceding month and 9.82% in December 2021.

Tanzania Lending and Deposit Interest Rates December 2021-2022 (in %)

Government Securities Market

Government securities primary auctions registered a mixed outcome in December 2022, with investors’ preference continuing to incline to instruments with longer maturities.

Two Treasury bills auctions were conducted in December 2022, with a combined tender size of TZS 354.9 billion.

The auctions attracted bids worth TZS 118.8 billion, which were all successful. The weighted average yield increased to an average of 6.11% from 5.60% in the preceding month.

Tanzania Treasury Bills Market Performance December 2021-2022

Auctions of long-dated government securities performed satisfactorily in December 2022.

The Bank of Tanzania auctioned 10- and 25-year Treasury bonds with a combined tender size of TZS 270.7 billion, which attracted bids worth TZS 378.5 billion, of which TZS 297.6 billion were successful.

The 10-year Treasury bond was undersubscribed whereas the 25-year Treasury bond was oversubscribed. Yields to maturity increased to 10.77% and 12.76% for 10- and 25-year Treasury bonds, respectively.

Government Revenues & Expenditures

In December 2022, domestic revenue collection amounted to TZS 3,090.4 billion, of which central government revenue was TZS 3,021.3 billion, equivalent to 106% of the target for the

month.

Out of the central government collections, TZS 2,536.4 billion was tax revenue, 6.2% above the target for the month.

The good performance was largely associated with increased collections under the income tax category (including Corporate Income Tax and Pay As You Earn), owing to the continued recovery of economic activities and tax efforts.

Collections from local government authorities’ own sources amounted to TZS 69.1 billion whereas grants totaled TZS 197.9 billion.

Tanzania Central Government Revenues December 2021-2022

In December 2022, expenditures amounted to TZS 3,021.3 billion, of which TZS 1,572.8 billion were on development projects and the rest were recurrent expenditures. Out of the total development expenditure, TZS 976.2 billion was from domestic sources.

Tanzania Central Government Expenditure December 2021-2022

National and External Debt

National debt stock, comprising public debt—external and domestic—and private sector external debt recorded a monthly increase of USD 512.1 million to USD 40,122.8 million at the end of December 2022.

The increase was mainly on account of disbursements of external loans, which outweighed repayments. Out of the stock, USD 32,353.6 million was public debt.

External Debt

The stock of public and private sector external debt increased by USD 966.4 million to USD 29,049.1 million at the end of December 2022 from the level recorded end of November 2022.

The increase was largely due to disbursements from the World Bank. Debt service was USD 143.1 million, of which USD 103.1 million was principal repayment and the balance was interest payments.

Multilateral institutions continued to dominate the portfolio, accounting for 47% of the stock, followed by commercial creditors.

The structure of disbursed outstanding debt by economic activities showed that transport and telecommunications dominate holding 20.8%, followed by social welfare and education, and energy and mining.

The composition of external debt by currency remained unchanged, with US Dollar denominated loans accounting for 69.1%, followed by the Euro.

Domestic Debt

At the end of December 2022, the stock of domestic debt was TZS 25,567.9 billion, a decrease of TZS 1,044.6 billion from the amount recorded at the end of November 2022. The decrease was on account of the settlement of the overdraft facility.

Treasury bonds and stocks commanded the largest share, accounting for 81.8% of the debt stock, reflecting sustained investors’ preference for securities with longer maturities.

Pension funds and commercial banks remained dominant creditors, jointly holding 59.2% of total domestic debt.

External Sector Performance

The external sector of the economy continued to endure challenges of commodity prices, tight financial conditions, high inflation in trading partners, and supply-chain disruptions caused by the resurgence of COVID-19 and the war in Ukraine.

Consequently, the current account balance recorded a deficit of USD 5,347.2 million in 2022, wider than a deficit of USD 2,407.2 million in the previous year, mainly due to high import bills.

Accordingly, the overall balance of payments was a deficit of USD 995.1 million, compared with a surplus of USD 1,852.1 million in the previous year, driven by higher payments abroad.

The stock of foreign official reserves declined to USD 5,177.2 million at the end of December 2022 from USD 6,386 million in the similar period in 2021.

Nonetheless, the reserves remained adequate, covering 4.7 months of imports, in line with the country benchmark of not less than 4 months.

Exports

Exports of goods and services increased to USD 12,000.3 million in 2022 from USD 9,873.4 million in 2021, driven by non-traditional exports, particularly manufactured goods, and minerals; and services receipts—mostly from tourism.

The increase in exports of manufactured goods largely emanated from fertilizers, textiles as well as iron and steel, owing to rising demand from neighboring countries, particularly the Democratic Republic of the Congo.

Coal worth USD 160.4 million was exported in 2022, higher than USD 13.2 million in 2021, largely on account of increasing demand for alternative sources of energy following the short supply of crude oil and natural gas amid the war in Ukraine.

Most of the coal was destined to neighboring countries including Kenya, the Democratic Republic of Congo, Rwanda, and Uganda; and other countries mostly Poland, Hong Kong, India, and Senegal.

Good performance was also observed in the export of diamonds, which also recorded a sharp increase to USD 62.7 million from USD 8.5 million in 2021, explained by the resumption of production at Williamson Mines following a period of closure for maintenance.

Gold exports, which accounted for 46.8% of goods exports, rebounded to USD 2,836.7 million from USD 2,743.1 million on account of a volume effect.

Exports of traditional goods also increased to USD 766.5 million in 2022 from USD 627.9 million in 2021, supported by cashew nuts, tobacco, cotton, and sisal.

As for cashew nuts and tobacco, the increase was on account of a volume effect, whereas for cotton it was due to the rise of prices in the global market.

On monthly basis, traditional exports rose to USD 140.1 million from USD 134.6 million in December 2021, whereas non-traditional exports increased to USD 486.1 million, from USD 465.2 million.

Tanzania Exports of Goods December 2020-2021-2022 (in Millions USD)

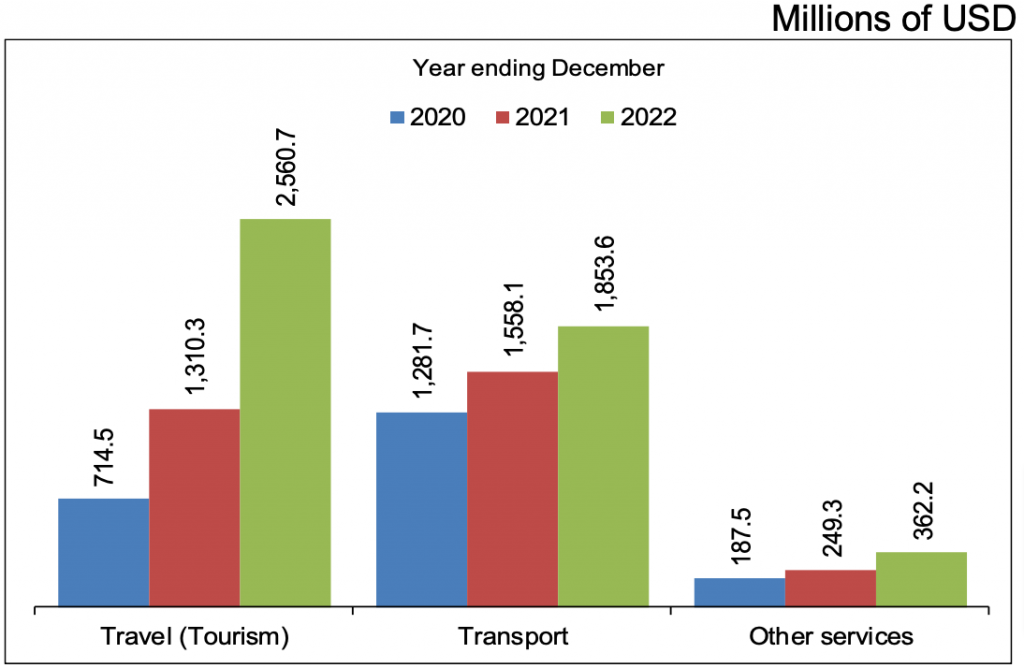

Services receipts amounted to USD 4,776.5 million in 2022, higher than USD 3,117.7 million in 2021 explained by the increase in travel and transport receipts.

Travel receipts almost doubled to USD 2,560.7 million from USD 1,310.3 million, consistent with the rise in the number of tourist arrivals by 57.7% to 1,454,920.

The level of tourist arrivals is approaching the pre-pandemic level of 1,527,230 in 2019, reflecting the recovery of the tourism sector.

On monthly basis, services receipts increased to USD 481.8 million in December 2022, from USD 339.4 million in the corresponding month in 2021.

Tanzania Services Receipts December 2020-2021-2022 (in Millions USD)

Imports

Imports of goods and services increased to USD 16,710.4 million in 2022-the highest level in recent years-from USD 11,610.4 million in 2021.

Almost all import categories recorded increases, reflecting the rise in prices owing to the disruption of the global supply chain.

Oil accounted for much of the import bill, at 23.3% from an average of 19.6% over the past five years.

Imports of machinery, industrial transport equipment, iron and steel, and plastics were also high, consistent with the revamping of economic activities.

On the contrary, edible oil imports declined following a decrease in volumes, partly emanating from the increase in prices.

On monthly basis, the import of goods edged up to USD 1,343.6 million in December 2022, from USD 1,032.1 million in December 2021.

Services payments increased to USD 2,465.4 million from USD 1,607.0 million in 2021, largely driven by higher freight payments consistent with the rise in the import bill.

On monthly basis, services payments amounted to USD 245.2 million, up from USD 165.1 million in December 2021.